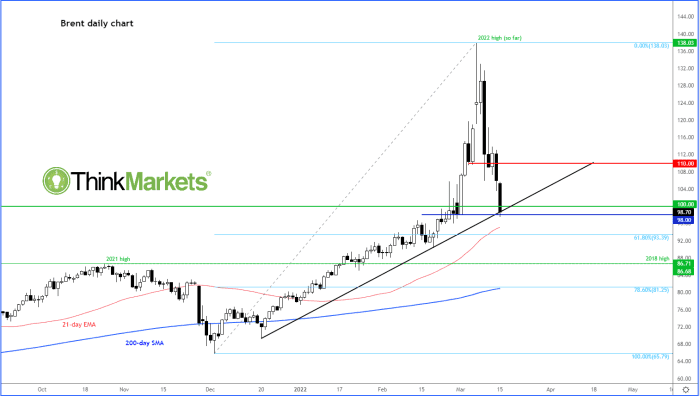

Oil suffers ‘spectacular’ collapse, enters bear market just 5 days after settling at nearly 14-year highs

U.S. and global benchmark crude oil officially entered a bear market on Tuesday, just five trading days after they settled at their highest prices since 2008.

“The collapse has been spectacular,” Fawad Razaqzada, market analyst at ThinkMarkets, in a market update.

On Tuesday, the front-month April West Texas Intermediate crude futures contract CL.1,

May Brent crude BRN00,

A bear market is technically usually marked by a drop of 20% or more from a recent high.

Brent crude futures hit an intraday high of $139.14 on March 7 and settled at $127.98 on March 8, the highest levels since 2008.

ThinkMarkets

That was the quickest decline for WTI from a recent high into bear market territory since April 2020, when prices took only one day to fall into a bear market. For Brent, that marked the quickest fall into a bear market since 1996, when it took five trading days to enter a bear market.

The biggest driver behind the selloff in oil has been “investor realisation that Europe is not going to wean off Russian oil supply immediately,” said Razaqzada. “Everything else is secondary, including the potential return of Iranian oil supply.”

Iran and world powers have been trying to negotiate a deal to revive the 2015 nuclear deal, which was aimed at limiting Iran’s nuclear activities. A deal would likely lift some U.S. sanctions on Iran, allowing it to contribute more oil to the world market.

Russia’s Foreign Minister Sergei Lavrov told his Iranian counterpart Tuesday that negotiations on reviving the deal were nearing an end, according to Reuters.

Meanwhile, the Organization of the Petroleum Exporting Countries has “highlighted the risk to the oil demand outlook arising from the Ukraine war and surging inflation,” he said.

In its monthly report released Tuesday, the group of major oil producers said it was leaving its economic forecasts and its estimates of 2022 crude-oil demand and supply growth “under assessment.” It warned that inflation stocked by the Russia-Ukraine war could undercut oil consumption.

“Also weighing on oil prices is something that had sent prices into the negative last year: surging COVID cases and lockdowns,” said Razaqzada. “This time in China, the biggest oil importer in the world.”

China’s southeastern manufacturing hub of Shenzhen, near Hong Kong, has been locked down due to a COVID outbreak, in addition to a COVID lockdown in the northeast of the country.

For now, however, Russia’s continued invasion of Ukraine is “likely to cause more disruption to global trade, if not to energy exports directly,” Marshall Steeves, energy markets analyst at S&P Global Commodity Insights, told MarketWatch.

So “upside risk remains, and the current retracement [in prices] appears to be profit taking motivated by the Chinese demand concerns,” he said.

Given the sharp sell-off in oil prices, Razaqzada said the oil market may “see a bit of ‘bargain’ hunting at these levels, especially as the threat of Russian supply disruptions remain high.”

Still, “we need to see evidence of a rebound first, ideally on a daily closing basis, before bullish speculators start to dip their toes in,” he said.