Russian stocks suffer biggest fall since 2008 as Ukraine war looms – live updates

Russian stocks have posted their biggest fall since the global financial crisis as fears mount that a war with Ukraine is imminent.

The benchmark MOEX Russia Index slumped as much as 14pc, while the dollar-denominated RTS Index slid 17pc, notching up the biggest decline since 2008.

Russian stocks tumbled across the board, though state-owned energy giant Gazprom and financial services group Sberbank were among the biggest fallers.

It came as Russian President Vladimir Putin said he was considering an appeal for official recognition from separatists in east Ukraine in a move that would further escalate the crisis.

The negative sentiment hit stocks across the globe, with the FTSE 100 sliding into the red after a strong start to the day. Wall Street was closed for a public holiday, further adding to volatility.

04:17 PM

Sterling still positive versus dollar despite fading risk appetite

Sterling has given up some gains but has remained in positive territory against a slightly weakening dollar on Monday while optimism about a diplomatic solution to the Russian-Ukraine standoff faded, dampening risk appetite.

The Kremlin said there were no concrete plans for a summit over Ukraine between Russian President Vladimir Putin and his US counterpart Joe Biden, after the French president said the two leaders had agreed on a meeting in principle.

The pound has added 0.15pc against the dollar at $1.3608, not far off its highest level since Jan. 20 at $1.3643.

“Because the markets are already very nervous due to high inflation, rising interest rates and upcoming rate hikes, the Ukraine-Russia conflict is temporarily acting as an amplifier of market movements,” said Moritz Paysen, a foreign exchange and rates analyst at Berenberg.

04:13 PM

Handing over

That’s all from me for today – thanks for following along! Giulia Bottaro is in charge for the rest of the day.

03:51 PM

Virgin Hyperloop axes half its staff in focus on freight

Virgin Hyperloop is said to have made almost half its staff redundant as the company shifts its focus from passenger travel to freight.

The company confirmed to the Financial Times that 111 people had been laid off on Friday in a move it said would allow it to focus on a cargo version of its concept.

The hyperloop – a variant of the vacuum train – propels pods through low pressure tubes at speeds of up to 670mph.

Virgin told the FT the company was “changing direction” due to supply chain issues and the impact of Covid.

03:41 PM

British regulator wades into Sir Nick Clegg’s battle with Google

Britain has waded into a battle between Google and Facebook over privacy changes that threaten to cost the social network tens of billions of dollars and figure high on the agenda of its lobbying chief Sir Nick Clegg.

James Titcomb has the details:

The Competition and Markets Authority (CMA) said it would “closely monitor” Google’s plans to block advert-tracking technology on more than 3bn Android phones.

Google, which owns the Android operating system, dealt a blow to advertisers last week when it said it would restrict how they can track smartphone owners’ activity across various apps.

The changes follow similar restrictions Apple has introduced on iPhones and are touted as a boost to privacy. However, Google’s plans, known as the “Android Privacy Sandbox” are likely to be closely watched because of the company’s own advertising empire.

Facebook, Google’s biggest rival for online advertising spending, is expected to suffer a $10bn (£7.4bn) blow to sales from Apple’s changes this year. Wall Street fears over the impact were partly responsible for a record-breaking 26pc drop in the share price of Facebook’s parent company Meta in a single session this month.

The CMA’s intervention is expected to lead to intense lobbying from Meta over Google’s similar plans.

03:08 PM

EU politicians call for blacklisting of Switzerland after Credit Suisse leaks

The main political grouping in the European Parliament has called for a review of Switzerland’s banking practices and its potential inclusion on the EU’s dirty-money blacklist following leaks of Credit Suisse documents.

Media organisations published findings from a leak of accounts belonging to 30,000 of the bank’s clients, totalling £80bn, that detailed funds controlled by corrupt businessmen and politicians.

The European People’s Party, the conservative grouping that holds the largest number of seats in the European Parliament, called on the EU Commission to “re-evaluate Switzerland as high-risk money-laundering country”.

The EU list currently comprises 21 countries who are deemed to have shortfalls in their rules and practices against money laundering. Among them are Iran, Myanmar, Syria and North Korea. No European country is on the list.

Credit Suisse said it strongly rejects the allegations about its business practices, arguing that some accounts referenced by the leaks dated back to the 1940s.

