Power prices crash as Storm Eunice drives wind turbines

Power prices have tumbled as stormy weather across Europe helped drive some of the highest output from wind turbines ever recorded.

Day-ahead UK power dropped 11pc to £140 per megawatt-hour as Storm Eunice whipped up gusts of up to 90 miles per hour.

German prices fell by more than two-thirds to their lowest this year, while output from wind farms in the country is set to double by tomorrow morning.

Millions of people have been told to stay at home as one of the worst storms in decades batters Britain. But the jump in wind generation will offer some relief to strained energy markets, which have relied heavily on coal and gas amid a supply crunch.

06:05 PM

Wrapping up

It’s that time of the week… but don’t worry, we’ll be back on Monday morning! Before you go, check out some of the latest stories from the business desk:

06:03 PM

Motorists could receive £150m compensation as class action authorised to proceed

Motorists who bought a new car between 2005 and 2015 could soon be entitled to automatically receive a payout from five of the world’s biggest shipping companies in a £150m legal case.

The Competition Appeal Tribunal in London has ruled that a collective proceedings order can be launched on behalf of UK consumers and businesses, which would see payouts on about 17m vehicles.

Mark McLaren, formerly of consumer group Which?, argued successfully that a class action suit should proceed, which means anyone who bought an affected car will be automatically entitled to compensation. A judgment was handed down on Friday afternoon.

05:46 PM

Virgin Media O2 boss warns Britain risks missing 5G targets

The chief executive of Virgin Media O2 has warned regulators that “something has got to change” if Britain is to hit its targets for upgrading to faster 5G mobile. Ben Woods writes:

Lutz Schuler said the incentives that have spurred the industry into carpeting the nation in gigabit speed broadband were missing for mobile, despite a pledge by Michael Gove, the Levelling Up Secretary, to bring widespread 5G coverage by 2030.

He echoed concerns from the mobile industry in recent weeks, which has demanded tax breaks, cheaper airwave fees and the ability to carry out industry mergers so they can make the returns needed to increase investment in mobile.

The call came as Virgin Media O2’s joint owners revealed that talks were underway with “a number of potential financial partners” about becoming an outside investor in a full-fibre network targeting 7m homes and businesses by the end of 2027.

05:31 PM

FTSE 100 records biggest weekly drop in three months

The FTSE 100 has fallen as weakness in healthcare stocks and simmering Russia-Ukraine tensions offset optimism around better-than-expected January retail sales data.

The blue-chip index recorded its biggest weekly drop in three months, closing 0.3pc lower at 7,513.

Western powers warned that Russia’s military build-up around Ukraine was continuing and an invasion was possible at any time, while Russian-backed separatists in eastern Ukraine said they planned to evacuate residents.

“If we see tensions dissipate, then the FTSE will recover and do much better next week because people will start to buy back stocks that they’ve got rid of now that they feel more confident,” said Danni Hewson, financial analyst at AJ Bell.

05:14 PM

Deliveroo, Just Eat and Uber limit deliveries due to Storm Eunice

Food delivery companies such as Deliveroo, Just Eat and Uber have limited their services for several hours in London as Storm Eunice batters the UK.

Once conditions eased in areas most affected by adverse weather, some deliveries began to be made available, although strong winds are expected to continue into the weekend.

Most inner-city orders fulfilled by food delivery companies in the UK are done via bicycle, scooter or on foot, putting workers at risk of being knocked into the road by the wind or injured by debris.

Just Eat had been criticised earlier after offering workers an extra £1 an hour today despite weather warnings.

04:58 PM

Home Builders Federation attacks Gove over ‘continued extraction of funds’ from the industry

Housebuilders have accused Michael Gove of the “continued extraction of funds” from the industry and argued that they won’t be able to build as many new homes if forced to pay more towards the cladding scandal. Matt Oliver reports:

In a submission to the Levelling Up, Housing and Communities committee of MPs, the Home Builders Federation claimed that measures unveiled by the Government to fix unsafe apartment blocks were unfairly focused on housing developers who only built a small proportion of the sites.

The lobbying group said Mr Gove had ignored the role of foreign firms in the scandal and risked scaring off investment. The secretary of state for housing has told housebuilders they must contribute to a £4bn fund or be blocked from doing business in the UK, .

