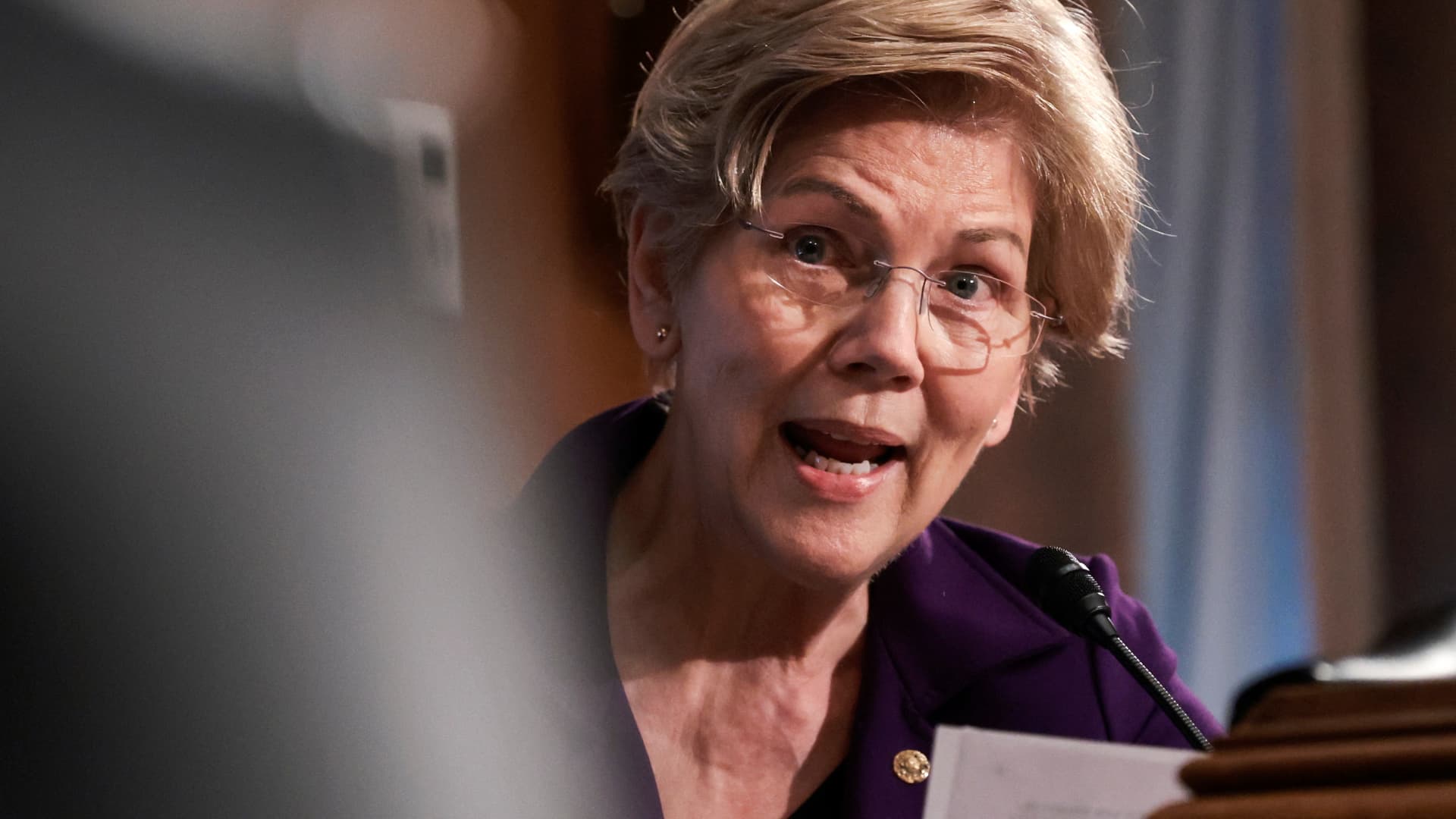

Sen. Elizabeth Warren lauds Biden billionaires’ tax, calls for even more CEO pay changes

Sen. Elizabeth Warren on Tuesday praised the Biden administration’s renewed effort to introduce a new tax on the country’s wealthiest households, calling for even more changes to the way corporate executives are paid.

Warren, a Democrat from Massachusetts, said that President Joe Biden’s proposal to require the top 0.01% of households — those worth over $100 million — to pay a 20% tax on their income is a welcome reform for a “broken” tax system.

“What Democrats are saying is that we’ve got a plan to try to raise taxes on the millionaires and billionaires, the people at the top who aren’t even paying taxes at the same rate as everyone else,” Warren told “Squawk Box.”

Higher taxes on the richest American households, she argued, would help fund future corporate subsidies like tax credits for clean energy projects as well as big-ticket government projects such as the president’s infrastructure bill.

Warren cited Tesla CEO Elon Musk as a key example of an executive and company that enjoy the benefits of public support.

In 2009, former President Barack Obama rolled out $2.4 billion in funding to encourage auto companies to ramp up their electric-car production. As part of that program, the government started offering a $7,500 tax credit that car buyers could use to offset manufacturers’ steeper sticker prices.

The tax credit for EV automakers, which applies to the first 200,000 EVs sold to spur demand, has since been phased out for Tesla buyers. But many analysts believe the program nonetheless helped accelerate Tesla’s growth in its younger years.

“I’m happy to celebrate success,” Warren said. “But let’s remember: Elon Musk didn’t make it on his own. He got huge investments from the government, from taxpayers.”

The Massachusetts Democrat has long called for more aggressive taxes on the wealthiest Americans.

During her 2020 presidential campaign, the former bankruptcy lawyer proposed a 2% annual tax on households with net worth between $50 million and $1 billion, as well as a 4% annual surtax on households worth over $1 billion.

She also renewed her attack on how corporations dole out profits, saying that rewarding CEOs with stock or investors with buybacks is flawed.

The composition of executive pay has undergone significant change over the last fifty years, with stock options and awards now representing a bulk of executive pay at many companies. Analysis from the Economic Policy Institute, a liberal-leaning think tank, shows that stock awards have risen to about 50% of all CEO compensation.

Biden’s budget proposal, released earlier this week, says that the president supports legislation that would require executives to retain company shares for “several” years and bar them from selling equity in the years following a corporate buyback.

“We saw the move to executives being paid in stock when there was actually an effort to put a cap on what executives get paid,” Warren said. “There was a sense at the time that executive pay was just out of control and had gone so far beyond what ordinary workers were making.”

“But moving over to getting paid in stock has obviously blown entirely through that rationalization,” she added. Buybacks don’t “have executives making the right decision on investments in [research and development], or on taking care of shareholders overall.”