02:52 PM

UK banks Nigerian bank with £73m credit facility

The UK is providing a $100m (£73m) credit facility to First Bank of Nigeria to help support women-owned businesses and small companies in the country.

CDC Group, the UK’s development-finance organisation, said the funding will “address the challenge of limited access to capital faced by under-banked and underserved groups in the country”.

A minimum of $30m will be allocated in the form of credit lines to women entrepreneurs. The facility will use First Bank’s 700 branches and 150,000 banking agents in Africa’s largest economy to improve credit access.

02:38 PM

Nord Stream 2 is part of Russia sanctions, says Austria

The Nord Stream 2 pipeline is among the targets in a package of sanctions being prepared by the EU in case Russia invades Ukraine, Austria has confirmed.

Austrian Chancellor Karl Nehammer said the sanctions would include blocking approval of the controversial energy link, which would supply from Russia to Germany.

He told reporters: “Certification [of the pipeline] would then be stopped [if Russia invaded]. There is no question about that. That therefore means that Nord Stream 2 is part of the sanctions.”

Nord Stream 2 has been built but is still awaiting German and EU regulatory approval. It’s faced opposition from the US and some EU member states amid concerns it will heighten reliance on Russia.

Moscow has argued that the pipeline will strengthen Europe’s energy security.

02:26 PM

Donald Trump’s social media app hits trouble after launch

Donald Trump’s new social media app, Truth Social, is already struggling with teething problems after users complained they were unable to log in just hours after it went live.

Hannah Boland reports:

Truth Social, which is backed by Trump Media & Technology Group, launched on Apple’s App Store late on Sunday night.

However, new users reported being placed on waitlists, with the app citing “massive demand”, and others said they were struggling to register for an account.

The launch of the app is expected to see the former president make a return to social media, following the furore around the Capitol Hill riots last year which led to Mr Trump being banned from websites including Twitter and Facebook. He was accused of inciting violence which led to rioters storming the White House.

The app has been in a testing phase in recent weeks, and Mr Trump’s son Donald Trump Jr last week posted a screenshot of his father’s first message on Truth Social, in which he wrote: “Get Ready! Your favorite President will see you soon!”

02:06 PM

Russian miners tumble as tensions mount

The FTSE 100 has gone into reverse this afternoon, and it’s Russian miners that are taking the brunt of it. The blue-chip index, which pushed higher this morning, is now down 0.7pc.

Hopes of diplomacy are starting to fade amid clashes on the border with Ukraine, while Boris Johnson’s spokesman warned an invasion was imminent.

Anglo-Russian miner Polymetal International was the biggest FTSE 100 faller, tumbling 8.7pc as tensions rose. Evraz, which is controlled by billionaire Roman Abramovich, fell 5.6pc.

The FTSE 250 suffered even more, slumping 1.4pc to an 11-month low. Petropavlovsk dropped 11pc to the bottom of the index.

01:53 PM

Ofwat: Water bosses ‘should have pay scrutinised’ over sewage dumping

Water bosses whose companies dump sewage in UK rivers should have their bonuses reined in.

That’s according to David Black, head of regulator Ofwat, who told firms they had to ensure chief executives were not handed bonuses that “reward poor performance”.

In a letter Mr Black wrote: “Companies’ performance in some areas, most notably on the environment, risks eroding trust and confidence in the sector.

“We therefore expect companies to ensure that these outcomes are reflected in performance-related pay for executive directors, including recognition of poor performance and any non-compliance with regulatory and statutory obligations.”

Last month a report from MPs on the Environmental Audit Committee found that only 14pc of rivers in England met food ecological status.

It placed blame on the Government, regulators and water companies for allowing “a Victorian sewerage system to buckle under increasing pressure”.

12:57 PM

Workers at Exxon’s Fawley refinery balloted over strike

Fuel supplies to airports and filling stations could be hit in the spring amid threats of a strike at the UK’s largest oil refinery.

A ballot of 100 workers at the Fawley refinery – owned by oil giant Exxon – gets underway today, with strikes set to begin in April.

Members of the Unite union are threatening the action over an “insulting” offer of 2.5pc increases in pay over the next two years. Inflation has hit a 30-year high of 5.5pc and is set to peak above 7pc in the spring.

