The Arm deal is dead, but Nvidia is not expected to slow down

Nvidia Corp.’s acquisition of Arm Ltd. has been scuttled, but that isn’t expected to stop the chip maker’s charge into the data center.

seeks to cut further into Intel Corp.’s and Advanced Micro Devices Inc.’s market share in that area.

Nvidia NVDA,

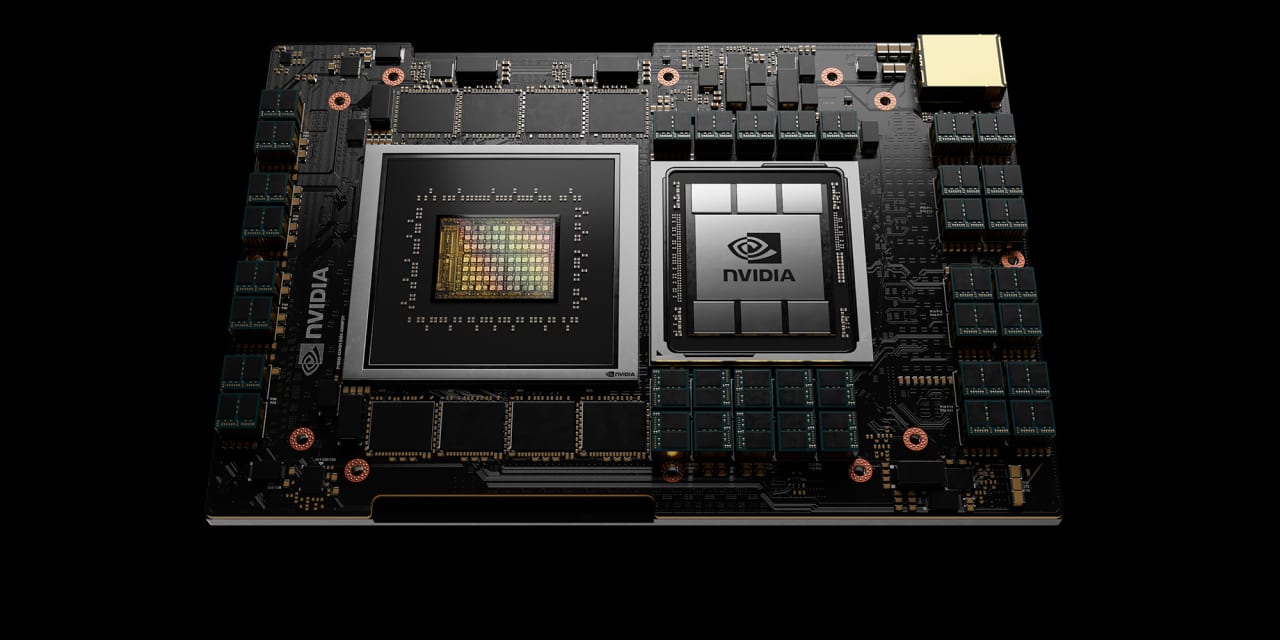

Nvidia, AMD and Intel are battling to supply hyperscale data centers, massive buildings full of servers that serve as the backbone for the cloud and the internet. Nvidia has built a big business supplying “hyperscalers” with its signature graphics processing units, or GPUs, and analysts believe that the end of the Arm deal will not preclude the company from moving into CPUs with its “Grace” chip.

Read: Wall Street’s reaction to death of Nvidia-Arm deal: No duh

Without the Arm deal to point to, Nvidia’s data-center growth will be even more important to Wall Street in the report. Analysts surveyed by FactSet expect Nvidia’s data-center sales to come in at $3.19 billion, a 68% gain from the year-ago quarter, which would be in between the growth rates and total dollars Intel and AMD put up in their recent reports.

Intel’s data-center revenue for the fourth quarter grew 20% to $7.3 billion, while sales from AMD’s enterprise, embedded and semi-custom chips unit — which includes data-center and gaming-console revenue — surged 75% to $2.24 billion from a year ago, with data-center sales accounting for about 25% of revenue for the quarter, or about $1.2 billion.

For more: Look back at earnings results from Intel as well as AMD

Susquehanna Financial analyst Christopher Rolland said he sees Intel’s and AMD’s data center results as a good sign for Nvidia, which will be “driven by continued GPU demand and a robust [data center] environment.” He also doesn’t expect Nvidia to suffer too much from the supply-chain difficulties that have hampered semiconductor production during the pandemic.

