Here’s what it will take to make stocks a ‘great’ buying opportunity, says this strategist

It was an interesting time for the best weekly gain for Wall Street since late 2020 as the devastating war in Ukraine grinds toward the one-month mark.

“Stabilizing stock markets point to less cautious investors. Not because views on geopolitical or policy/rates risk have improved but because price action shows a market more tolerant of those challenges,” notes Stephen Innes, managing partner at SPI Asset Management, in a note to clients.

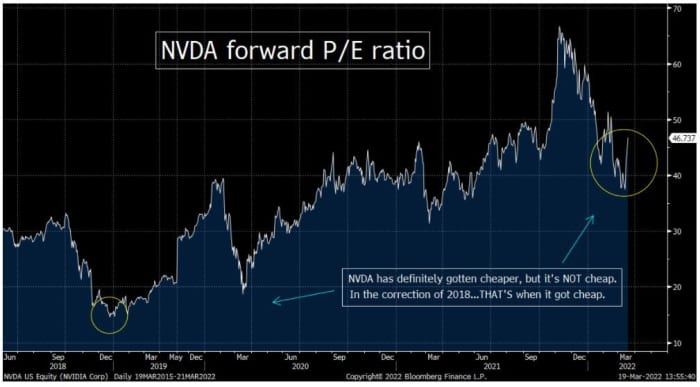

Onto our call of the day, which refutes the idea that some big-name companies are looking like bargains.

“Just because they have worked off some of the extremes in terms of valuation, it does not mean that they’re cheap enough (healthy enough) to make them a great buying opportunity,” Miller Tabak + Co.’s chief market strategist Matt Maley told clients in a note.

Maley said some pundits say the problems markets are facing now or going forward have been “priced into” markets. But that doesn’t alter what he sees as high valuations for many stocks on a historical basis.

So “fabulous companies with bright prospects,” such as Apple AAPL,

“In other words, it took a historic and MASSIVE stimulus program to push these stocks to their extreme levels of valuations…and their recent declines have only made them ‘less expensive’…not ‘cheap,” he said.

Even the hardest-hit stocks, such as PayPal PYPL,

“In our opinion, we’re going to have to reach the kind of valuation levels that were more in-line with the average of several years before the pandemic (at least) before we can look at the stock market as a ‘great’ buying opportunity,” he said.

On the flipside, Maley has got his eye on one name, Salesforce CRM,

But with the economy weakening and inflation set to rise, a poor combination for a still expensive stock market, the jury is definitely out on whether last week’s bounce is going to stick, said Maley.

The buzz

Boeing BA,

Alleghany Corp. Y,

The weekend saw Russia intensify its bombardment across Ukraine, which rejected Moscow’s ultimatum for a surrender in battered Mariupol. Turkey’s foreign minister said the two sides are close to agreeing on “fundamental issues.” And President Joe Biden will head to Poland this week to meet with NATO allies.

Disney’s DIS,

It’s a big week for Fed speakers, following last week’s as-expected 25 basis-point rate increase. Kicking off, Atlanta Fed President Raphael Bostic said he wasn’t sure an ‘extremely aggressive rate path’ is appropriate. Fed Chairman Jerome Powell will be speaking at a National Association for Business Economics conference at 12 noon.

The markets

Stocks DJIA,

The chart

Investors still on the fence on whether growth or value stocks are the best way forward should check out our chart of the day from RBC Capital’s Lori Calvasina and Sara Mahaffy. While value stocks rise ahead of interest rate hikes, now that Fed tightening is under way, growth may come back en vogue:

The tickers

These were the most active stock-market tickers as of 6 a.m. Eastern:

Random reads

Football legend David Beckham loans his Instagram account to a doctor on the front lines in Ukraine

The U.K.’s Royal Mint can is turning old phones into gold.

Trombonists: It’s your moment.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.