S&P 500 Will Stall, Then Rise to ‘New Rally Highs,’ JPMorgan Says

(Bloomberg) — The S&P 500 Index looks set to climb to “new rally highs” in the second half of 2022, but before that it will likely limp through a soft second quarter, according to JPMorgan Chase & Co.

Most Read from Bloomberg

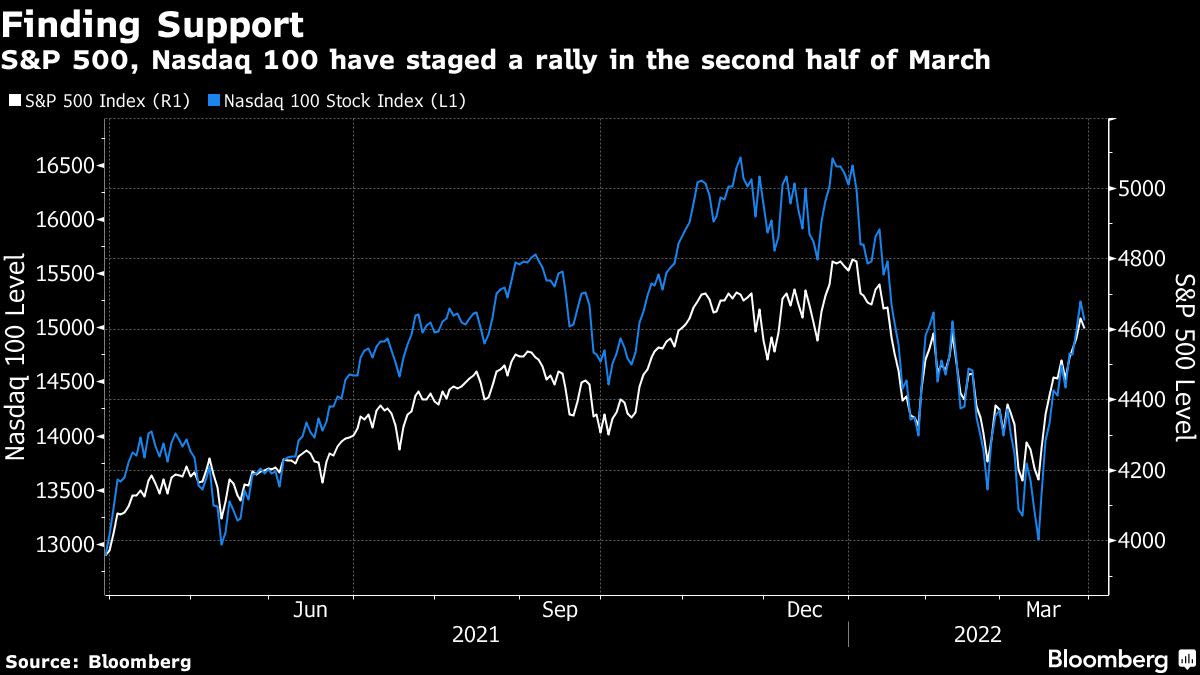

The index has rebounded from the bank’s favored medium-term range of support between 4,100 to 4,300, as it caps a turbulent first quarter by climbing nearly 5% so far in March. Investors have found safety in shares of the biggest American companies this month, as risks rise from the war in Ukraine to the Federal Reserve tightening policy.

Read: Yield-Curve Inversion Rarely Upends a Stocks Rally, Truist Says

The S&P 500, however, has overshot key resistance levels in the upper 4,500s to briefly trade above 4,600, JPMorgan said. The rally has moved into the upper end of what the bank thinks is a narrow, multi-month trading range.

“While the move is somewhat stronger than we anticipated, we still expect more range bound price action in the weeks/months ahead,” JPMorgan strategists, led by Jason Hunter, Alix Tepper Floman, Harsha Uppili and Marko Kolanovic, wrote in a note to clients. “We think the rally decelerates and tops out not too far from current levels.”

As the current range matures, JPMorgan expects that the S&P 500 will have “at least one more medium-term push to new rally highs in the second half of 2022,” the strategists said. “Such a move would be consistent with the current cross-market setup and how mid- to late-cycle dynamics played out since 1980.”

How inflation expectations evolve into the summer and fall and its effects on the Fed’s tightening cycle will likely dictate whether there is potential for a protracted rally for the S&P 500 through 2023, or whether investors should reposition to a more defensive posture in the latter months of this year, according to the bank.

“The important part of the message for right now is that we believe it is too early to expect a protracted bear trend at this point,” JPMorgan said.

The NASDAQ 100 Index, which has jumped nearly 8% in the past two weeks, currently trades around 15,000 and faces a key zone of resistance between 15,057 to 15,352, according to JPMorgan. The firm projects the tech-heavy index’s momentum will also decelerate near current trading levels that will lead to further strength into summer.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.