China economic activity gauge falls to 2nd lowest on record in March

A reading of official Chinese purchasing managers’ indexes (PMIs) for March shows a sharp fall in economic activity. Construction and manufacturing activity in China, responsible for more than half the world’s consumption of industrial metals, has an outsize impact on prices.

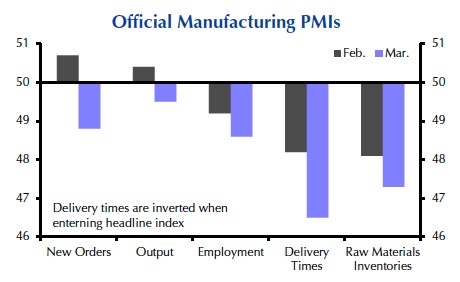

The composite PMI released by the Chinese government fell to 48.8 from 51.2, its second lowest level on record and well below consensus estimates. A PMI reading over 50 indicates growth or expansion while a reading under 50 suggests contraction.

The March survey is an indication that the Chinese economy is contracting at its fastest pace since the initial covid outbreak in Wuhan in February 2020 according to Capital Economics, a London-based researcher.

While the services sector showed the sharpest pullback, manufacturing also fell below the 50-level in March.

For steel and copper demand there are positive signs too with the construction index ticking up from 57.6 to 58.1, “which hints at a further pick-up in infrastructure spending amid increased fiscal support,” Capital Economics points out:

“The near-term outlook remains highly uncertain and will largely depend on how the virus situation develops. Cases are rising in Shanghai but seem to be falling elsewhere, leaving us hopeful that the current wave can still be contained.

But even if the outbreak is brought under control soon, it will still take a while for the economy to get back on track.”