The submission to MPs also argued that housebuilders were already facing new taxes to pay for the scandal, as well as a rising corporation tax rate, tougher environmental rules and the introduction of green building standards.

It said: “The almost exclusive focus by the Government on UK home builders to resolve the current building crisis is extremely worrying in the context of the country’s wider housing delivery challenges and also for the attractiveness of the sector for future investment.

04:41 PM

Coastguard urges Britons to stop taking storm selfies

The Coastguard has pleaded with people to stop taking storm selfies as record-breaking winds lashed northern Europe and sent waves curling over the roofs of coastal property.

Storm Eunice has battered Britain with winds of up to 122 miles per hour, a record for England, and killed at least one person in Ireland while causing power and travel disruptions for tens of thousands.

Coastguard tactical commander Ben Hambling said: “A dramatic photograph or selfie is not worth risking your life for and those who are going to the coast to take pictures are also putting our teams at risk.

“We are urging people in the strongest possible terms to stay away from the coast.”

The Coastguard said there had been multiple reports of people at the waterline taking pictures of the waves, and even of families standing by the surf line with their children.

04:22 PM

Credit Suisse to pay $81m to end lending-stock suit

Credit Suisse will pay $81m (£60m) to resolve a lawsuit by some US pension funds over control of the more than $1 trillion market for stock lending and has agreed to help with similar cases pending against other banks.

It’s the first settlement of a class-action lawsuit filed in 2017 alleging a group of major banks blocked development of all-electronic trading systems that match lenders and borrowers of stock used for short sales.

Pension plans including the Iowa Public Employees Retirement System claimed banks including Credit Suisse, Goldman Sachs and JPMorgan schemed to protect their profits from a less-efficient over-the-counter system by boycotting trading platforms that would eliminate them as middlemen and improve price transparency and competition.

“While we continue to believe that the plaintiffs’ case against Credit Suisse cannot be certified as a class action and that the plaintiffs’ claims are without merit, we are pleased to resolve the litigation,” a spokesman told Bloomberg.

04:16 PM

Handing over

That’s all from me, thanks for following along on a stormy day! Giulia Bottaro will see you through to the weekend.

04:04 PM

Kent power station taken offline after chimney collapses

A power station in Kent has been shut down after one of its chimneys appeared to collapse during strong winds.

Images circulating on social media appeared to show just two stacks at the Grain Power Station, rather than three, as Storm Eunice whipped up gusts of up to 122mph.

Uniper Energy, which owns the power station near Rochester, tweeted:

An incident has occurred at #Grain power station, during storm Eunice. We can confirm that there are no casualties and there is no risk to the local community.

However, it has caused some damage on site and the power station has been temporarily taken offline as a precaution.

03:54 PM

Oil heads for weekly loss as rally finally cools

Oil is headed for its first weekly loss in two months as a recent red-hot rally shows signs of cooling.

Benchmark Brent crude and West Texas Intermediate both fell back as traders weighed ongoing tensions between Russia and Ukraine with the possibility of an Iranian nuclear deal.

Prices had surged to fresh seven-year highs earlier in the week amid fears an invasion of Ukraine could be imminent, threatening energy supplies to Europe. While tensions are still running high, planned talks between the US and Russia next week have helped sentiment.

Meanwhile, there’s mounting speculation that a nuclear deal could be reached with Iran. This could pave the way for the removal of US sanctions on the nation’s crude exports, adding much-needed supply to the market.

03:24 PM

Just Eat under fire for offering Storm Eunice bonuses

Just Eat has come under fire from unions after offering bonuses to its delivery drivers for working during Storm Eunice despite warnings of danger to life.

The food delivery app offered workers an extra £1 an hour today even as the Met Office issued a red weather warning and people were urged to stay at home.

In a message to staff, the company warned there could be a “bit of windy weather”, while encouraging riders to store important numbers in their phone “in case you have an accident”.

It added: “Let’s smash Storm Eunice out the ballpark!”

The IWGB Couriers union took aim at Just Eat, saying: “It’s a storm not a line of shots.”

It’s a storm not a line of shots.

FAO @H_S_E @SNewtonUK

Messages sent by @JustEatUK to couriers.

