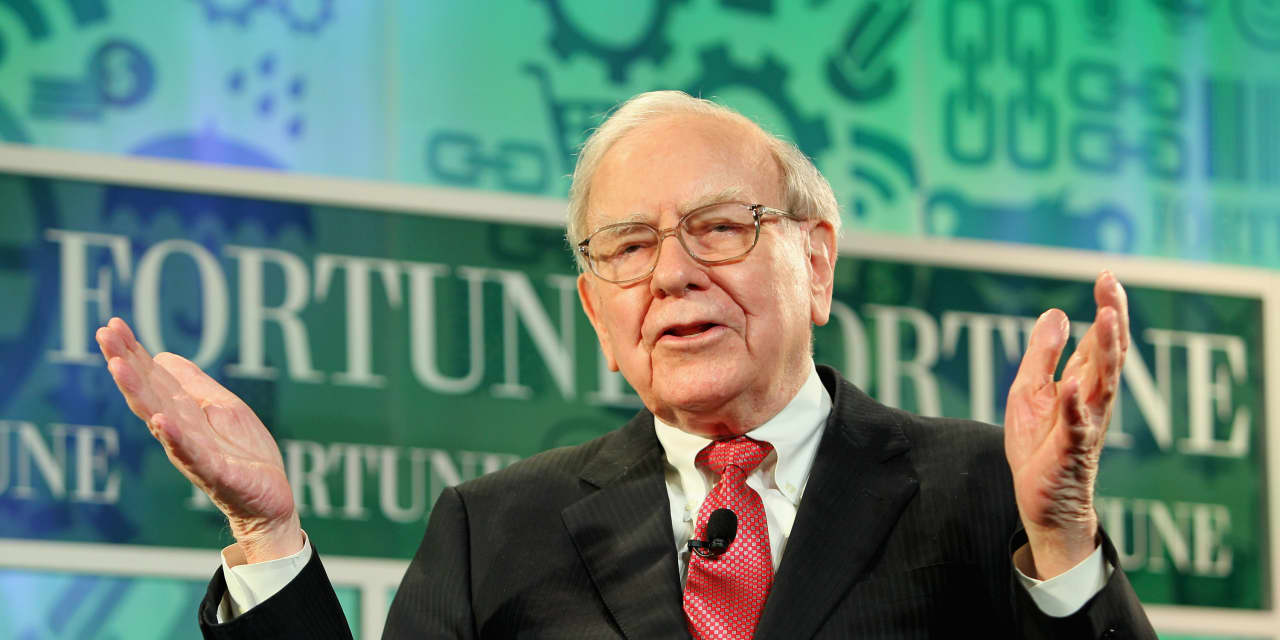

Warren Buffett puts cash to work with $11.6 billion deal for Alleghany

Warren Buffett picked the industry he arguably knows best, insurance, for his first major deal in two years.

Berkshire Hathaway BRK.B,

The $848.02 per share price is 1.26 times book value as of Dec. 31 and a 29% premium to its average price over the last 30 days, the companies said. Alleghany shares ended Friday at $676.75.

Alleghany shares jumped 25% to $844.82 in premarket trade. Berkshire Hathaway’s B shares edged up 0.4%.

The deal allows Alleghany to actively solicit and consider alternative acquisition proposals during a 25-day “go-shop” period.

Joseph Brandon, only months in the job as Alleghany’s chief executive, ran Berkshire Hathaway’s General Re business from 2001 to 2008.

Alleghany Corp., like Berkshire Hathaway, does hold stakes in companies outside of insurance, including hotel management company Concord Hospitality Enterprises and Precision Cutting Technologies, a maker of machine tools. Jazwares and W&W|AFCO Steel each generated over $1 billion in annual revenue for the first time last year, Alleghany said.

The $11.6 billion acquisition, if successful, will be Berkshire Hathaway’s largest deal since its $34.6 billion acquisition of Precision Controls, that completed in 2016. A more recent billion-dollar deal was the $8 billion acquisition of Dominion Energy’s gas transmission and storage deal in 2020.

Berkshire Hathaway recently disclosed it had $144 billion in cash. “These periods are never pleasant; they are also never permanent,” Buffett said in his most recent annual letter to shareholders.