This is what it will take to drive the S&P 500 beyond 5,000 this year, say global fund managers

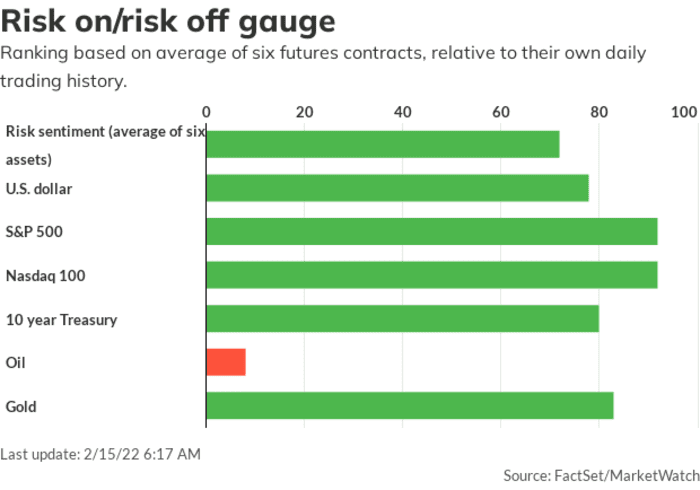

And just like that. A positive turn in Ukraine-Russia newsflow has a rebound firmly underway for risk assets on Tuesday.

The back and forth may be far from over, with Credit Suisse warning clients that armed conflict would knock 10% off stocks. And should this crisis start to ease, the full focus is likely to go back to high inflation and how central banks will handle that.

According to JPMorgan’s chief global markets strategist Marko Kolanovic, markets caution over central banks has reached a tipping point, and with that, some good news.

“Even as central bank hawkishness has ramped up, with market assumptions perhaps having gone too far in some cases, the silver lining to the recent pain is that equities are better equipped to handle it going forward,” JPMorgan’s chief global markets strategist Marko Kolanovic and colleagues tell clients in a note.

Of course, maybe stocks keep wobbling for a while as many say volatility should just be expected this year as central banks tighten monetary policy. If markets can’t, in fact, handle it and things start to get even more volatile, some wonder what it will take for the Federal Reserve to ride to the rescue.

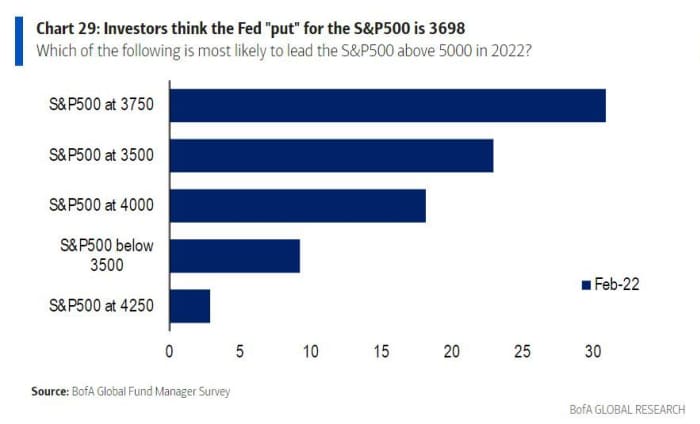

Our call of the day from Bank of America’s monthly global fund managers survey, puts that pain point at 3,698 on the S&P 500 index, a 15% drop from Monday’s close of 4,401. Some 314 participants with $1 trillion in assets under management responded to BofA’s roundup.

As for the most bullish factor for the S&P 500 that could drive it to above 5,000 this year, 37% of respondents said a drop in U.S. consumer price inflation to 3% would do the trick. CPI inflation rose to another 40-year high of 7.5% in January.

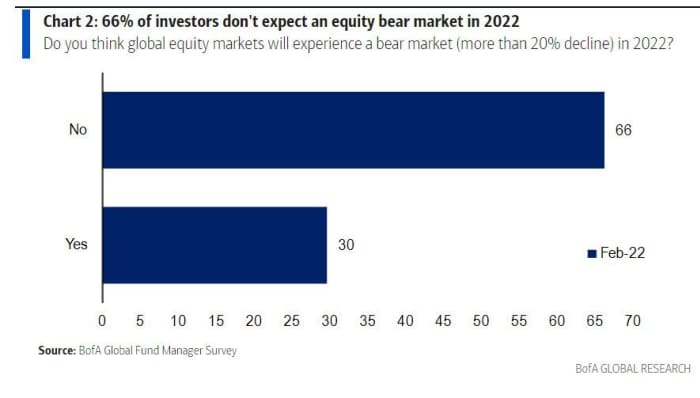

Most investors don’t expect a bear market this year, with U.S. corporate earnings and the economy likely to keep growing, so that 5,000 S&P 500 level is not so far fetched. While the February fund manager survey from BofA was bearish, due to fears of interest rate-hikes and slower growth, sentiment was not “extremely bearish”.