Sharon Graham, Unite general secretary, said:

The employers need to take back this insulting pay offer, which is actually a cut, and think again. Our members have mounting bills to pay like everyone else, and with runaway inflation there is no way we will accept a derisory 2.5pc for this workforce.

12:32 PM

Lotus explores IPO as it gears up for electric growth

British sports car maker Lotus is exploring options for a stock market listing as it seeks to fund a major expansion in China and its shift to electric vehicles.

Geely, the Chinese company behind Lotus, last year split the firm into two parts, a Norfolk-based sports car manufacturer and a “lifestyle” brand based in China focused on making electric sports utility vehicles.

It is now gearing up for a stock market listing of the lifestyle division, which could take place in the UK, US or China.

The China-based unit, Lotus Tech, forms a key part of the company’s efforts to grow sales from 1,710 cars in 2021 to as many as 150,000 each year.

An initial public offering for Lotus would mark the latest move into public markets for one of Geely’s investments.

It is a major shareholder in Volvo, which was valued at more than $15bn in a Stockholm listing last year. Polestar, the electric car specialist spun out of Volvo, plans to list this year in a blank-cheque deal that could value it at $20bn.

12:20 PM

FTSE 100 swings into the red

It’s set to be a quiet afternoon of trading, with US markets closed for Presidents’ Day. Closer to home, the FTSE 100 has erased its earlier gains to swing 0.2pc into the red.

The blue-chip index had started the day on the front foot amid hopes of a summit between Joe Biden and Vladimir Putin, but it seems the optimism is running out of steam.

AstraZeneca is one of the winners, rising 2.5pc following positive trial data for its breast cancer drug.

But oil majors BP and Shell, as well mining stocks, are all dragging down shares as commodity prices swing amid geopolitical tensions.

The domestically-focused FTSE 250 slumped 1.3pc. Miner Petropavlovsk, which has operations in Russia, slumped more than 10pc.

11:50 AM

SoftBank leads $190m PrimaryBid funding

Retail investor platform PrimaryBid has raised $190m (£140m) in a funding round led by Softbank’s Vision Fund 2.

The latest cash injection values the UK fintech, which is backed by the London Stock Exchange Group, at around $715m, Bloomberg reports. It plans to use the funding to scale up its business in continental Europe and the US.

PrimaryBid has cashed in on a growing trend of opening up share sales to the public. Deliveroo, PensionBee and Soho House all offered shares to retail investors through PrimaryBid during their stock market floats.

It comes after the company raised $50m in October 2020 from backers including LSEG, Molten Ventures, Fidelity, ABN Amro and Hambo Perks.

11:40 AM

New taxes rake in £50bn for HMRC ahead of National Insurance rise

New levies imposed on businesses over the last decade have raked in more than £50bn for the Treasury, as the UK’s tax burden rises to its highest level since the 1950s.

Tim Wallace has more:

The bank levy, apprenticeship levy, soft drinks tax and a range of other charges have all contributed to the public purse, according to analysis by Thomson Reuters.

It comes as National Insurance is set to rise in April, adding 1.25 percentage points to the tax levied on employers and on their workers’ pay packets.

Jas Sandhu Dade at Thomson Reuters said it is a tough time to add to the burden on taxpayers.

She said: “Adding new taxes and placing a heavy burden on businesses comes at a difficult time for those still recovering from the economic impact of the pandemic.

“These new taxes have proven themselves to be a successful way to bring in billions of pounds in a relatively short space of time. The new National Insurance surcharge is sure to be a success from a public purse perspective, but will add considerable financial and compliance stresses to both businesses and individuals.”

11:27 AM

Bundesbank: Germany may have tumbled into second recession

Germany may have fallen into its second recession since the outbreak of Covid as the omicron variant dragged down activity.

That’s according to the Bundesbank, which warned output in Europe’s largest economy may decline “noticeably” in the first quarter, having already shrunk by 0.7pc in the final three months of the year.

In its monthly report, the central bank said: “In contrast to previous waves of the pandemic, it’s not just the services sector that’s hit by restrictions and adapted behavior.”

It warned pandemic-related worker absences would “markedly” hit activity in other areas too.

There is some cause for optimism, though. The report, which followed upbeat PMI data for the eurozone, predicted a strong rebound in the German economy in the spring thanks to “very good” demand.

11:13 AM

Oil prices swing as traders weigh up Biden-Putin summit

Oil slumped and then recovered in volatile trading this morning after France said the US and Russian presidents had agreed in principle to a meeting over Ukraine.

