A key part of the Treasury yield curve has finally inverted, setting off recession warning — here’s what investors need to know

A closely watched measure of the yield curve that serves as one of the bond market’s most reliable recession indicators inverted on Tuesday, underlining fears about the economic outlook as the Federal Reserve considers aggressively hiking interest rates.

The widely followed spread between 2-year TMUBMUSD02Y,

Traders are responding to the likely need for Fed policy makers to deliver a larger-than-normal, half-point rate hike, and possibly more, soon in order to combat inflation. Fed Chairman Jerome Powell opened the door earlier this month to raising benchmark interest rates by more than a quarter percentage point at a time, a view supported by other officials. And signs of progress in Russia-Ukraine peace talks free up the Fed to tighten as needed, some say.

“Bond markets continue to reflect mounting pessimism over the outlook for economic growth,” despite a recovering stock market, said Mark Haefele, chief investment officer at UBS Global Wealth Management.

“The risk of an abrupt slowdown or recession has increased, along with the prospect of a swifter sequence of rate rises from the Federal Reserve and disruptions due to the war in Ukraine,” he wrote in a note Tuesday.

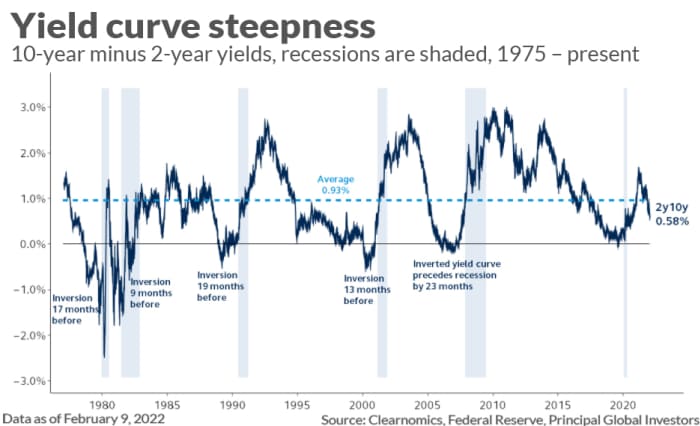

Investors pay close attention to the Treasury yield curve, or slope of market-based yields across maturities, because of its predictive strength. An inversion of the 2s/10s has signaled every recession since the 1950s, according to Principal Global Investors. That’s true of the early 1980s recession that followed former Fed Chairman Paul Volcker’s inflation-fighting effort and the early 2000s downturn marked by the bursting of the dot-com bubble, the 9/11 terrorist attacks, and various corporate-accounting scandals — as well as the 2007-2009 Great Recession triggered by a global financial crisis and the brief 2020 contraction fueled by the pandemic.

But economic downturns tend to follow 2s/10s inversions with a lag. That lag “has been about 20 months, and in several instances, it has been longer than two years,” Anshul Pradhan and Samuel Earl of Barclays BARC,

Already, inversions have struck elsewhere along the U.S. Treasury curve. Spreads between the 5- and 7-year Treasury yields versus the 10-year, along with the gap between 20-and 30-year yields, have all been below zero.

The 2s/10s spread has been flattening at a faster pace than it has at any time since the 1980s, and moved closer to zero than at similar points of time during past Fed rate-hike campaigns, according to Ben Emons, managing director of global macro strategy at Medley Global Advisors in New York.

Ordinarily, the curve doesn’t approach zero until rate hikes are well under way. But it went there anyway after only a single quarter-point rate hike was under the Fed’s belt.

The chart below, compiled in February, shows how long it took the 2s/10s to invert ahead of past recessions versus this year’s pace. The 2s/10s spread has traveled toward zero within a matter of months, this time around — as opposed to the years that it took during its last two trips into negative territory.

Ordinarily, the curve slopes upward when investors are optimistic about the prospects for economic growth and inflation because buyers of government debt typically demand higher yields in order to lend their money over longer periods of time.

The contrary is also true when it comes to a flattening or inverting curve: 10- and 30-year yields tend to fall, or rise at a slower pace, relative to shorter maturities when investors expect growth to cool off. This leads to shrinking spreads along the curve, which can then lead to spreads falling below zero in what’s known as an inversion.

An inverted curve can eventually mean a period of poor returns for stocks and hits the profit margins of banks because they borrow cash at short-term rates, while lending at longer ones.

On Tuesday, the 10-year rate fell below 2.4% as investors factored in a more pessimistic outlook. Meanwhile, the shorter-term 2-year rate, which is tied to the near-term outlook for Fed policy, rose to its highest level since April 2019.