As for Bank of America strategists, they “remain negative on credit & stock returns in ’22 as we believe FMS investor probabilities of a credit event (3%), recession (12%) and bear market (30%) are too low.”

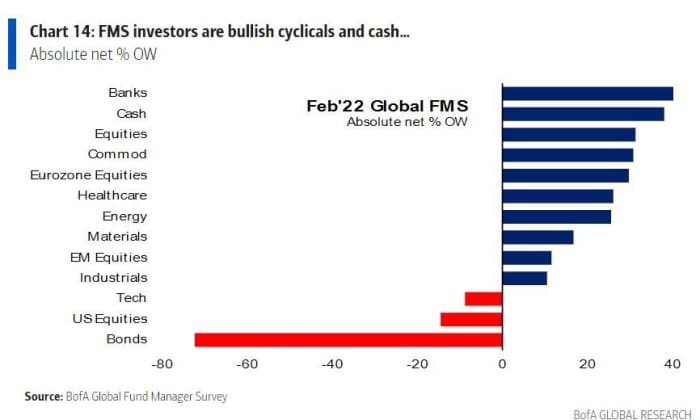

And here’s another look at how bullish those global investors are on the cyclical sectors, with long positions on banks, cash equities and commodities, European equities, energy and healthcare.

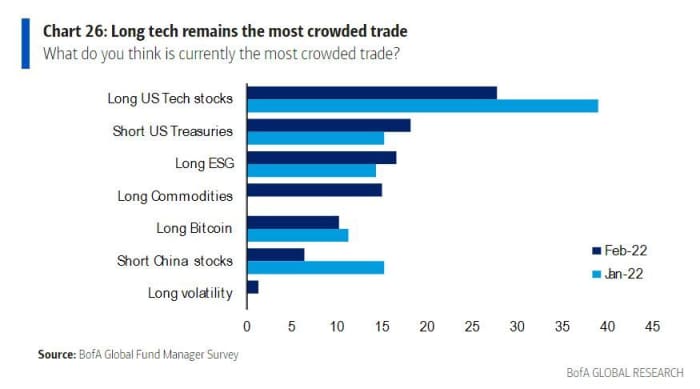

And while investors have been fleeing technology stocks, with the survey showing a net underweight at minute 9%, the lowest since August 2006, some think there is still too much money in that sector.

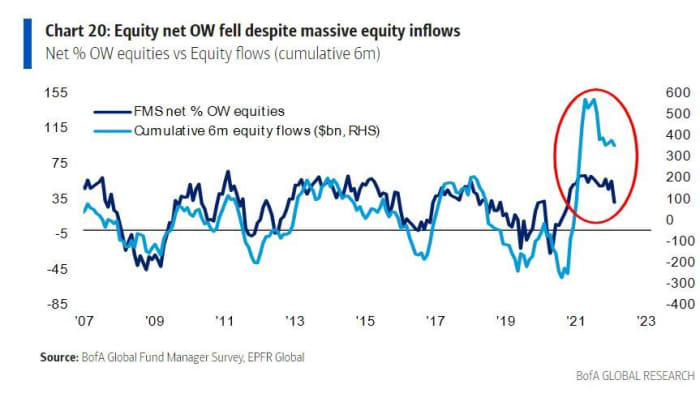

And while Goldman Sachs recently told clients it was raising its cash position as it pulls back on credit, this BofA chart shows how much cash allocations rose at the expense of an equity overweight, which fell to a net 55% from 31%.

The buzz

Russia said some troops who had been doing military exercises around Ukraine will return to their bases, news that sparked a rally in risk assets. Germany’s Chancellor will also meet with President Vladimir Puton on Tuesday.

Intel INTC,

Virgin Galactic shares SPCE,

Airbnb ABNB,

Tesla TSLA,

The U.S. producer prices jumped 1% in January, blowing past forecasts, while the Empire State manufacturing index was barely positive for February.

It’s time for U.S. SEC 13F filings, which provides insight into what hedge funds and other big investors are buying. Warren Buffett’s Berkshire Hathaway BRK.A,

The markets

U.S. stocks SPX,

Another big mover has been iron ore, which has been on a tear since late last year, but got hammered in Singapore amid fears over a China cracking down surging in prices. Bloomberg reported that several trading firms were warned about speculation and hoarding by regulators.

The tickers

| Ticker | Security |

| TSLA, |

Tesla |

| GME, |

GameStop |

| AMC, |

AMC Entertainment |

| NIO, |

NIO |

| FB, |

Meta Platforms |

| NVDA, |

NVIDIA |

| AAPL, |

Apple |

| AMD, |

Advanced Micro Devices |

| AMZN, |

Amazon |

| XELA, |

Exela Technologies |

Random reads

An unvaccinated Novak Djokovic says he may skip both the Wimbledon and the French Open tennis this year.

A boat launched by New Hampshire students in 2020 was just found in Norway

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.