West Texas Intermediate initially fell as much as 2.7pc before recovering most of its slump, while Brent crude is now marginally higher at $93.67 a barrel.

US officials said Joe Biden had agreed to meet with his Russian counterpart this week, provided the country did not attack Ukraine. The Kremlin issued a cautious response saying there were “no concrete plans” in place for the talks.

Investors also have an eye on negotiations to rekindle Iran’s 2015 nuclear agreement. Iran this morning said there had been some progress in the talks, but warned the two sides had yet to resolve the toughest issues.

11:04 AM

Expert reaction: PMIs show omicron ‘just a blip’

Adam Hoyes, assistant economist at Capital Economics, says “punchy” PMI numbers give even more evidence that the economy has rebounded strongly from omicron.

Perhaps unsurprisingly after suffering the most as a result of omicron, the rise in the composite measure was driven primarily by the services PMI, which rose from 54.1 in January to 60.8 in February as lower Covid-19 cases meant people returned to leisure venues.

Meanwhile, the manufacturing PMI held steady at 57.3 as weaker employment growth offset a rise in the output balance.

More importantly, the prices balance showed some further signs that inflationary pressures from supply disruptions are easing. The suppliers’ delivery times balance of the manufacturing PMI suggests that delivery times lengthened at their slowest pace since November 2020.

That probably helped both the input and output manufacturing price balances tick down. Although admittedly the rise in the services input price balance suggests wage pressures are continuing to build.

In sum, the PMIs suggest the economy shrugged off the hit from omicron. And the tentative signs of easing supply disruptions and price pressures are encouraging too. But with CPI inflation far above the Bank of England’s 2pc target and rising, we still expect Bank Rate to reach 1.25pc by the end of this year and 2pc by the end of next year.

10:56 AM

Mary Berry cake maker warns of price rises

The food group behind Marry Berry cakes reported record sales in the second half of last year but warned customers would face higher prices.

Finsbury Food, which also makes Weight Watchers branded cakes, posted 9pc growth in revenue to £166.5m. However, pre-tax profits dipped from £7.4m to £5.7m as costs spiralled.

The London-listed company said it would be able to mitigate the impact in the coming months by passing higher costs onto consumers.

Finsbury held its forecasts for the full year steady, but shares fell 2pc.

10:44 AM

Eurozone growth jumps as Covid restrictions ease

Much like in the UK, economic growth in the eurozone was handed a major boost this month as virus restrictions were eased.

Growth accelerated to a five-month high, according to the latest IHS Markit survey, but it also noted that persistent supply constraints and soaring energy prices also pushed inflation to a record level.

Its purchase managers’ index (PMI) surged 3.5 points to 55.8, higher than the 52.3 recorded in January. A figure above 50 indicates growth.

The rise was attributed to the eurozone exiting two months of tough restrictions designed to slow the spread of the omicron variant.

10:26 AM

Pound gains ground against dollar

Sterling has pushed higher against the dollar this morning amid rising hopes of a diplomatic solution for the Russia-Ukraine conflict and solid PMI numbers.

US President Joe Biden and Russian counterpart Vladimir Putin have agreed to a summit in principle, fuelling risk sentiment and shifting focus away from safe havens such as the dollar.

Meanwhile, the latest PMI data showed a strong rebound in private sector activity in February as omicron jitters faded, reinforcing expectations that the Bank of England will move to raise interest rates.

The pound rose 0.4pc against the dollar to $1.3636. Against the euro it fell 0.1pc to 83.39p.

10:19 AM

Expert reaction: PMIs keep interest rate decision finely balanced

Simon Harvey at Monex Europe says there’s something for the interest rate hawks and doves in today’s PMI numbers.

Today’s PMI data is unlikely to dissuade the more hawkish traders within money markets as services activity exceeded expectations by a considerable margin and manufacturing activity held up despite expectations of a minor slowdown.

Despite the strong indicators sent from the services sector, the manufacturing PMI data did show some areas of weakness. Supply chain disruptions and staffing issues due to omicron persisted in February and weighed on production growth.

Despite this, backlogs of work decreased at the fastest rate since June 2020 as new order growth in the manufacturing sector stalled and rising inventories helped alleviate capacity pressures.

