Whether or not a bottom is in, here’s what will ride to the stock market’s rescue over 12 months, one strategist forecasts

So, is this it? After the powerful 2.6% rebound for the S&P 500 SPX,

Arguing yes is Mark Newton, head of technical strategy at Fundstrat, who notes that while huge rallies are normally to be expected within big downtrends, this move was accompanied by a nearly 5-to-1 breadth. He says the 4,250 mark on the S&P 500 was an important line in the sand, and that if Treasury yields rise from here, that could give a boost, given that financials are the third-largest sector in the S&P 500. Newton says there isn’t evidence of true capitulation, but the recent negative retail sentiment has helped drive a near-term bottom.

By contrast, Dhaval Joshi of BCA Research says stocks may fall further in the short-term. Unlike the COVID-19 pandemic, when governments unleashed tax cuts and spending increases, this time they are sanctioning Russia, which will also hurt their domestic economies. The other big difference is that this time monetary policy is tightening rather than loosening, as the Federal Reserve readies the first of what it says will be multiple interest-rate rises. He also worries about another wave of COVID-19 coming from Europe’s largest refugee crisis in decades.

On a three-month basis, Joshi says the inflationary impulse from soaring energy and food prices will choke growth. Bond yields could nudge higher as the Fed and other central banks respond, as he says the global stock market hasn’t bottomed, and the U.S. dollar will rally.

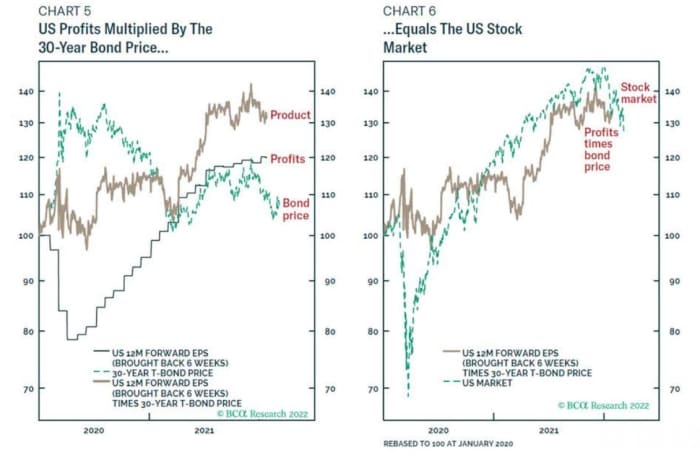

But going out 12 months, he expects stocks, particularly in the U.S., to rise. He says the U.S. stock market has a long duration, of 30 years, meaning that the market should be valued at U.S. profits multiplied by the 30-year bond price. “The short-term inflationary impulse combined with sanctions will be massively demand-destructive, at which point the cavalry of lower bond yields will charge to the rescue,” he says.

He recommends overweighting both the U.S. TMUBMUSD30Y,

The buzz

The U.S. Labor Department reported that consumer prices climbed 0.8% in February to stretch the year-over-year rate to 7.9%, a new 40-year high. Core prices rose 0.5%.

“The Russia-Ukraine war adds further fuel to the blazing rate of inflation via higher energy, food, and core commodity prices that are turbo charged by a worsening in supply chain problems. This will lead to a higher near-term peak in inflation and a slower descent through 2022 than previously envisaged,” said Kathy Bostjancic, chief U.S. financial economist at Oxford Economics.

The European Central Bank unexpectedly decided to speed the pace of bond-buying tapering.

There was no breakthrough in talks between Russia’s and Ukraine’s foreign ministers in Turkey, although the two sides agreed to keep talking, with possibly a meeting between Russian President Vladimir Putin and Ukrainian President Volodymyr Zelensky in the future. Ukrainian foreign minister Dmytro Kuleba said after the talks that Russia was seeking a surrender and that it rejected a proposed 24-hour cease-fire.

The U.K. sanctioned seven oligarchs, including Roman Abramovich, though it gave permission for the Chelsea soccer team he owns to continue playing.

Amazon.com AMZN,

The markets

It was looking again like a risk-off session after the lack of progress in talks in Turkey. U.S. stock futures ES00,

The euro EURUSD,

Top tickers

Here are the top stock market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, |

Tesla |

| GME, |

GameStop |

| AMZN, |

Amazon.com |

| AMC, |

AMC Entertainment |

| NIO, |

Nio |

| CEI, |

Camber Energy |

| AAPL, |

Apple |

| MULN, |

Mullen Automotive |

| NVDA, |

Nvidia |

| BABA, |

Alibaba Group |

Random reads

The Federal Bureau of Investigation found a January 6 Capitol rioter from a photo by a sea turtle charity.

An Austin, Texas accountant has made $75,000 suing telemarketers over illegal robocalls.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.