Clearly hazards were assessed but result is incompetent. Risk only controlled hours later by app clousure but not before financial incentives & shift extensions were also offered pic.twitter.com/II1ABzqzN5

— IWGB Couriers (@IWGB_CLB) February 18, 2022

03:13 PM

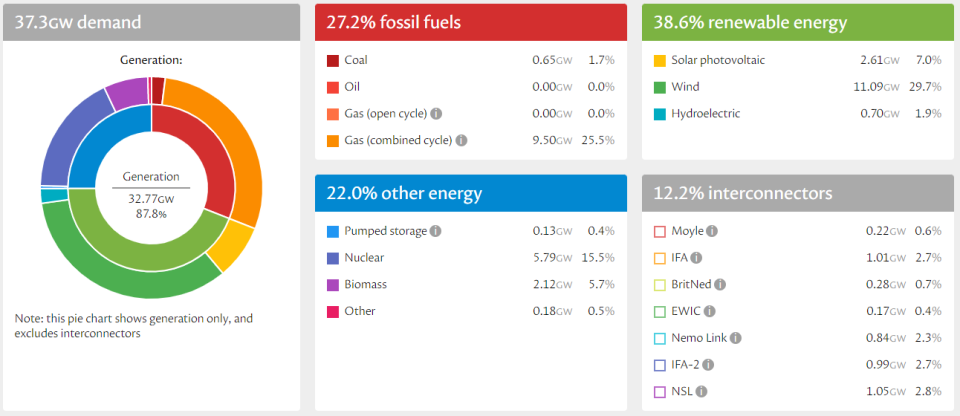

Chart: Wind power outstrips gas

Here’s an illustration of just how much of an impact Storm Eunice is having on the UK’s power supplies.

Over the last week, wind power has outstripped gas, with energy generation from turbines averaging 11.48 gigawatts, compared to 7.2GW for gas.

It’s good news for the push to renewable energy and provides a much-needed breather amid a recent surge in wholesale gas prices.

02:59 PM

Pret sounds alarm over its future as it scrambles to repay loans

Pret a Manger has fired a fresh warning shot over its future as it races to delay debt repayments following two years of lockdown turmoil.

Hannah Boland has the story:

Company filings for the coffee chain’s owner, Pret a Manger Ltd, said it was attempting to buy more time to repay its loans. It has until June to pay back £66.7m in loans, after having already extended that facility. A separate £605m loan facility is due to expire the following summer.

Pret took on more debt during the pandemic as it suffered a slump in trading amid a slump in office workers commuting to city centres. It secured a £105.7m shareholder cash injection in November last year to bolster its finances.

Pret said its directors were seeking to negotiate the extension of the first tranche of debt and refinance its larger bank facility.

However, it admitted the ability to do so was among the factors which were outside their control, warning that this could cast significant doubt on its ability to continue as a going concern.

Pret said the potential for renewed Covid restrictions and “associated unpredictability of consumer behaviour” was also outside their control. If new rules do come in again, Pret warned this could hammer sales and cause the company to breach its liquidity covenant.

However, it added that it had a “reasonable expectation” that the company would be able to continue in operation and meet liabilities as they fall due, and would seek shareholder support if necessary.

02:37 PM

Wall Street opens mixed as Ukraine fears linger

US stocks were mixed at the opening bell as investors keep a wary eye on the latest developments in the Ukraine crisis.

The S&P 500 and Nasdaq both nudged up 0.1pc, while the Dow Jones was flat.

02:29 PM

Two more energy suppliers go bust

Speaking of energy crisis reminders, another two suppliers have just gone bust.

Whoop Energy and Xcel Power both announced they’re ceasing to trade, regulator Ofgem said.

Whoop Energy supplies 262 unique customer accounts, gas and electricity, 50 domestic and 212 non-domestic. Xcel Power has 274 unique customer accounts, gas only, and all non-domestic.

They’re the latest in a long list of supplier collapses as companies have struggled to pass on soaring wholesale gas prices to consumers.

02:15 PM

Europe ‘has 1.5 months of gas’ if Russia turns off the taps

While today’s gales have offered a temporary reprieve in the energy crisis, there’s a reminder that bigger problems remain…

Analysts have warned that Europe would cope for just one and a half months without Russian gas supplies if Vladimir Putin turned off the taps in response to Western sanctions.

Tom Rees has the details:

Germany’s economy would be hardest hit in a Russian energy supply freeze as Europe’s gas buffer would only last until April, according to analysts at Commerzbank.