Meanwhile, cost inflation continued to moderate within the manufacturing sector, signalling a decline in core goods inflation is likely in the coming six months.

The divergence in the two sectors means today’s PMI report provided something for both the more conservative and more hawkish side of the monetary policy argument and is therefore unlikely to move the pricing of a 50bps hike by the BoE in March.

10:11 AM

Private sector rebounds as omicron worries fade

Private sector growth has rebounded to its strongest level in eight months as the easing of omicron fears drove consumer spending on travel, leisure and entertainment.

The IHS Markit Flash Composite index stood at 60.2 in February – up from 54.2 in January and the highest since June 2021.

Output growth in the service economy sharply outpaced that of the manufacturing sector, as restrictions eased and more people got back to the office.

However, input cost inflation accelerated again in February and came close to breaching the survey-record high seen last November. Faster rises in operating expenses at service sector firms once again offset a slowdown in cost inflation at manufacturing companies.

Looser pandemic restrictions prompted a stronger expansion in the UK with the #PMI at a 8-month high of 60.2. Output growth in the service economy exceeded that seen in the manufacturing sector, while supply chain issues showed signs of easing. Read more: https://t.co/I4tg3UtgmT pic.twitter.com/SKMrajGbGa

— IHS Markit PMI™ (@IHSMarkitPMI) February 21, 2022

09:52 AM

Gas prices fall on Biden-Putin summit hopes

Natural gas prices have plunged as traders weighed up hopes for talks between US President Joe Biden and Russian leader Vladimir Putin.

The White House has accepted French proposals for a summit on the condition that Russia doesn’t invade Ukraine. The Kremlin said there were “no concrete plans” for talks yet.

The prospect of a meeting fuelled hopes that war could be avoided. A conflict threatens to disrupt energy supplies to Europe and wreak further havoc in the market.

Benchmark European prices fell as much as 6.5pc, while the UK equivalent was down 3.7pc.

09:48 AM

TfL funding talks extended by a week

Grant Shapps has given Sadiq Khan another week of funding for Tube, bus and rail services across London.

My colleague Oliver Gill reports:

Mr Khan, chairman of Transport for London, is locked in talks with the Government to agree a fresh bailout. The latest Westminster funding originally ran out on Feb 4. It was extended for two weeks until midnight on Friday.

A further extension has been granted by Mr Shapps, the Transport Secretary, on Feb 25, TfL announced this morning.

TfL is facing a £1.5bn funding black hole over the next two years. This, however, is for operating expenditure rather than the money required to prevent the London Underground and other public transport falling into disrepair.

The key sticking point in negotiations are a series of conditions attached to the latest bailout. Mr Khan is desperate to receive a “long-term” deal and has resisted calls to introduce driverless Tubes.

Ministers, meanwhile, are refusing to give Mr Khan the money unless he commits to a series of reforms, including closing the Underground’s final salary pension scheme.

09:10 AM

German factory inflation at post-war high

German factory inflation has surged to its fastest pace in the post-war era, fuelling expectations that producers will pass higher costs onto consumers.

Producer prices jumped 25pc in January compared to last year – the sharpest growth since 1949 – according to the latest official figures.

Higher energy bills were the main driver of higher prices, with energy costs up by two thirds compared to January 2021. Supply troubles have also driven up costs.

08:59 AM

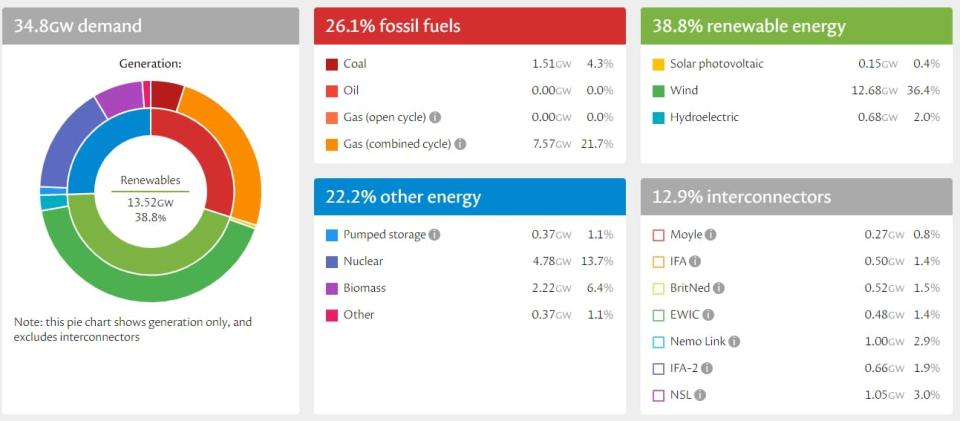

Storm Franklin whips up wind power

Storm Franklin is the third to hit the UK in the last week, wreaking havoc up and down the country.

