How energy company short sellers bet on oil crash as crude soared above $100 a barrel

Short sellers zeroed in on energy stocks last month as oil prices soared, betting that a move by crude above $100 a barrel would be a short-lived phenomenon, according to data compiled by S&P Global Intelligence.

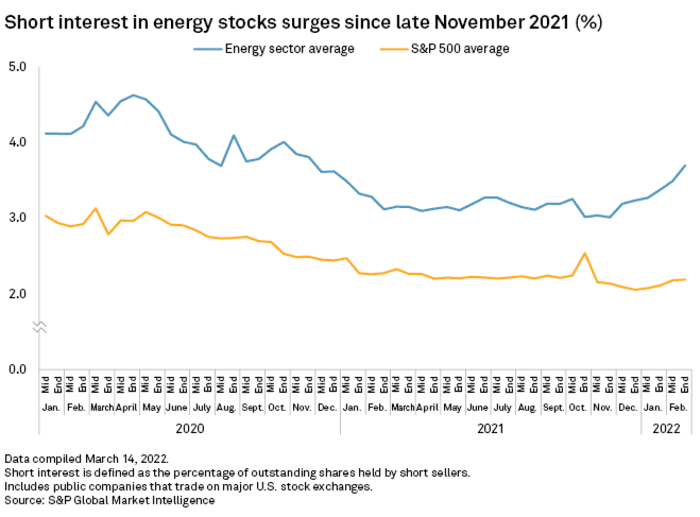

Short interest in energy stocks climbed nearly 70 basis points, or 0.7 percentage point, since the end of November 2021 to 3.7% at the end of February — the highest since November 2020, the research company said in a Wednesday note. That compares with short interest in overall S&P 500 SPX,

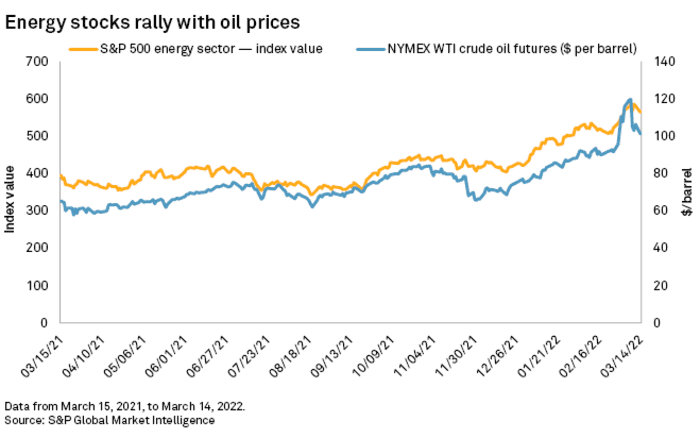

The short bets, in which traders sell borrowed shares of companies with the aim of buying them back later at a lower price, rose as oil futures were on a tear. The U.S. crude oil benchmark CL.1,

Oil prices fell back hard this week, with crude falling more than 20% from its March 8 highs to meet the technical definition of a bear market, as investors assessed negotiations between Kyiv and Moscow and sweeping COVID-19 lockdowns in China which may lower demand. Crude remains up 29% for the year to date.

Energy stocks, which had marched higher in lockstep with crude oil prices, outperforming other S&P 500 sectors, fell sharply this week as oil tumbled. The energy sector was down more than 6% but remains up more than 28% for the year to date, still outpacing other sectors.

Short sellers had focused heavily on oil and gas refining and marketing companies, S&P Global Market Intelligence said, with short interest in those stocks averaging 7.3% at the end of February, surpassing short interest for other industry subgroups in the energy sector.

But Arch Resources Inc. ARCH,

Arch Resources shares were down 10% for the week, but had likely been a source of pain for shorts. Shares remain up more than 15% for the month and over 50% for the year to date as coal prices have soared.