Russia to foreign firms: stay, leave or hand over the keys: Ukraine updates

Check here for the latest news on how the conflict is affecting markets, businesses and the economy

Article content

Russia’s invasion of Ukraine has sparked unprecedented economic and financial retaliation from western nations which are piling on sanctions in what France has called “all-out economic and financial war.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

But the conflict will have consequences for the whole world as it cuts off crucial energy and crop supplies, disrupts businesses and upsets financial markets, already under stress as central banks tighten policy.

There is a lot going on out there so check here for the latest news on how the conflict is affecting markets, businesses and the economy.

4:30 p.m.

Bombardier, Canadian Tire halt operations in Russia

You can add Bombardier Inc. and Canadian Tire Corp. Ltd. to the list of Canadian companies that have halted operations in Russia over the country’s invasion of Ukraine.

Both announced the moves on Friday afternoon.

Plane-maker Bombardier said it was suspending all activities with Russian clients.

“We will continue to adhere to international laws, regulations and sanctions, as they evolve,” the Montreal-based company said in a statement.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

It said the suspended activities include all forms of technical assistance.

Bombardier has said about five or six per cent of its business jet deliveries traditionally go to customers in the region. The company’s latest reported order backlog is $12.2 billion.

Retailer Canadian Tire, meanwhile, said it will temporarily pause the Helly Hansen brand’s operations in Russia.

Helly Hansen, which sells outerwear and luggage, operates 41 retail locations across Russia and employs more than 300 people in the country.

Canadian Tire bought the Oslo-based brand from the Ontario Teachers’ Pension Plan in 2018.

— Reuters and Financial Post Staff

4:15 p.m.

Wall Street ended lower on Friday as the war in Ukraine overshadowed an acceleration in U.S. jobs growth last month that pointed to strength in the economy.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Most of the 11 major S&P sector indexes declined, with financials leading the way with a 2 per cent drop as investors worried about how the West’s sanctions against Moscow may affect the international financial system.

The Dow Jones Industrial Average fell 0.53 per cent to end at 33,614.8 points, while the S&P 500 lost 0.79 per cent to 4,328.87.

The Nasdaq Composite dropped 1.66 per cent to 13,313.44.

For the week, the S&P 500 and Dow both fell 1.3 per cent, while the Nasdaq gave up 2.8 per cent.

In Canada, the S&P/TSX composite index closed up 152.02 points to 21,402.43.

— Reuters

3:30 p.m.

Ukraine uses crypto donations to buy military gear

Ukraine has already spent US$15 million of the donations it received in cryptocurrencies on military supplies, including bulletproof vests that were delivered Friday, according to Alex Bornyakov, deputy minister of Digital Transformation of Ukraine.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The Ukrainian government anticipates doubling the US$50 million of crypto donated so far in the next two or three days, Bornyakov said in a Zoom interview from an undisclosed location inside Ukraine. Most of the donations have been in Bitcoin and Ether.

The 250-person ministry has managed to find suppliers in Europe and the U.S. for everything from the vests to food packages to bandages and night-vision devices for the army within two days after Russia invaded Ukraine on Feb. 24, Bornyakov said. About 40 per cent of the suppliers are willing to take crypto. The rest are typically paid with crypto converted into euros and dollars, he said.

While many companies and crypto startup founders have donated money, “most donations come from people,” Bornyakov said, while noting that air-raid sirens occasionally require him to run into a bomb shelter.

The ministry has also received donations in Tether, Polkadot and Solana, he said. It also received hundreds of NFTs, including a valuable CryptoPunk.

— Bloomberg

3:18 p.m.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

3:12 p.m.

World may face fertilizer shortage

Russia’s trade and industry ministry has recommended the country’s fertilizer producers temporarily halt exports, the ministry said on Friday, in a sign that sanctions imposed after Russia’s invasion of Ukraine could have a global impact.

Major international shipping groups including container lines this week suspended almost all cargo shipments to and from Russia to comply with the Western sanctions.

“The ministry had to recommend Russian producers temporarily suspend export shipments of Russian fertilizers until carriers resume rhythmic work and provide guarantees that Russian fertilizer exports will be completed in full,” the ministry said.

The Russian association of fertilizer producers declined to comment to Reuters on the ministry’s proposal.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Russia produces more than 50 million tonnes a year of the fertilizers, 13 per cent of the global total.

— Reuters

3 p.m.

2:44 p.m.