There are fears Moscow would restrict Europe’s gas supply if the West slaps tough sanctions on Russia following an invasion of Ukraine. Around 40pc of Europe’s gas comes from Russia with a supply squeeze set to send prices rocketing even higher.

Europe’s storage facilities are currently 33pc full at 33 billion cubic metres (bcm) of natural gas but would typically fall over the colder months even without Russian supply curbs. If stocks fall as expected and Russia turns off the taps, EU countries could replace the lost supply for just one and a half months, Commerzbank said.

Every month 12 bcm of gas is imported from Russia through pipelines and close to 1.5 bcm of liquefied natural gas (LNG) is also brought into Europe.

01:48 PM

Wind drives 30pc of UK power generation

It may be causing chaos across the country, but Storm Eunice is at least providing some much-needed power.

Wind is now making up 30pc of all power generation in the UK thanks to stormy weather that’s whipped up record gusts of up to 122mph.

Over the last week, wind has accounted as 37pc of power on average. That’s compared to just 19pc over the last 12 months.

01:39 PM

Ship carrying hundreds of Porsches and Bentleys adrift after catching fire

A ship carrying Bentleys and Porsches is drifting in the mid-Atlantic after it caught fire, forcing the 22-strong crew to be evacuated.

Howard Mustoe reports:

The ship was travelling from Emden in Germany, where Volkswagen, which owns Bentley and Porsche, has a factory, to Davisville, Rhode Island in the US.

Volkswagen said a number of Audi vehicles were also on board, as well as cars which had already been paid for by customers. It was not clear whether the cars were damaged.

A spokesman for Volkswagen said: “We are aware of an incident involving a third-party cargo ship transporting Volkswagen Group vehicles across the Atlantic. We are in contact with the shipping company to get more information about the incident.”

No-one was hurt in the blaze, which was being brought under control by Portuguese authorities off the coast of the Azores islands. The crew were evacuated from Felicity Ace, a 60,000 tonne car carrier ship registered in Panama, on Wednesday, according to Portugal’s navy.

Read Howard’s full story here

01:00 PM

EDF’s UK arm swings into red

EDF’s UK division reported millions of pounds in lost profits as nuclear plant outages and the impact of the pandemic piled pressure on France’s biggest energy firm.

EDF Energy Ltd posted a £21m loss in earnings before interest, taxes, depreciation and amortisation last year, a major drop from its £712m gain the year before.

The company blamed the reversal on the “ongoing impact of Covid-19, high global gas prices, and unplanned outages at UK nuclear power stations.”

EDF has come under major pressure from repeated outages and strikes at its nuclear power plants in France, as well as a Government cap on how much it can raise bills for consumers.

The state now plans to inject more than €2bn into the firm to bolster its finance.

Read more on this story: Macron pumps almost £2bn into EDF after capping energy prices

12:35 PM

Wind turbine blown over by wind

Storm Eunice is whipping up record levels of wind power generation, but for one turbine it all got a bit too much.

A 300ft wind turbine – one of 29 at the Pant-y-Wal wind farm in Gilfach Goch, Wales – snapped in strong winds earlier in the week.

The Met Office has issued a red weather warning for some parts of the country. This morning wind speeds of 122mph were recorded on the Isle of Wight – the biggest gust ever recorded in England.

12:16 PM

Wall Street set to rise on planned Ukraine talks

It looks like there could be an upbeat end to a tumultuous week for Wall Street as planned talks between the US and Russia over Ukraine help to calm investor nerves.

Global markets have been on a wild ride this week, following every twist in turn in the standoff on the Ukrainian border.

While tensions remain, Russian Foreign Minister Sergei Lavrov has agreed to meet US Secretary of State Antony Blinken for talks in Europe next week, helping to ease fears of an imminent invasion.

Futures tracking the S&P 500 rose 0.4pc, while the Dow Jones was up 0.3pc. The Nasdaq gained 0.6pc.

12:04 PM

Hermes slumps as supply troubles hit Birkin bags

Shares in Hermes slumped after the French luxury goods maker said supply bottlenecks had left it unable to keep up with demand for its exclusive Birkin bags.

The stock fell as much as 8.4pc – its biggest fall in five years – having lost more than a quarter of its value since a peak late last year.

Hermes said Friday that sales of leather goods and saddlery fell 5.4pc at constant exchange rates in the fourth quarter, more than double the decline analysts expected.

