Mrs. Dunster’s dilemma: Volatile wheat market is putting the squeeze on bakers

Russia’s invasion of Ukraine has sent wheat prices into a panic, forcing Canadian bakers into some tough calls

Article content

Blair Hyslop, co-owner of Mrs. Dunster’s Bakery in Sussex, N.B., has a dilemma. He’s been getting emails from flour companies, offering to lock in a price for future shipments. Each week, the price gets higher. The independent bakery needs up to four million pounds of flour a year to keep producing doughnuts and bread rolls for grocery chains across Atlantic Canada, and its current flour contracts only run until August.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

If Hyslop doesn’t sign more contracts before then, he’ll pay the market price when his flour runs out. That could be trouble, if inflation keeps up this frantic pace. But there’s also the risk that by booking more contracts now, he’s inadvertently locking himself into a peak rate.

“We could take our chances and gamble, but you’re betting the future of your business,” Hyslop said in an interview.

Until recently, the plan at Mrs. Dunster’s was to stick it out at least until the spring, when there will be a clearer picture of how much wheat is seeded across North America. If the crop forecasts are strong, prices should go down. And this coming harvest couldn’t possibly be worst than the last, he said. His annual flour costs are already up roughly 52 per cent, year-over-year, mostly because of last summer’s extreme drought across Western Canada that drove down crop yields by as much as 40 per cent.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

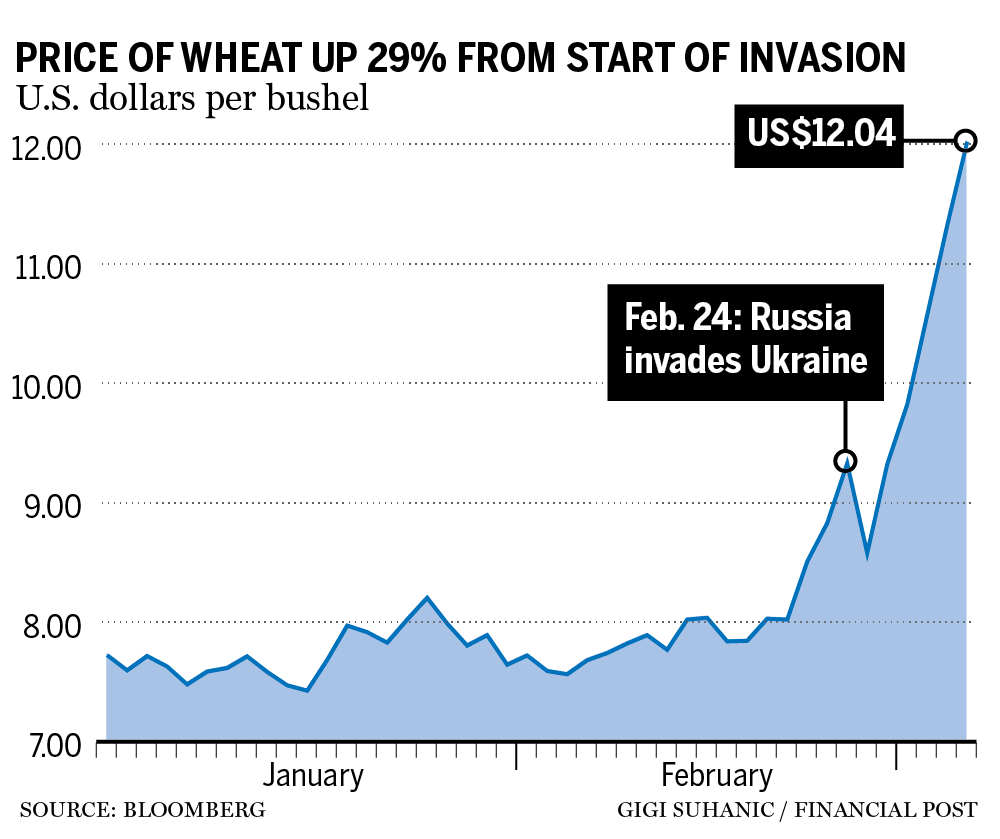

But then Russia invaded Ukraine, sending global commodity markets, and wheat prices in particular, into a panic — forcing Canadian bakers into some tough calls.