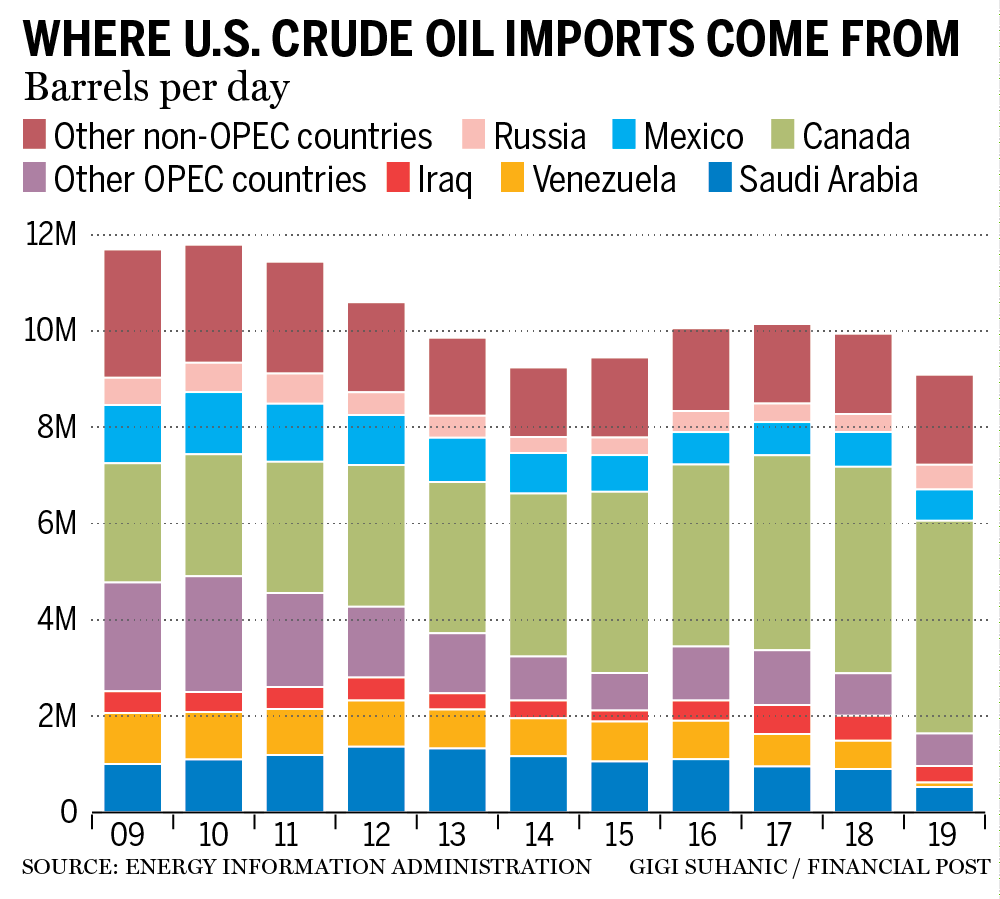

America weighs Russian oil ban

The White House is weighing a ban on U.S. imports of Russian crude oil as Congress races toward passing such a restriction to punish the Kremlin for its invasion of Ukraine.

Conversations are taking place within the administration and with the U.S. oil and gas industry on the impact such a move would have on American consumers and the global supply, according to people familiar with the matter.

Earlier this week, the White House publicly rebuffed suggestions from lawmakers that the U.S. ban Russian oil. But pressure has grown for a ban along with American outrage over Russia’s invasion, and lawmakers have made clear they will act.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Russian oil made up only about 3 per cent of all the crude shipments that arrived in the U.S. last year, data from the U.S. Energy Information Administration show.

— Bloomberg

2:18 p.m.

Chicken Kyiv on the menu

British supermarket chain Sainsbury’s is changing the name of its chicken kiev to chicken kyivs in solidarity with the Ukrainian people.

The rebranding abandons the Soviet name for Ukraine’s capital city, replacing it with the Ukrainian version, reports the Guardian.

Packaging for the poultry dish would change in the next few weeks, it said.

Tesco and Morrisons are also said to be considering renaming chicken kiev.

Sainsbury’s is also removing from its shelves any items “100% sourced from Russia” which includes some vodka and sunflower seeds.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

1:24 p.m.

Two oil tankers owned and managed by Sovcomflot, the Russian maritime and freight shipping company blacklisted by the United States last week, are rerouting from their Canadian destinations because of bans.

The two are the first to change course after Canada this week shut its ports and waters to Russian-owned ships over the invasion of Ukraine.

The Liberia-flagged oil tanker SCF Neva was carrying bunker fuel from Colombia to Irving Oil in New Brunswick.

It changed course yesterday and is now headed to the Bahamas, vessel data show.

Irving Oil, which owns the 320,000-barrel-per-day Saint John refinery, confirmed the SCF Neva had been scheduled to arrive at its New Brunswick facility.