It comes in contrast to a boom elsewhere in the luxury sector. Gucci owner Kering yesterday reported a surge in sales for 2021, while the likes of LVMH, Burberry and Cartier owner Richemont have all cashed in on a rebound in demand.

11:38 AM

CVS tumbles as regulator raises concerns over vet takeover

CVS plunged as much as 13pc this morning after the competition watchdog said its planned takeover of a rival vet group raised competition concerns.

The Competition and Markets Authority (CMA) carried out a phase 1 investigation into CVS’ deal to buy Quality Pet Care, which trades as The Vet.

It found the merger raised competition concerns in five local areas, including Bristol and Nottingham.

CVS has five working days to offer proposals to address the concerns, after which the watchdog has a further dive days to decide whether or not to accept them.

CVS owns 467 vet practices across the UK, while The Vet operates eight in England.

11:21 AM

Oil prices drop as rally begins to lose steam

Meanwhile, it looks like oil’s bumper rally may finally be running out of steam.

The latest easing in tensions over Ukraine combined with progress in talks on Iran’s nuclear deal mean oil is headed for its first weekly loss in two months.

Brent crude hovered above $90 a barrel, having jumped as high as $96 earlier in the week. West Texas Intermediate fell below $90 after shedding 3pc.

Mounting speculation that Iran’s nuclear deal may be revived, potentially paving the way for the removal of US sanctions on the nation’s crude exports, is easing some pressure on prices.

Tensions over Ukraine remain, but an agreement for talks between the US and Russia next week has helped sentiment.

10:54 AM

Renault returns to profit but chip troubles linger

Renault swung back to a profit last year, but warned the global chip shortage would hit production again in 2022.

The French car maker posted a better-than-expected net profit of €967m (£807m) after a record €8bn loss at the height of the pandemic in 2020.

Renault sold 500,000 fewer cars last year but the company has cut costs, raised prices and shifted to a strategy of focusing on its more profitable brands instead of volumes.

Revenue rose 6.3pc to €46.2bn as the company exceeded its financial targets despite the shortage of semiconductors and the higher cost of raw materials.

Chief executive Luca de Meo said: “Renault is back. We have shown that we can overcome adversity.”

Still, Renault said it would 300,000 fewer cars this year as a result of chip shortages.

10:33 AM

Publishers eating up smaller rivals threatens diversity of authors

Major mergers between publishing houses are raising concerns not only about competition, but also what it means for the range of voices on our bookshelves.

Giulia Bottaro looks at competition and cancel culture in the world of books.

10:23 AM

Gas prices fall as US and Russia agree meeting

Natural gas prices have gone into reverse after the US said it had agreed to meet Russia over Ukraine, helping to ease fears of an imminent conflict.

Russian Foreign Minister Sergei Lavrov agreed to hold talks with US Secretary of State Antony Blinken next week after skirmishes on the border reignited tensions.

Benchmark European prices fell as much as 5.6pc this morning, while the UK equivalent was down a similar amount.

10:07 AM

Expedia boss: This summer will be ‘busiest travel season ever’

After two years of chaos, summer 2022 will be the “busiest travel season” ever.

The bold claim comes from Expedia chief executive Peter Kern, who’s predicting a golden period for the industry.

He told Bloomberg: “We’ve been talking about pent-up demand for a long time, but until now there have been too many restrictions in place for people to do too much with it.”

But it’s not just the easing of travel restrictions that Mr Kern’s looking forward to – it’s a combination of high volumes and high prices.

“Airlines are expecting to be back to historic levels by August,” he says. “And yes, prices will be high. But at this point, I think people are willing to pay whatever the hell it takes to get away and go to a place they want to go.”

The travel chief also reckons that cities will be the biggest winners, with cultural capitals such as London set to benefit from huge demand.

09:49 AM

Macquarie ‘lines up bid’ for National Grid’s gas business

Macquarie Group is said to be mulling a bid for a controlling stake in National Grid’s gas transmission business that could value the division at more than $10bn (£7.3bn).

The Australian financial services firm has made an initial non-binding offer for a majority stake through its asset management division, Bloomberg reported.

National Grid announced plans to sell the unit last year as part of its shift to green energy sources. Infrastructure specialist IFM, Canada’s Public Sector Pension Investment board and pension fund investors APG are all said to have expressed interested.