“These are big decisions for a small food company like us to be making. The geopolitical impact of commodity price increases in flour, you know, these are not experiences that we’re experts at,” Hyslop said. “But I’ll tell you, if we make the wrong decision, we’ll feel it.”

If we make the wrong decision, we’ll feel it

Blair Hyslop

Wheat futures have spiked in the past week over concerns that the war will disrupt the planting season in Ukraine and continue choking off exports from one of the most important grain-producing regions in the world. Ukraine and Russia export a third of the world’s wheat, and a supply reduction on that scale could still be impacting the price of flour in August, when Mrs. Dunster’s flour contracts expire.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The Food and Agriculture Organization of the United Nations (FAO) is warning of a food security crisis in Ukraine. Farmers are fleeing conflict zones and could end up missing the spring planting season, making it even harder for people to access food in the country, FAO said.

The invasion is liable to have serious impacts on food security outside Ukraine as well, if countries that depend on the region’s grain crops continue to be cut off from shipments and then have to pay higher prices in a tighter global market.

It’s tragic in the Ukraine, but it’s wider than that. This is lunacy

Ted Bilyea

“It’s tragic in the Ukraine, but it’s wider than that,” Ted Bilyea, a distinguished fellow at the Canadian Agri-Food Policy Institute, said in an interview last week. “This is lunacy.”

Bloomberg reported on Thursday that wheat futures were at their highest level in 14 years, with May contracts up over US$11 per bushel at the Chicago Board of Trade — an exchange that heavily influences Canadian grain prices. A good harvest across the Canadian Prairies this year would help boost global supply and relieve some of the inflationary pressure.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

But to do that, Canada needs rain to bounce back from last year’s drought.

“Farmers are concerned about the moisture situation,” said Tom Steve, the general manager of the Alberta Wheat and Barley Commissions. “We don’t have a lot of snow cover in Western Canada and we didn’t get much moisture in the fall. We really need a wet spring to recharge the soil moisture.”

With major reductions in crop yields last year, some farmers don’t have the same amount of grain left in their storage bins as they normally would — which means they aren’t able to take full advantage of the recent spike in wheat prices. At the end of 2021, Canada’s total stocks of wheat were down 38 per cent year over year to 15.6 million tonnes, according to a Statistics Canada report last month.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The Baking Association of Canada (BAC) said the invasion of Ukraine isn’t likely to impact grain supplies for domestic baking operations, but it does risk driving up production costs — which are already high due to last year’s drought.

-

Canadian farmers face volatility as war in Ukraine creates swings in global market for grains, oilseeds

-

Blockades, fruit and the annoying impact of hiccups in the supply chain

-

What your fruit has been through: A green grape’s journey through a global supply chain on edge

-

Nutrien asks Canadian government to halt CP Rail strike

“These forces are expected to increase global market prices, which will in turn translate into higher costs for Canadian flour – cost which may need to be passed onto consumers,” BAC executive director Martin Barnett said in a statement. “The baking industry is already grappling, along with other food manufacturing sectors, with almost seven per cent inflation.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

In the baking business, the price of flour is one of the big four considerations — along with eggs, lard and sugar, said Hyslop, who has owned Mrs. Dunster’s Bakery with his wife for almost eight years. They have about 200 employees, and two factories. One, in Moncton, specializes in bread rolls, and another in Sussex specializes in sweet goods, including doughnuts fried “like your grandmother would.”

Grocery chains this year have complained that their suppliers are pushing to raise prices all at once, in an attempt to make up for high inflation in the supply chain. But the grocers have been resisting, to the point that snack giant Frito-Lay has refused to ship to Loblaw Companies Ltd. until the chain accepts a price increase. So Hyslop can’t count on being able to recoup higher flour costs through price hikes on grocers, at least not soon.

Still, on Thursday, he was leaning toward locking in a price now. The situation in Ukraine just seemed too big to chance it.

• Email: [email protected] | Twitter: jakeedmiston

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.