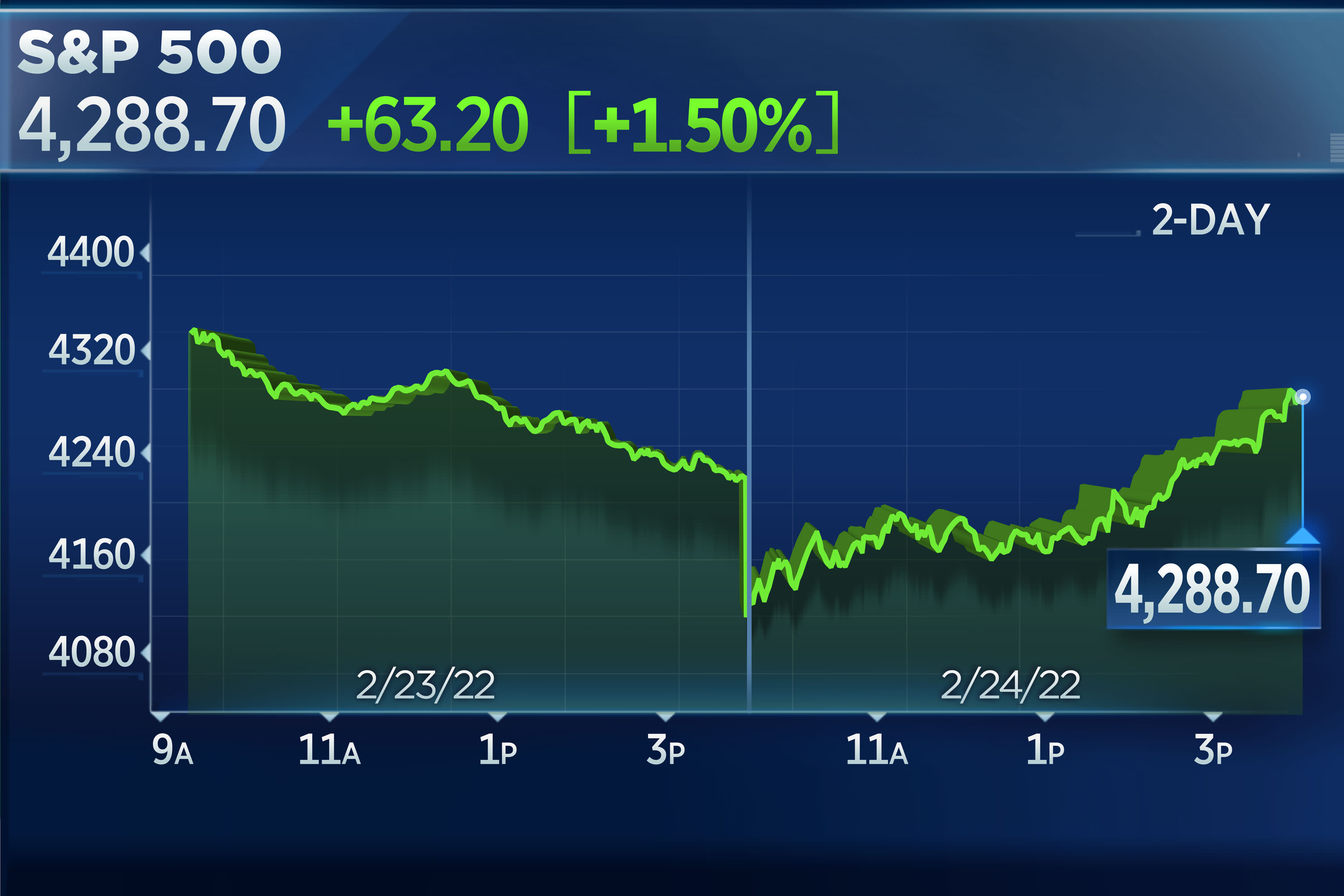

Stocks rose broadly on Thursday, staging a massive comeback from steep declines seen earlier in the day, as investors looked past Russia’s attack on Ukraine.