Shares in National Grid rose 1.5pc in early trading, giving it a market value of around £39.8bn.

09:39 AM

Pound holds steady as retail sales rebound

Sterling held its ground against the dollar as investors turned away from safe-haven assets amid a focus on further discussions between Russia and the US next week.

A strong rebound in retail sales also boosted the sentiment and added further duel to expectations of a Bank of England interest rate rise, though economists expect spending to slow as the cost-of-living crisis bites.

The pound edged up marginally against the dollar to $1.3625. Against the euro it was little changed at 83.45p.

09:28 AM

Cineworld secures deal to delay shareholder payments

Cineworld has reached an agreement to delay payments to disgruntled former shareholders in its US cinema chain Regal.

In September the embattled cinema group agreed to pay £170m to Regal investors who were unhappy at the purchase price of Cineworld’s £2.4bn takeover. The London-listed company took on significant debt as part of the deal, which made it the world’s second-largest cinema operator.

But it’s now received a three-month extension to pay the remaining £79.3m to shareholders in instalments by the end of June, freeing up vital cash.

Cineworld is separately embroiled in a legal battle over its botched move to buy Canadian chain Cineplex, and is appealing a court order forcing it to pay out CA$1.2bn (£720m).

The breathing room failed to impress investors, though, and shares dropped 2.6pc.

09:18 AM

GSK pauses trial in pregnant women after safety review

GlaxoSmithKline has paused a late-stage trial of its vaccine candidate against the respiratory syncytial virus (RSV) in pregnant women following a safety review by an independent committee.

The British pharmaceutical giant didn’t give further details on why it paused the trial – dubbed “GRACE” – as well as two other studies, but said a trial of its experimental RSV vaccine for adults aged 60 and over would continue.

Shares in GSK fell as much as 1.5pc, before recovering losses to trade flat.

RSV is a leading cause of pneumonia in toddlers and the elderly, but vaccine development has been plagued by setbacks for decades. However, many drugmakers are working to bring a candidate to the market over the next few years.

09:04 AM

Segro jumps as warehouse value soars

Segro has jumped to the top of the FTSE 100 this morning after huge rent increases drove up the value of its warehouse properties.

Europe’s biggest landlord booked a £4.1bn – or 29pc – increase in the value of its portfolio, while net asset value per share rose 40pc.

Analysts at Liberum hailed “another excellent set of results”, saying the business had benefited from strong occupier and investor demand for warehouse space during the pandemic.

Shares gained as much as 8.7pc – the biggest rise since March 2020.

08:54 AM

Macron forced to pump almost £2bn into EDF after capping energy prices

French President Emmanuel Macron has been forced to pump more than €2bn (£1.7bn) into EDF after ordering it to sell power below market prices.

The French state will buy up the majority of a €2.5bn share sale by the energy giant, which is struggling to shore up its battered balance sheet.

The government, which holds an 84pc stake in EDF, has told the company it can only increase prices by 4pc this year in an effort to shield households from soaring energy bills.

The order, which wiped out a fifth of the firm’s value last month, is set to dent profits by around €8bn this year.

EDF is also grappling with a drop in nuclear output as it carries out repairs and maintenance on its feet of ageing reactors.

While the Paris-based utility said higher energy prices had driven an 11pc rise in earnings before interest, tax, depreciation and amortisation last year, its outlook for 2022 was significantly worse.

08:52 AM

NatWest chairman: I’ve got no plans to leave

NatWest chairman Howard Davies has issued a robust (but good-natured) riposte to speculation he’s preparing to step down from the bank.

“Reports of my death have been much exaggerated,” he told reporters. “There are no plans for me to leave at present, there is no process under way.”

Mr Davies, a former Bank of England deputy governor who became NatWest chairman in 2015, said his term runs until July 2024 and he expects to remain in the job for the “foreseeable future”.

Last week Sky News reported that the bank was preparing to appoint headhunters to find a successor to Mr Davies.

08:46 AM

NatWest warns on rising costs

Let’s delve a little deeper into NatWest’s figures, as it seems a warning on costs is dragging down shares.

The bank warned rising prices would make it harder to cut overheads, and lowered its annual cost-cutting target to 3pc from 4pc previously.

It also reported higher-than-expected costs in the fourth quarter, with the cost-to-income ratio at 87pc, compared to its target of 82pc.