But it’s good news for energy markets. Wind now accounts for 37pc of all electricity generation – a sharp increase on the average of 19.3pc over the last year.

Dudley, Eunice and Franklin mean wind power has been elevated for a week now, with demand peaking at 45pc over the last 24 hours.

08:41 AM

FTSE risers and fallers

The FTSE 100 has gained ground in early trading on hopes of a de-escalation in the crisis between Russia and Ukraine.

US President Joe Biden and Russian leader Vladimir Putin have agreed in principle to a summit over Ukraine, raising hopes an invasion could be avoided.

The blue-chip index gained 0.6pc, driven by miners including Evraz, Rio Tinto and Anglo American, tracking higher copper prices amid a weaker dollar as easing geopolitical tensions.

Dechra Pharmaceuticals rose 1pc after beating expectations for revenue and profit in the first half of the year, while AstraZeneca was boosted by positive trials of its breast cancer drug.

Meanwhile, Boris Johnson is set to outline plans to lift the remaining Covid restrictions, helping to boost sentiment and driving up travel and leisure stocks.

The FTSE 250 inched marginally higher.

08:26 AM

AstraZeneca reports positive data on breast cancer drug

AstraZeneca has reported positive data from a late-stage trial that shows its drug helps patients with breast cancer live longer.

The pharmaceutical firm said Enhertu boosted survival rates in patients with HER2-low unresectable and metastatic breast cancer.

Susan Galbraith, Astra’s executive vice president of oncology research and development, said the results “could reshape how breast cancer is classified and treated”.

Shares rose as much as 2.2pc in early trading.

08:21 AM

Clipper Logistics jumps on £950m takeover offer

It’s a busy morning for M&A, but Clipper Logistics appears to be one of the biggest winners.

The Leeds-based company surged 13pc in early trading after revealing it’s agreed a takeover by US rival GXO that values it at around £943m.

GXO’s offer is valued at 920p per share, with 690p in cash and the rest in new GXO shares. Clipper said its board would unanimously recommend the offer to shareholders.

A merger would combine two huge global supply chain management groups. Clipper handles logistics for a string of major European retailers including Asda and Argos, while GXO operates hundreds of warehouses globally.

08:16 AM

Hammerson in talks over £120m Leeds shopping centre sale

Hammerson is lining up the sale of two of its shopping centres in Leeds in what could be a £120m deal.

The real estate group confirmed it’s in talks with Swiss firm Redical Holding over a sale of its Victoria Gate and Victoria Quarter sites.

Hammerson, which owns Birmingham’s Bullring and Brent Cross, said there’s no certainty a deal will be agreed.

08:08 AM

Made.com boss steps down for family reasons

The chief executive of Made.com is stepping down for family reasons.

Philippe Chainieux, who took over the top role in 2017, said he was pausing his professional activities to take care of his family.

Nicola Thompson, currently chief operating officer, will join the board and assume the position of interim chief executive with immediate effect.

Susanne Given, chair of Made.com, said:

On behalf of the board, I would like to thank Philippe for his dedication and hard work over the last nine years, during which he and the Made team have built this exciting, unique and successful digital consumer business.

In 2021 we delivered record revenues and finished the year in a strong financial position. It is with sadness and understanding that the board accepts Philippe’s resignation and we wish him and his family well for the future.

08:01 AM

FTSE 100 opens higher

The FTSE 100 has kicked off the week in positive territory as traders keep their focus on the situation in Ukraine.

The blue-chip index rose 0.5pc at the open to 7.554 points.

07:56 AM

John Menzies set to accept new £560m takeover bid

It could well be third time lucky for the Kuwaiti suitor circling John Menzies.

The airport services firm said it’s ready to accept a £560m takeover approach after the proposal was sweetened for a third time.

Agility Public Warehousing is now offering 608p per share in cash for the company after tabling an initial bid of 460p.

