U.S. Wheat ETF Runs Out of Shares Due to Rush of Demand

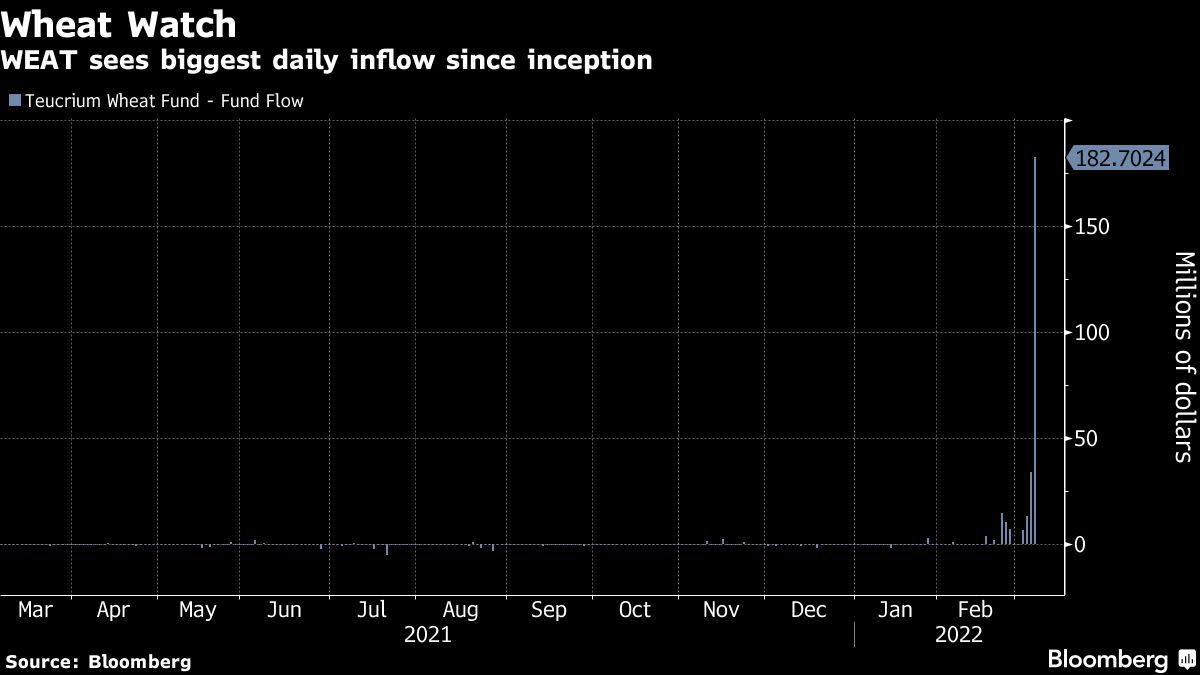

(Bloomberg) — Until this month, the only U.S. exchange-traded fund tracking wheat had never lured more than $35 million in a single day. On Friday alone, it added five times that amount.

Most Read from Bloomberg

The Teucrium Wheat Fund (ticker WEAT) gathered almost $183 million at the end of last week as futures soared following Russia’s invasion of Ukraine. That historic flow caused an unusual problem for the ETF — it ran out of shares.

Ordinarily, ETFs can constantly create or redeem shares depending on demand. But WEAT is a so-called commodity pool, which have a pre-set number and require regulatory permission to generate more. With demand still strong on Monday, the fund temporarily halted the creation of more shares pending the approval of the U.S. Securities and Exchange Commission.

“The market will be notified as soon as we are able to resume issuing shares,” said Jake Hanley, managing director at Teucrium.

Wheat, a key food staple, fell 2.9% to $12.49 a bushel on Wednesday in Chicago after reaching a record high in the previous session. Russia and Ukraine represent 29% of global trade in the commodity, according to Bank of America Corp., and rising prices of the commodity may tighten broader agricultural markets.

Other supplies from corn to sunflower oil have also seen their prices spike, further stoking fears of food inflation as the global economy recovers from the depths of the pandemic.

As of Monday, WEAT had around 7,375,000 shares registered with the regulatory agency, according to its filing. Investors can still buy and sell shares of the $483 million fund in the secondary market, and redemption requests will continue to be accepted, the issuer said.

WEAT’s settlement schedule means flow data arrives with a one-day lag. The fund added another $82 million on Monday, the latest data show.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.