Automatically saving a percentage of your salary can be an easy way to save for your retirement.

As a rule of thumb, most financial advisors suggest you save 10% to 15% of your earnings.

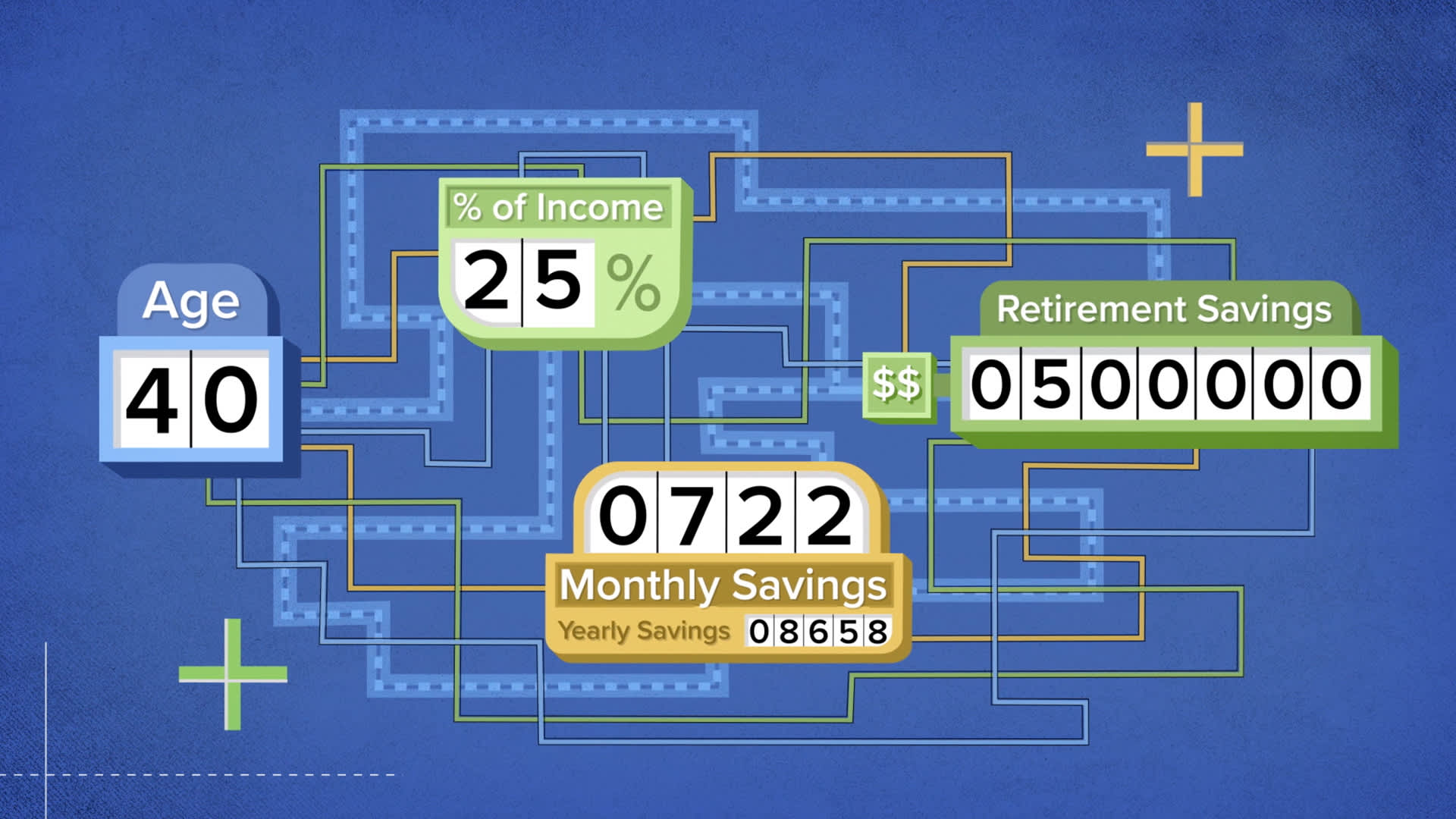

Here’s a case study assuming you start with no savings, plan to retire at 65 and have investments that earn 6% annually.

If you want to retire with $500,000, you’ll need to invest about 9% of a salary of $35,000 starting in your 20s. Waiting until you’re older will require a larger portion of your pay. If you wait until your 40s, then that number jumps to 25% of your salary. This does not account for variables such as pay increase or decrease, employer match, inflation or any other of life’s curveballs.

Watch this video to find out how much money you will need to invest to save $500,000 for retirement, broken down by age.

More from Invest in You:

The American dream of the middle class isn’t what it used to be

How a four-day workweek helped an online retailer cure employee burnout

How Suze Orman recommends couples should fairly split their finances

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox. For the Spanish version Dinero 101, click here.

CHECK OUT: 27-year-old who turned $500 into $60,000: How to invest if ‘you’re scared of losing money’ with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.