Swallow your fear and prepare for a ‘relief rally,’ says analyst, as Russia invasion in Ukraine sparks stock-market maelstrom

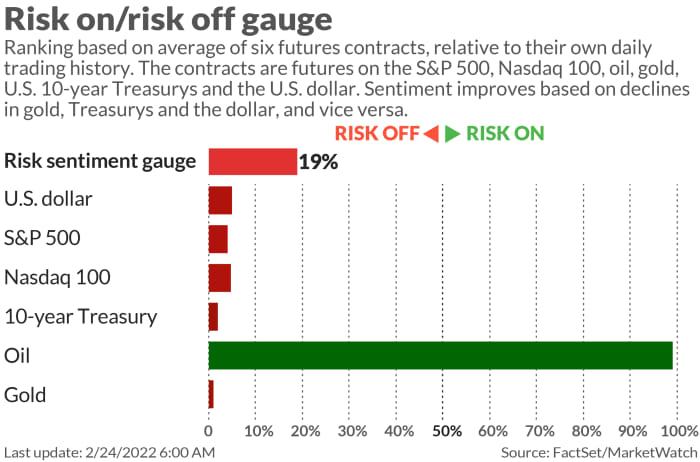

Russia’s attack in Ukraine has investors in risk-off mode. It is geopolitical drama that global economies and markets can likely ill-afford and comes as countries are attempting to extricate themselves from the worst pandemic in over 100 years.

Thus far investors have been able to navigate a public health crisis and now are confronting problems on a number of fronts that may be exacerbated by Russian President Vladimir Putin’s decision to launch a “special military operation” in and around Kyiv.

Investors on Thursday were decidedly not in the buying mode and it isn’t clear if optimism will resurface soon, with many of the key benchmarks in the U.S. at or near correction levels.

“If they’re not worried about Russia-Ukraine tensions, they’re worried about inflation and the Fed. Or Russia. Or oil. Or tech. The stock and crypto rallies have stalled for now, and they may be stuck until we get some clarity on these issues,” Callie Cox, U.S. investment analyst at social trading and multiasset brokerage eToro, told MarketWatch in comments via email recently.

But what many investors don’t realize is that fear can be a “good development for markets,” Cox says in our call of the day.

“When investors get nervous, they tend to add more cash and hedge their positions. The worst market storms typically happen when investors least expect it. Right now, people are hedged and ready for a big punch to the stomach, but it may not hurt as badly as we think,” she said.

And that tends to be a “recipe for a relief rally” when headlines finally calm down, said Cox.

The sheer amount of fear and uncertainty is being overlooked right now, she said, noting American Association of Individual Investors survey data showing the level of bearish and neutral investors at the highest since May 2016, just before Brexit. Historically this tends to work out better than investors think.

“Since 1990, when fear and uncertainty has risen this high, the S&P 500 has averaged 18% returns in the following 12 months,” Cox said, noting that it also hasn’t led to drops of 10% or more in the following months.

The best strategy for investors to keep the fear in check and working for them is to be ready for all scenarios, said Cox, adding that eToro is helping customers develop barbell strategies, in which both high-and low-risk stocks are held to grab the good and bad times.

“We also see decent short-term opportunity in cheap cyclical stocks at the moment,” said the analyst.

“When in doubt, look at what the economy and earnings are doing. Right now, sectors such as financials, energy and industrials could continue to thrive in a high-growth, high-inflation environment. And if you’re nervous about the future, protecting your portfolio with safer assets like bonds and defensive stocks never hurts,” Cox adds.

Touching on Russia’s attack in Ukraine, she noted that when Russia annexed Crimea in 2014, the S&P 500 sold off 6% in the first few weeks of the year on worries about a full invasion. The market bottomed two weeks before the country was fully occupied.