The S&P 500 rose 1.5% to 4,288.70 after dropping more than 2.6% earlier in the session. The Dow Jones Industrial Average added 92.07 points to 33,223.83, erasing an 859-point decline. The Nasdaq Composite ended the session 3.3% higher at 13,473.59, after being down nearly 3.5% at one point in the session.

Despite the stunning reversal, the S&P 500 remains in correction territory — more than 10% off its Jan. 3 record close. The Nasdaq Composite opened in bear market territory on Thursday, down more than 20% from its record high in November, before bouncing off those levels. The Nasdaq still sits about 16% from its all-time high, however.

Loading chart…

Investors bought the dip on some of the biggest tech names during Thursday’s volatile session. Amazon, Netflix, Alphabet and Microsoft all closed higher — erasing sharp declines from earlier in the day. Netflix rose 6.1%, and Microsoft added 5.1%. Alphabet and Meta Platforms popped 4% and 4.6%, respectively.

President Joe Biden addressed Russia’s invasion of Ukraine on Thursday, announcing that the U.S. will introduce a new wave of sanctions against Russia in a broad effort to isolate Moscow from the global economy.

The White House has also authorized additional troops to be stationed in Germany as NATO allies look to bolster defenses in Europe, Biden said.

“Today I’m authorizing additional strong sanctions, and new limitations on what can be exported to Russia,” Biden said. “This is going to impose a severe cost on the Russian economy both immediately and over time.”

Meanwhile, Russian President Vladimir Putin said Thursday that “Russia remains a part of world economy. We are not going to harm the world economy system we are a part of as long as we are a part of it.”

Moscow launched the military action in Ukraine overnight Thursday. There were reports of explosions and missile strikes on several key Ukrainian cities including its capital, Kyiv. Russian President Vladimir Putin called the invasion “the demilitarization” of Ukraine and said Russia’s plans do not include the occupation of Ukrainian territories.

NATO, the most powerful military alliance in the world, is set to reinforce its presence on its eastern front following Russia’s invasion of Ukraine. (Investors can follow along CNBC’s live blog tracking Thursday’s developments in Russia’s attack on Ukraine.)

The Russia invasion “is really worse than a baseline expectation that we had or the markets had. I would argue we are talking basically another 5% to 6% down which would put us close to 20% or bear market territory,” said Binky Chadha, chief U.S. equity and global strategist at Deutsche Bank,” on CNBC’s “Squawk Box” Thursday.

Oil prices settled well off their highs alongside the recovery in equities. Global oil benchmark Brent jumped 1% to around $92 per barrel, after the $100 level for the first time since 2014. The U.S. oil benchmark, WTI, traded about 1% higher around $92 per barrel after hitting just shy of $100 per barrel earlier in the session.

Loading chart…

The U.S. 10-year Treasury yield stayed below 2% as investors sought safe-haven bonds. Bitcoin turned positive alongside equities but was getting hammered earlier.

The Cboe Volatility index, a gauge of Wall Street fear, spiked to above the 37 level on Thursday, near hits highest levels of the year. The index later slid to around 30.

European stocks sold off, with the pan-European Stoxx 600 dropping more than 3% to its lowest point of the year. The VanEck Russia ETF, a U.S.-traded security which invests in top Russian companies, plunged 19% on Thursday.

“How long this crisis takes to unfold will determine how much inflation, financial conditions, and growth will be impacted,” wrote Dennis DeBusschere of 22V Research.

Prior to the invasion, U.S. stocks had been reeling due to decades-high inflation stemming from the pandemic.

Markets have also been worried about tighter Federal Reserve policy amid escalating inflation. Traders have adjusted their views on the Fed in recent days, with the likelihood of a 0.5 percentage-point interest rate hike in March down to 13.3%, according to CME Group data.

— CNBC’s Christine Wang contributed to this report.