08:41 AM

FTSE risers and fallers

The FTSE 100 has pushed higher this morning, boosted by more positive sentiment over the Ukraine crisis and robust retail sales figures.

The blue-chip index rose 0.2pc, but it’s still on track for its worst week in nearly three months after sky-high inflation and war fears dragged down shares.

Despite posting a £4bn profit, NatWest fell 1.8pc after it lowered its annual cost-cutting target for the next two years.

Warehouse specialist Segro led the rises, up 2.7pc after record rent increases drove up the value of its properties. Reckitt Benckiser also pushed higher for a second day after it shrugged off inflation to predict higher profit margins.

The domestically-focused FTSE 250 was trading flat.

08:35 AM

NatWest boss: We’re ‘acutely’ aware of the cost-of-living crunch

NatWest chief executive Alison Rose said she was “very pleased” with the bank’s £4bn profit, but struck a note of caution for consumers in the year ahead.

Speaking on BBC Radio 4’s Today programme, she said:

We’re very pleased with the financial performance and the return to profitability and that is really a sign of how well our customers are performing in terms of how we’re supporting them…

We’re acutely aware of the challenges our customers are facing from the rising cost of living and for lots of customers and businesses actually, these are challenges that they haven’t faced for almost over 10 years.

So these are new challenges. We’re not seeing any signs of strain at the moment but things like our financial health check are really helpful ways of helping families and households look at their finances and figure out how they deal with that rising cost of living.

08:32 AM

NatWest returns to profit as bad loans shrink

NatWest swung back to a huge profit last year as the Government-backed bank released more money it had set aside to cover loan defaults during the pandemic.

The high street lender reported a pre-tax profit of £4bn in 2021, up from a loss of £481m the year before.

It came as NatWest returned £1.3bn to its balance sheet from the £3.2bn ringfenced during the pandemic, including £341m in the final three months of the year alone.

Shareholders will be handed £3.8bn through a dividend of 7.5p per share, while the bank announced a £750m share buyback.

This includes £1.7bn for the taxpayer, as the Government holds a 51pc stake. The bonus pool for NatWest’s bankers increase from £200m to £298m.

08:02 AM

FTSE 100 rises 0.3pc

The FTSE 100 nudged higher this morning after new data showed a strong rebound in retail sales last month.

The blue-chip index rose 0.3pc to 7,561 points.

07:58 AM

Expert reaction: Delicate pricing balance needed

Aled Patchett at Lloyds Bank says retailers will have to decide how much price pressure they’re willing to pass on.

January’s return to growth is something of a New Year’s bonus across the sector, with most having anticipated a slow month due to the rapid rise in the cost of living beginning to put pressure on household budgets.

Longer-term, the sector will need to consider how willing, and indeed able, it is to absorb inflationary pressures, which include their own commodity, energy, labour and shipping costs.

At a time when the sector is being boosted by recovering footfall as Covid restrictions ease and workers return to the UK’s towns and cities, a delicate pricing balance needs to be found to protect margins whilst encouraging consumers to spend against a backdrop where their disposable incomes are reducing.

07:53 AM

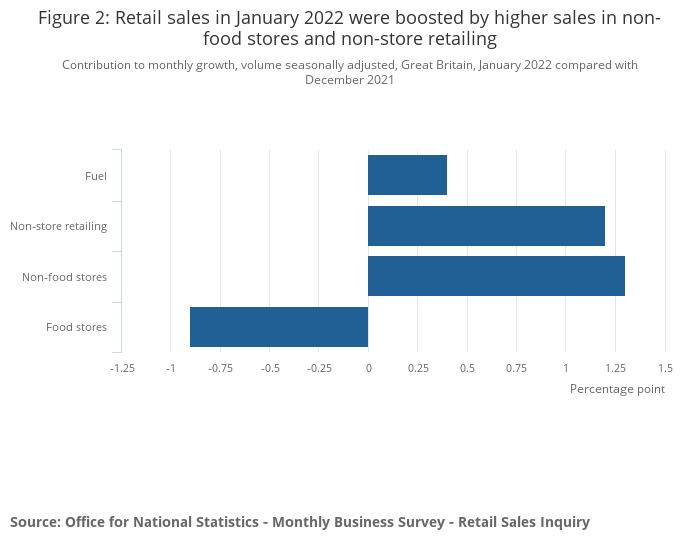

Retail sales give more ammo to Bank of England

January’s retail sales figures came in ahead of economists’ forecasts and suggest consumer spending bounced back strongly from December’s omicron-fuelled slump.