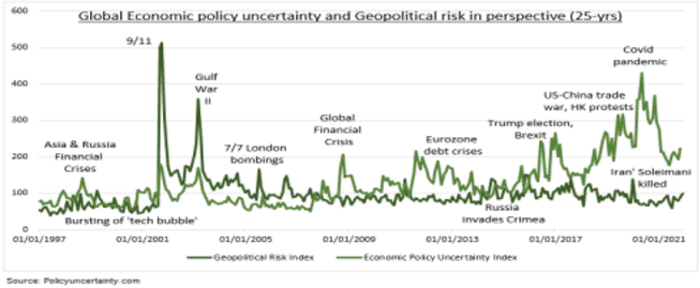

Observe the following chart from her colleague, eToro global market strategist Ben Laidler:

Many of these events are “mere blips on the radar for the stock market. It is actually quite rare for geopolitical events to change the trajectory of markets and the economy,” said Cox.

The buzz

Among the earnings highlights, Alibaba BABA,

On the data front, we’ll get weekly jobless claims and fourth-quarter gross domestic product data, followed by the latest on new home sales.

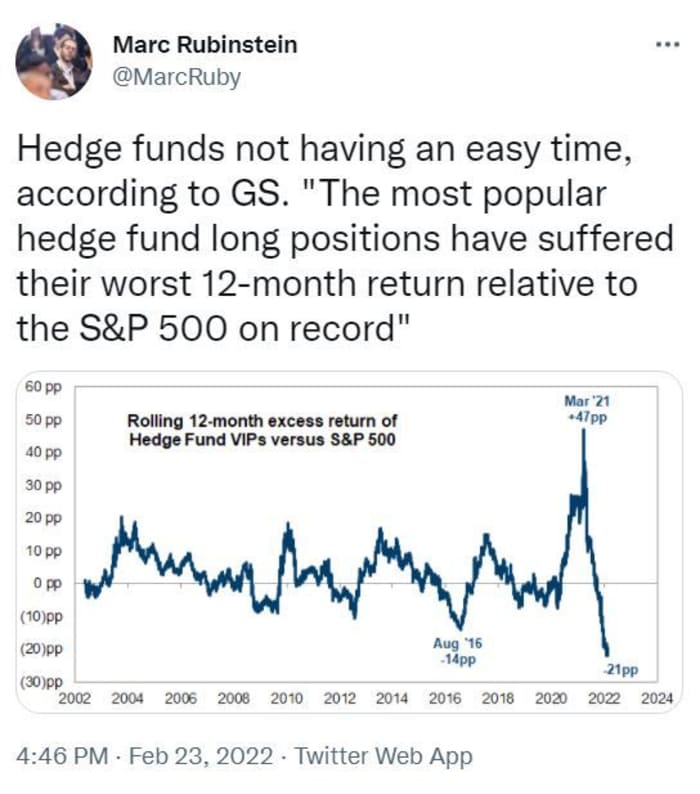

The chart

Hold my Champagne? Here’s a look at the hard luck hedge funds have been having.

The markets

U.S. stock futures ES00,

The tickers

These were the top tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, |

Tesla Inc. |

| GME, |

GameStop |

| AMC, |

AMC Entertainment Holdings |

| NIO, |

NIO Inc. |

| AAPL, |

Apple Inc. |

| GC00, |

Gold continuous contract |

| NVDA, |

Nvidia Corp. |

| FB, |

Meta Platforms |

| CEI, |

Camber Energy Inc. |

| BABA, |

Alibaba Group Holding |

Random reads

Wheel of Fortune contestant’s incorrect answer to a puzzle: “_ urassic Park _o_ies,” stuns viewers.

- Wheel of Fortune contestant’s incorrect answer to puzzle stuns viewers: “_ urassic Park _o_ies.” Of course, the answer is Jurassic Park Movies, in reference to the Steven Spielberg box office blockbusters. It most certainly isn’t Jurassic Park Bodies.

- Eating leftover pasta or rice can be a tragic mistake.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.