A second vessel, the SCF Ussuri, a refined products tanker chartered by Suncor Energy, slowed down on Thursday and is currently near the Gulf of St. Lawrence after suspending its original route to Montreal, Canada, according to vessel data and sources.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The vessel loaded at New York on Feb. 24 and had been due to arrive in Montreal on March 1. As the SCF Ussuri loaded in the U.S. East Coast, it cannot return to the United States without violating the Jones Act, which prevents non-U.S. ships moving goods between U.S. ports.

“It’s incredibly confusing for where these ships go, whether they will be received or not and if ports will accept them,” said Dan Yergin, vice chairman of energy research and consultancy HIS Markit.

The Biden administration is considering following Canada in barring Russian ships from U.S. ports, a government official said this week.

— Reuters

12:12 p.m.

BREAKING Prime Minister Justin Trudeau is heading to Europe this weekend to meet with allies over their responses to Russia’s invasion of Ukraine.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Trudeau will travel to London, Berlin and Latvia, where Canada is leading a multinational NATO battle group, and to Warsaw, Poland.

— The Canadian Press

11:15 a.m.

Companies around the globe grappled with a dilemma over what to do with their Russian investments today as Moscow laid out their options: stay in the country, exit entirely or hand over their holdings to local managers until they return.

First Deputy Prime Minister Andrei Belousov spelt out the government’s position a little more than a week after Russia invaded Ukraine, and a day after French bank Societe Generale sent a chill through the corporate world by saying Russian authorities could seize its assets in the country.

Belousov outlined three alternatives for foreign firms.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“The company continues to work fully in Russia,” he said in a statement. “Foreign shareholders transfer their share to be managed by Russian partners and can return to the market later,” he added, and: “The company permanently terminates operations in Russia, closes production and dismisses employees.”

No route comes without risks. Those staying could face a backlash in Western markets where the public have rallied to Ukraine’s cause, those transferring shares could be handing over the keys with few guarantees, while those quitting may face a big loss at best, or might have to sell up for a nominal sum.

— Reuters

11:08 a.m.

Fears of food security crisis in Ukraine grow

The United Nations says it is working to stabilize the situation for farmers in Ukraine in an attempt to staunch a growing food security crisis.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Fears about Ukraine’s agriculture sector have driven volatility in global grain markets ever since Russia’s invasion more than a week ago. The region is one of the world’s most important bread baskets, where Ukraine and Russia combine for about a third of all wheat exports, and about 20 per cent of corn exports.

The war has choked off crucial ports in the Black Sea and is displacing farmers in the region — which could disrupt the upcoming planting season, a top EU official said this week.

Before the Feb 24. invasion, Ukraine was already facing a food crisis in the eastern part of the country due to the eight-year conflict with pro-Russian separatists. Roughly 28 per cent of people in the region were struggling with access to food, according to the UN’s Food and Agriculture Organization (FAO).

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“While the evolving situation remains unpredictable, expectations are high of a further deterioration of food security in the east and across the country,” the FAO said in a statement on Friday.

The FAO announced plans to provide cash transfers, seeds and animal feed to farmers a way of protecting “agricultural livelihoods” at a crucial time for Ukraine’s food production. The organization said it needs US$50 million over the next three months to assist up to 240,000 vulnerable people in rural parts of the country.

“When a major supplier of those crops is taken out of the supply chain, the ramifications are substantial. And then there’s the human suffering.” said Alison Blay-Palmer, an associate professor at Wilfrid Laurier University who serves as UNESCO Chair on Food, Biodiversity and Sustainability Studies. “It’s hard to know where to start with this one.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Ukraine sets a cap on annual wheat exports as a way of guarding against domestic food shortages. Last fall, after a bumper crop, the country raised its cap to a record-high 25.3 million tonnes of wheat for the 2021/22 growing season, which ends in June. Ukraine’s inability to export wheat and other crops during the invasion will have consequences for the Middle Eastern and African nations that depend heavily on the Black Sea region for food.

World Food Programme (WFP) executive director David Beasley has warned that the “world cannot afford to let another conflict drive the numbers of hungry people even higher.”

Egypt, for example, relies on Russia and Ukraine for 86 per cent of its wheat imports, according to 2020 figures reported by Bloomberg this week. Uncertainty and sanctions on exports from the Black Sea region have driven up global commodity prices, from grains to oil, making it more expensive to source alternatives to Russian or Ukrainian goods.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

WFP depends on the region for half of the wheat used in food relief programs for Yemen, Investment Monitor reported. “It is going have a dramatic impact on food costs, shipping costs, oil and fuel,” Beasley said.