“Intel in particular noted strength in enterprise and government, the same markets where Nvidia has recently seen growing A100 traction,” Rolland said, while predicting a beat-and-raise quarter from Nvidia. ” Of note, AMD also doubled Epyc revenue YoY, signaling a robust hyperscale DC environment.”

“As for supply, we continue to note Nvidia’s dual-manufacturing strategy (TSMC and Samsung) serves as a distinct advantage in a time of industrywide supply constraints,” Rolland, who has a positive rating and a $360 price target, said. “Interestingly, 2022 could be the year that datacenter top-line surpasses gaming’s, though tight and we give the edge to gaming.”

What to expect

Earnings: Of 34 analysts surveyed by FactSet, Nvidia on average is expected to post adjusted earnings of $1.23 a share, up from 78 cents a share reported a year ago and $1.09 a share expected at the beginning of the quarter. All figures are adjusted for last year’s 4-for-1 stock split.

Revenue: Wall Street expects revenue of $7.42 billion from Nvidia, according to 34 analysts polled by FactSet. That’s up from the $5 billion Nvidia reported in the year-ago quarter and $6.84 billion forecast at the beginning of the quarter. In its last earnings report, Nvidia forecast $7.25 billion to $7.55 billion. On top of data-center sales, analysts also expect gaming sales of $3.34 billion.

Stock movement: Over Nvidia’s fourth, or January-ending, quarter, shares declined 4%, while the PHLX Semiconductor Index SOX,

Nvidia has topped analyst estimates for earnings consistently over the past five years and has beaten Street revenue estimates for 11 consecutive quarters. While shares gained 8.2% the day after last quarter’s report, the stock’s movement has been mixed amid those beats.

What analysts are saying

Cowen analyst Matthew Ramsay, who has an outperform rating and a $350 price target, expects “multi-quarter momentum to sustain.”

Ramsay said Nvidia is “well positioned to capitalize on multiple open-ended secular growth trends given its technological leadership across accelerated computing hardware (GPU, DPU, and now CPU), mature programming environment, and vertical-specific software.”

In fact, Ramsay boosted his fiscal 2023 and fiscal 2024 estimates for Nvidia “almost exclusively in datacenter,” expecting “a continuation of recent fundamentals to drive another beat/raise from Nvidia with demand still exceeding supply.”

B. of A. Securities analyst Vivek Arya, who counts Nvidia as a top pick in chips, said the chip maker is the “No. 1 GPU vendor benefiting from slowing of Moore’s Law creating need for accelerators and their unique software/developer ecosystem.”

“Nvidia’s unique combination of highly leverageable graphics silicon, software, scale, and systems expertise position it at the forefront of some the largest and fastest growth markets in tech including cloud computing/AI, gaming, edge processing, metaverse, and autonomous & electric vehicles,” Arya said.

Stacy Rasgon, who has an outperform rating and a $360 price target, said that the collapse of the Arm deal gives Nvidia a lot of dry powder to play with going forward.

“Without a deal, Nvidia has $19B+ in cash and is likely generating $10B+ annually going forward, leaving room for further actions such as buybacks, or further (hopefully less controversial?) M&A,” Rasgon said. “The $1.25B breakup is paid. And the stock remains well above where it was at announcement (~$120 split adjusted). So they seemingly have options from here.”

Read: Nvidia seeks to lead gold rush into the metaverse with new AI tools

Citi analyst Atif Malik sees upside for Nvidia and expects data-center sales to beat and gaming revenue to meet the consensus.

“We expect data center trends to remain solid in 2022 as AI/ML adoption remains in early innings at ~10-15% of IT cloud spend, training models complexity continues to grow exponentially with GPT-3, and new data center (Hopper) 5nm products launch,” Malik wrote, while maintaining a buy rating and $350 target price. “While some investors worry about a crypto-driven gaming pullback as Ethereum ETHUSD,

Production issues could still limit Nvidia as it has other chip makers, warned Rosenblatt Securities Hans Mosesmann.

“We believe constraints in supply, broadly speaking, will be a factor that limits near-term upside,” wrote Mosesmann, who has a buy rating and $400 price target. “Key points to look for during the earnings call include comments on the supply chain and the Omniverse, as well as the implications of the Arm breakup.”

Of the 44 analysts who cover Nvidia, 35 have buy ratings, seven have hold ratings, and two have sell ratings, with an average price target of $345.21, which is about 30% above the stock’s current price, according to FactSet.

MarketWatch staff writer Jeremy C. Owens contributed to this article.