Menzies said its board voted unanimously to recommend the bid to shareholders. Agility now has until March 9 to make a formal offer.

07:49 AM

Tencent leads China sell-off as crackdown fears mount

Chinese tech stocks tumbled this morning, heading for their worst two-day drop since July amid fears Beijing could clamp down further on the sector.

Video game giant Tencent led the losses, falling as much as 6.3pc, while Alibaba dropped 4.3pc.

The country’s banking watchdog issued a warning last week against fund-raising and investment products relating to the metaverse. An industry body this morning vowed to resist speculative trades in the capital market.

The sell-off was also prompted by a new policy aimed at curbing delivery platforms’ service fees, which sent shares in Meituan down as much as 18pc.

07:41 AM

Expert reaction: Housing demand holding up

Jeremy Leaf, former RICS chairman, says the housing market is continuing where it left off last year.

Although Rightmove‘s figures are based on asking, rather than selling, prices, there still seems to be scope for further increases.

Demand hasn’t been blown off course so far by the weather, rising interest rates or inflation as we have recorded a significant proportion of buyers who missed out in some of last year’s competitive bidding returning for another try.

Listings are increasing but not fast enough to satisfy appetite for houses in particular which is inevitably reducing the number of transactions.

Looking forward, stretched affordability will mean prices cannot keep rising at the same pace but certainly there’s no sign of any significant softening yet.

07:37 AM

Rightmove: Many Brits still determined to move

Tim Bannister, director of property data at Rightmove, says many house hunters are still determined to move despite a squeeze on finances.

The rising cost of living is undoubtedly affecting many people’s finances, especially those trying to save up enough for a deposit to get on the ladder or to trade up.

However, despite rising costs and rising interest rates, the data right now shows demand rising across the whole of Great Britain, with many people determined to move as we head into the spring home-moving season.

07:32 AM

House hunters flocked back to the capital

Good morning.

After the pandemic turning the housing market on its head, we’ve got the first sign that things are returning to normal.

Buyer enquiries for properties in London surged 24pc this month from a year earlier – the sharpest growth of any region. Asking prices also rose to a record £667,001.

It’s a turnaround for the capital, which had underperformed the rest of the country during the pandemic, and suggests buyers are looking for homes in commuter areas again as they get back to the office.

Overall, UK house prices rose 9.5pc year on year to £348,808 – the highest annual growth since 2014.

5 things to start your day

1) Developers warn of crisis in older people’s housing Britain’s biggest retirement housebuilder has said that demand for older people’s homes is four times higher than supply.

2) Channel 4 launches new political show with Andrew Neil to counter Piers Morgan’s TalkTV The broadcaster is bolstering its current affairs output by launching a 10-part series of live political interviews starting in May.

3) Credit Suisse leak reveals criminals and dictators among its clients Credit Suisse has been rocked by a huge data leak, the latest scandal to engulf the Swiss bank, with fresh accusations that it served some clients who were alleged to be involved in torture and drug trafficking.

4) Delay ‘red diesel’ ban or companies will collapse, Rishi Sunak warned Ending use of the low-tax fuel will pile up to £500m of extra costs on firms and put the UK’s recovery at risk, according to industry groups.

5) UK set to reject Canada’s hormone beef demands in early trade talks setback Government sources said ending a ban on the use of hormones in beef production is highly unlikely after Canada’s trade minister signalled that Ottawa will push for the UK to ditch its tougher standards on the controversial practice.

What happened overnight

Asian share markets pared sharp early losses on Monday as a glimmer of hope emerged for a diplomatic solution to the Russian-Ukraine standoff, though there remained plenty of devil in the detail.

Wall St futures rallied on news US President Joe Biden and Russian President Vladimir Putin have agreed in principle to hold a summit on the Ukraine crisis.

Just the chance of a peaceful solution was enough for S&P 500 stock futures to reverse out of early losses to trade 0.4pc higher. Nasdaq futures edged up 0.2pc, having been down more than one per cent earlier.

MSCI’s broadest index of Asia-Pacific shares outside Japan pared their losses to be down 0.4pc, while Japan’s Nikkei halved its drop to be down 0.9pc.

Coming up today

-

Corporate: Dechra Pharmaceuticals (interim results)

-

Economics: Manufacturing and services PMIs (UK, EU); Rightmove house prices (UK); interest rates (China)