Wheat futures at the Chicago Board of Trade soared past US$12 a bushel on Friday morning, up 6.6 per cent over the previous day’s price for a May contract.

— Jake Edmiston

10:37 a.m.

Most big Canadian companies with business in Russia are quitting the country. Magna International Inc. and Kinross Gold Corp. plan to stop their operations, and Bombardier Recreational Products Inc. and Canada Goose Holdings Inc. say they will stop exporting.

But Laval, Que.-based Alimentation Couche-Tarde Inc., which oversees a global network of service stations and convenience stores, isn’t yet ready to bail on its 320 Russian employees at 38 locations, a company spokesperson said in an email.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“As our people are our number one priority, we are following the situation closely and continue to support our team members inside and outside Russia,” the company said.

— Kevin Carmichael

10:08 a.m.

No more Ski-Doos for Russia

Another flag carrier from Corporate Canada has decided to quit Russia. Bombardier Recreational Products Inc., the Valcourt, Que.-based maker of Ski-Doo snowmobiles and Sea-Doo personal watercraft, has decided to stop exporting to Russia, which accounts for about five per cent of the company’s sales.

“As always, BRP’s priority is to care for our employees, our dealers, and our valued customers,” a spokesperson said by email. “In the past few weeks and days, we have been monitoring the situation in Eastern Europe very closely. Given the instability of the current situation and the trade complexities, we are pausing our product exports to Russia.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

BRP has been in Russia for three decades and was at one time the company’s third-biggest market. The international sanctions that followed Russia’s annexation of Crimea in 2014 have significantly reduced BRP’s sales in the country, however. BRP currently has an office in Saint Petersburg that oversees about 100 dealerships.

— Kevin Carmichael

9:37 a.m.

Maersk stops rail shipments between Europe and China

A.P. Moeller-Maersk A/S, the Cophenhagen-based shipping giant, advised its clients this morning that it has temporarily suspended all intercontinental rail shipments — east and west — between Asia and Europe, “without exception.”

Maersk is known primarily for its ships. But it also offers land- and air-based options. Among other things, Maerk’s website lists a “block train” option that allows customers to book a train of their own to move goods between China and Europe. Alas, the tracks run through Russia.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The decision reinforces warnings that the war in Eastern Europe will have a ripple effect on shipping costs around the world.

“If you have cargo currently in transit or have completed a booking before this suspension was announced, we will do our utmost to get it delivered to its intended destination across the normal routes,” Maers said in a customer advisory. “The latest sanctions also mean Maersk has suspended all new air bookings to and from Russia and Ukraine until further notice. We do see a potential risk to the cost of air transportation, as airspace gets restricted and flights are further subject to rising fuel and insurance costs.”

Maersk also advised its customers that it had decided to limit its dealings with Belarus, in part because of sanctions visited on Russia’s ally in its invasion of Ukraine, and partly for moral reasons.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“For Belarus, going forward, only bookings for foodstuff, medicines, and humanitarian supplies (except dual use) will be accepted after extensive screening,” the company said. “This exemption is to underline that Maersk is focusing on social responsibility and making the efforts to support society despite the complications and uncertainties within the current supply chain.”

— Kevin Carmichael

9:32 a.m.

North American stocks are in the red this morning as concerns over the intensifying conflict in Ukraine overshadowed data that showed an acceleration in U.S. jobs growth last month.

The Dow Jones Industrial Average fell 139.23 points, or 0.41 per cent, at the open to 33,655.43.

The S&P 500 opened lower by 21.37 points, or 0.49 per cent, at 4,342.12, while the Nasdaq Composite dropped 82.71 points, or 0.61 per cent, to 13,455.23 at the opening bell.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The TSX composite index was down 42.34 points, or 0.2 per cent, at 21,208.07.

8:30 a.m.

Magna International Inc., Canada’s biggest maker of automobile parts, has changed its mind about trying to hang on in Russia.

As other multi-nationals headed for the exits, the Aurora, Ont.-based company said on March 1 that it planned to keep its six factories open, and its 2,500 Russian employees working. That stance lasted about two days.

“Like most in the international community, we remain deeply concerned with the very unfortunate situation in Ukraine,” Tracy Fuerst, vice-president of corporate communications and public relations, said in an email. “Given current conditions, Magna is idling its Russian operations.”

Magna will make a “significant” donation to the UN Refugee Agency and will match any donations that its workers make towards the “well-being and safety” of Ukrainians.

“Although we don’t have facilities in Ukraine, we have the privilege of working with thousands of Ukrainian colleagues in our Magna operations around the world as well as those from Russia who share the same values of human rights, diversity and inclusion,” Fuerst said.

— Kevin Carmichael

Additional reporting by Reuters, Bloomberg

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.