Protesters have also blasted an effort to speed up ownership changes for both state and private mining projects. The outrage forced President Aleksandar Vucic to send the proposal back to parliament for reworking.

“If all mining projects for which the government has issued exploration licences go through, Serbia will cease to exist,” Now Zlatko Kokanovic, a farmer from Gornje Nedeljice, where the mine would be built, told Reuters. “The country will become a colony of big, foreign companies,” he said. “We do not deserve to be ecological refugees.”

Related article: Rio Tinto says 60 Jadar mines wouldn’t fill looming lithium gap

Prices for the commodity, key for manufacturing the batteries that power electric vehicles, shot to a record last year, increasing supplies concerns.

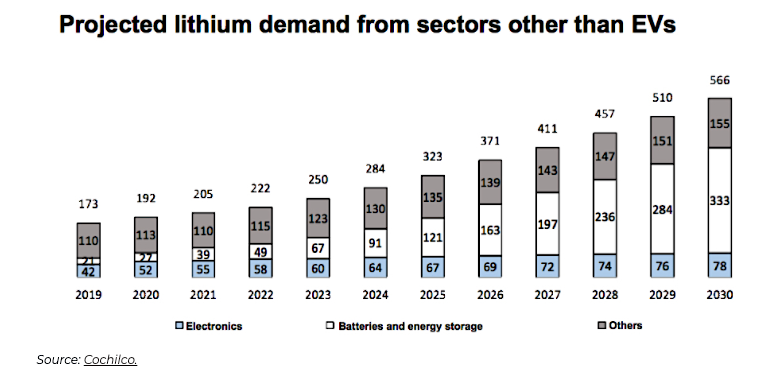

The world’s top automakers, from Tesla to Volkswagen to Toyota, need an ever-growing supply of battery materials to accelerate the roll-out of EVs, with experts expecting demand for the battery metal coming from the sector will account for almost three quarters of its consumption by 2030, up from 41% in 2020.

Experts said the world’s shortage of lithium had been forecast to last for another three years at least, but with the cancellation of the Jadar project, the shortfall would now last for several years.

“We’re at the point now where lithium supply is going to set the pace of electric vehicle rollout,” Credit Suisse analyst Saul Kavonic said in January.

The Jadar project, which would have been one of Serbia’s biggest foreign investments, was part of official efforts to draw in investment and boost economic growth. The government’s goal is to have the mining sector generating between 4% and 5% of Serbia’s total GDP in less than 10 years, a significant increase from its current 2%.

At full capacity, the mine was expected to produce 58,000 tonnes of refined battery-grade lithium carbonate a year, making it Europe’s biggest lithium mine by output.

(With files from Reuters)