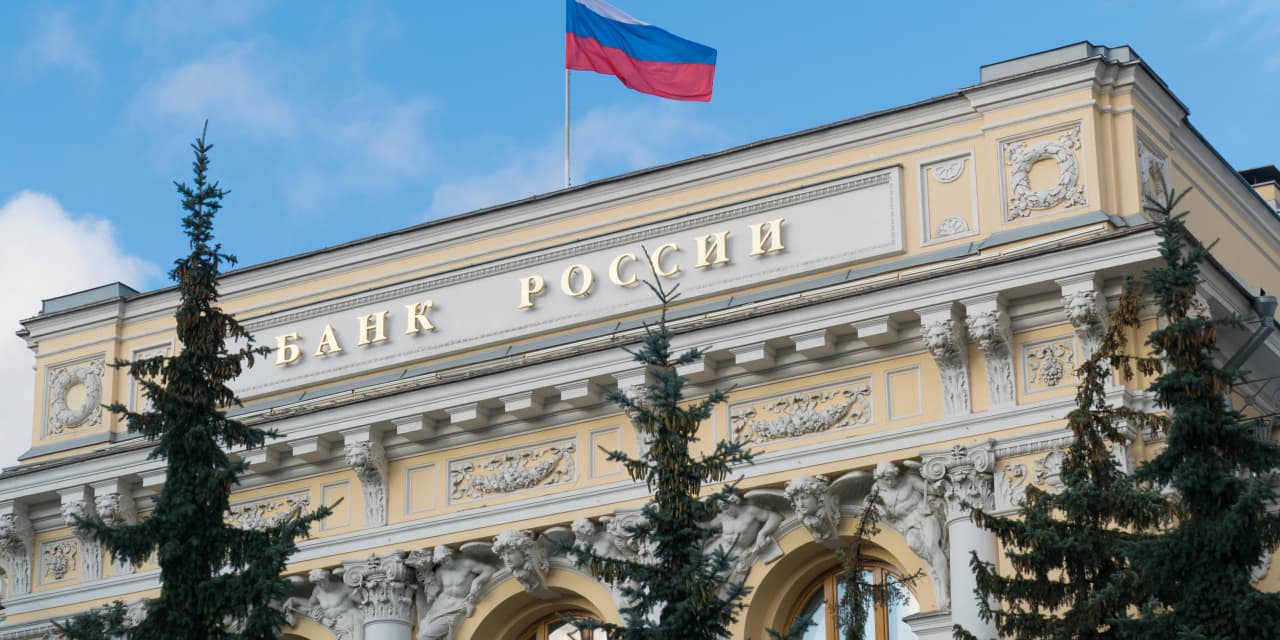

Russia’s credit rating cut to junk by S&P as other agencies mull or take downgrade action

Russia’s credit rating was cut to junk by S&P Global Ratings, part of a wide review by all major rating agencies to grade the soundness of the gas-exporting giant’s financial health after the country’s invasion of Ukraine.

Moody’s Investors Service, meanwhile, said late Friday it has placed Russia’s and Ukraine’s credit ratings on review for possible downgrades, again to speculative, or junk, ratings for Russia.

S&P joined Fitch Ratings in downgrading Ukraine.

The war, which entered its third day Saturday as Russian troops reportedly pushed closer to the capital Kyiv, has prompted the U.S. and allies to impose sanctions on Russia. President Joe Biden also sanctioned Vladimir Putin’s own finances and those of several key aides.

The action has roiled stock, debt and energy markets this week. Energy supplies from Russia, natural gas NG00,

S&P lowered Russia’s broadest credit rating to BB+, below investment grade, from BBB- late Friday and warned of further cuts.

It also downgraded Russia’s foreign currency RUBUSD,

“Russia’s military intervention into Ukraine has prompted strong international sanctions, including on large parts of Russia’s banking system,” S&P said in its note.

“We believe that the announced sanctions could have significant direct and second-round effects on economic and foreign trade activity, domestic resident confidence, and financial stability,” it added. “We also expect geopolitical tensions to drag on private-sector confidence, weighing on growth.”

Moody’s Investors Service said late Friday it has placed Russia’s and Ukraine’s credit ratings on review for possible downgrades, which in the case of Russia’s debt would mean a slide toward speculative, or junk, ratings.

Russia currently holds a Baa3 rating, Moody’s lowest rung of investment grade, while Ukraine holds B3 ratings, the middle rung of non-investment grade.

The Russian invasion of Ukraine represents “a significant further elevation of the geopolitical risks … which is being accompanied by additional and more severe sanctions on Russia, potentially including those that could impact sovereign debt repayment,” Moody’s said.

It added that a fuller picture of the impact of sanctions would depend on the sanctions’ scope, the sectors targeted, and the degree of coordination between Western countries.

For Ukraine, an “extensive conflict” would pose a liquidity risk as the country has “sizeable” debts maturing in the coming years and its economy relies on foreign-currency funding, Moody’s said.

S&P lowered Ukraine to B- from B.

Fitch, meanwhile, took Ukraine’s level down to CCC from B, putting it seven steps below investment grade or on par with El Salvador and Ethiopia.

Claudia Assis contributed to this report.