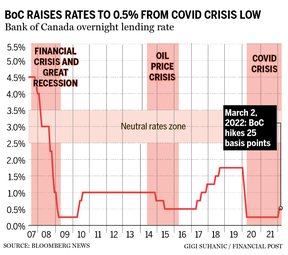

Bank of Canada raises interest rate to 0.50% in first hike since 2018

Kevin Carmichael: Discomfort with surging inflation outweighed worries about the economic fallout from the war in Europe

Article content

The Bank of Canada raised interest rates for the first time in more than three years, as Governor Tiff Macklem decided his discomfort with surging inflation outweighed worries about the economic fallout from the war in Europe.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Macklem and his deputies would have been getting ready to make a call on what to do with interest rates when Vladimir Putin sent troops into Ukraine last week. The chaos that unfolded likely ended any talk of raising interest rates more aggressively than the careful quarter-point increase the central bank announced on March 2, lifting the benchmark rate to 0.5 per cent.

“The unprovoked invasion of Ukraine by Russia is a major new source of uncertainty,” the Bank of Canada said in a statement. “Prices for oil and other commodities have risen sharply. This will add to inflation around the world, and negative impacts on confidence and new supply disruptions could weigh on global growth. Financial market volatility has increased. The situation remains fluid and we are following events closely.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The post-pandemic burst of inflation is what most concerns the Bank of Canada, at least for now. The consumer price index surged to 5.1 per cent in January from a year earlier, the most in more than three decades and well off the central bank’s target of two per cent. Statistics Canada reported on March 1 that the economy grew at an annual rate of 6.7 per cent, faster than the central bank had forecast, suggesting demand will continue to test companies ability to keep up with orders, a recipe for further inflationary pressure.

“Economic growth in Canada was very strong in the fourth quarter,” the central bank said, adding that the number “confirms its view that economic slack has been absorbed.”

By “economic slack,” the central bank means the difference between what it thinks the Canadian economy can produce without stoking inflation, and its actual level of output. The gap widened dramatically during the COVID recession, but now that it’s closed, policy-markers will feel pressure to get interest rates back to a more normal setting. The benchmark rate was 1.75 per cent in February 2020, although the central bank hadn’t altered policy since October 2018.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“The rebound from Omicron now appears to be well in train: household spending is proving resilient and should strengthen further with the lifting of public health restrictions,” the central bank said. “Housing market activity is more elevated, adding further pressure to house prices. Overall, first-quarter growth is now looking more solid than previously projected.”

-

Bank of Canada raises interest rate: Read the official statement

-

GDP grew faster than expected in fourth quarter, ensuring Bank of Canada interest rate hike

-

What happened to the housing market the last time the Bank of Canada hiked rates

Solid economic growth means policy-makers can focus on inflation. Their January forecast had the consumer price index averaging year-over-year increases of 5.1 per cent in the first quarter, and they acknowledged that inflation is “now expected to be higher in the near term,” in part because the war is putting upward pressure on commodity prices.

Price increases have become more pervasive,” the statement said. “Persistently elevated inflation is increasing the risk that longer-run inflation expectations could drift upwards. The bank will use its monetary policy tools to return inflation to the (two-per-cent) target and keep inflation expectations well-anchored.”

• Email: [email protected] | Twitter: CarmichaelKevin

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.