Household goods and garden centres led the way, while fuel sales also climbed close to pre-pandemic levels. This shows Brits are resuming normal movement and spending patterns, suggesting the UK’s post-Covid recovery is in good shape.

All this will be further ammunition for the Bank of England to announce its third consecutive interest rate rise next month.

Money markets are expecting the MPC to raise the base rate from its current level of 0.5pc to 0.7pc or even 1pc in a bid to curb surging inflation.

07:46 AM

Expert reaction: Dust from pandemic boom begins to settle

Karen Johnson at Barclays says the industry faces an uncertain year ahead as the pandemic boom eases and inflation pressures set in.

Many retailers saw something of a spending boom during the course of the pandemic, but now it looks like the dust from this explosion is finally beginning to settle. Consumer spending appears to be dropping back down to normal, whatever normal means in 2022…

After the seasonal boost to clothing retailers pre-Christmas, spending on clothing reduced back to low growth levels in January. Health and beauty did fare slightly better, as people kitted out in support of their New Year’s resolutions, but this wasn’t enough to reignite the sector last month.

Looking ahead, the outlook is uncertain. Interest rate rises and increasing costs are front of mind across the industry. What impact these pressures will have on consumer spending is THE question for the months ahead.

07:42 AM

Expert reaction: Cost-of-living crisis set to hit spending

Paul Martin, UK head of retail at KPMG, says businesses are facing tough decisions about how to handling rising costs.

The retail sector started the year in relatively good health and not facing further Covid restrictions on the ability to trade.

Retailers will be acutely aware however that the cost of living squeeze could see consumers scrutinising their spending more over the coming weeks and months, impacting trade. This picture will be compounded if those who managed to save during the pandemic decide the time isn’t right to spend what they’ve accrued.

As is the case for consumers, retailers also face inflationary pressures. Businesses have challenging decisions to make about how to absorb those, or how to pass them on without losing custom.

07:39 AM

ONS: Biggest monthly sales rise since reopening

Darren Morgan, director of economic statistics at the ONS, said:

After a sluggish December where the omicron wave had a significant impact, retail sales rebounded in January with their biggest monthly rise since the shops reopened last spring.

It was a good month for garden centres, department and household goods stores, with particularly strong trading for furniture and lighting.

Food sales fell below their pre-pandemic level for the first time, though, as more people returned to eating out and there was also anecdotal evidence suggesting higher demand for takeaways and meal-subscription kits.

Following a rise in high street footfall towards the end of the month, the proportion of online sales dropped to its lowest level since March 2020, while an increase in road traffic helped push fuel sales up from December.

07:26 AM

Retail sales recover

Good morning.

There’s some good news for retailers this morning, as the latest ONS figures show sales picked up last month.

The volume of goods sold in-store and online rose 1.9pc in January – a much-needed recovery from the 4pc slump suffered in December as omicron kept shoppers away.

It suggests rising inflation isn’t having a big impact on consumer spending just yet.

However, with price growth set to peak at 7.25pc and a cost-of-living crisis looming, it’s likely consumers will tighten the purse strings in the coming months.

5 things to start your day

1) Why the cost of a cup of coffee is soaring Cost pressures on coffee shops means price increases are now “inevitable”

2) Barristers swap horsehair for hemp as they try out first vegan court wigs London lawyer challenges 200-year-old tradition with plant-based headpieces

3) Elon Musk accuses US of trying to ‘muzzle’ his free speech Claims add to billionaire’s ongoing feud with regulator over his Twitter posts

4) BBC renews licence fee collection contract with Capita The contract to enforce the fee is worth £456m to Capita

5) NatWest faces £2m reparations for unfair dismissal of employee with cancer Adeline Willis’s dismissal was ‘tainted with discrimination’

What happened overnight

Asian markets fell on Friday following a steep drop on Wall Street. Hong Kong, Tokyo, Sydney, Seoul, Singapore, Taipei, Wellington, Manila and Jakarta slipped, though Shanghai edged up slightly.

Coming up today

-

Corporate: NatWest, Segro, TBC Bank (full-year results)

-

Economics: Retail sales (UK); consumer confidence (EU)