Why Russian oil can’t find buyers even as crude soars above $100 a barrel

Call it a “buyers strike” or “self-sanctioning,” but Russian crude is being shunned in the physical market even as a scramble for barrels sends oil futures to their highest levels in years.

“The current central bank sanctions and selective SWIFT action is causing major risk aversion by key market participants,” said Helima Croft, head of global commodity strategy at RBC Capital Markets, in a Thursday note.

The U.S. and its allies have imposed tough sanctions on major Russian banks, blocking them from the crucial SWIFT interbank messaging service, and have also targeted the nation’s central bank. The efforts are aimed at effectively ejecting Russia from the global financial system in response to Vladimir Putin’s decision to invade Ukraine.

However, they have so far included carve-outs for Russia’s energy exports amid worries over surging inflation.

Nevertheless, energy companies, trading houses, shipping companies, and banks have all backed away from the Russian energy business, Croft noted, adding that the country’s “already staggering” export losses could hit 3 million to 4 million barrels a day if Western powers follow through and impose the sort of energy-focused “secondary sanctions” that were aimed at Iran.

Related: Russia-Ukraine war fuels ‘biggest supply shock to global grain markets’ in living memory

News reports have noted the struggle to clear Russian crude in the physical market. Bloomberg reported Thursday that commodity-trading giant Trafigura Group offered to sell a cargo of Russia’s flagship Urals crude at a record discount of $22.70 to Dated Brent, a global benchmark for physical oil transactions, but received no bids.

Oil futures ended lower Thursday after the U.S. benchmark CL.1,

Meanwhile, a growing premium for nearby oil futures contracts over later months — a phenomenon known as backwardation in commodities trading lingo — underlines how worried traders are about the ability to secure crude in the near term.

The premium for May Brent over the contract for delivery nine months later temporarily topped $20 a barrel, a level not seen since the 1990s, noted Edoardo Campanella, an economist at UniCredit Bank in Milan.

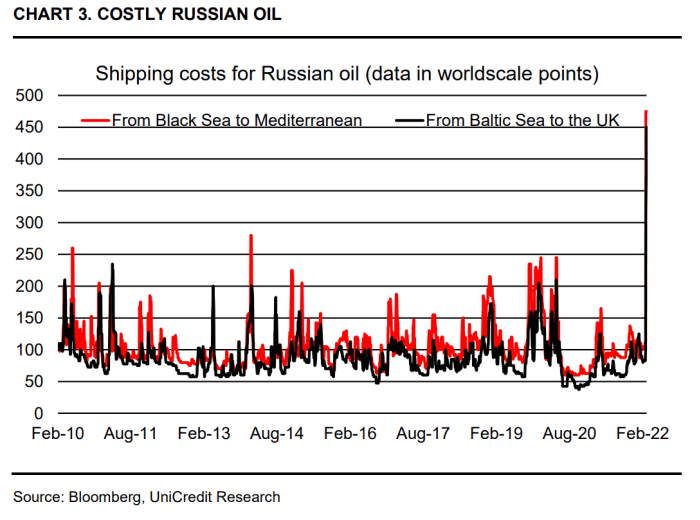

That geopolitical risk premium takes into account not only the risk of damage to oil facilities due to military action or potential Western sanctions, but also reflects soaring insurance costs to ship Russian oil. He observed that freight rates for oil coming out of both the Black Sea and Baltic sea more than tripling over the space of a few days as crude-oil buyers struggled to find shippers willing to send vessels into Russian ports (see chart below).

“This is part of a broader phenomenon of ‘self-sanctioning,’” he wrote. “Market participants are simply refusing to deal in Russian oil, even if Western governments allow it within the sanctions they have imposed on Russia in response to its invasion of Ukraine.”

The possibility of energy-specific sanctions, meanwhile, can’t be ruled out as the war rages on, said RBC’s Croft.

Read: As U.S. lawmakers push to ban Russian oil, analyst sees ‘limited impact’ on prices for Americans

“Such punitive measures would curtail buying by India and China, with their refiners being forced to choose between accessing U.S. capital markets and doing business with Russia,” she said. “Though concerns about inflation are running extremely high in Washington, we believe the energy carve-outs could soon prove untenable as the Russian conduct of the war grows more gruesome and the civilian toll climbs.”