Bank of Canada hikes interest rate by 0.5% for first time in 22 years

Another half-point increase in June is definitely possible

Article content

The Bank of Canada raised its benchmark interest rate a half point Wednesday and released a new economic forecast that says inflation will remain well above its comfort zone for the rest of the year.

Advertisement 2

Story continues below

Article content

Here’s what you need to know:

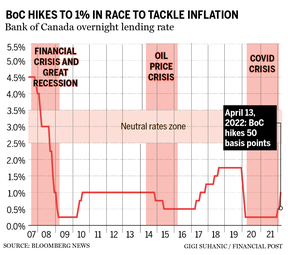

0.5% biggest rate hike since 2000

Bank of Canada Governor Tiff Macklem and the six deputies on Governing Council increased the benchmark interest rate to one per cent from 0.5 per cent, the biggest one-time increase in borrowing costs since 2000. (The central bank typically adjusts policy a quarter-point at a time.)

The central bank also initiated “quantitative tightening,” or QT, which is the opposite of quantitative easing, the aggressive approach to monetary stimulus known as QE.

Under QE, the central bank created hundreds of billions of dollars to purchase government bonds. It stopped creating money to buy bonds last year, but as the assets it purchased during the COVID recession matured, it had been using the proceeds to purchase more bonds. The central bank will no longer do that, removing itself as an active buyer in the debt market.

Advertisement 3

Story continues below

Article content

The outlook

The Bank of Canada said gross domestic product will increase 4.2 per cent this year and 3.2 per cent in 2023, compared with estimates of four per cent and 3.5 per cent, respectively, in January. Both represent strong rates of growth based on Canada’s pre-pandemic trajectory.

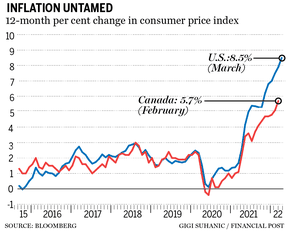

Policy-makers see the consumer price index climbing 5.3 per cent in 2022 (previous estimate: 4.2 per cent) and 2.8 per cent next year (previous estimate: 2.3 per cent).

The context

Policy-makers said the war in Ukraine blew up their January forecasts. The conflict ignited new surges in prices for oil, natural gas, and other commodities, while Western sanctions have disrupted supply chains, putting additional upward pressure on costs.

Advertisement 4

Story continues below

Article content

A year ago, central bankers thought global inflation was primarily a supply story. That’s no longer the case. The Bank of Canada observed that domestic demand in the United States is “very strong.” The Canadian central bank described growth at home as merely “strong.” Labour markets are tight, wages are accelerating, exporters are reaping windfalls from the surge in commodity prices, and the economy appears to have learned how to push through waves of COVID-19.

The economy is at least as strong as it was before the pandemic, when the benchmark interest rate was 1.75 percent. The Bank of Canada has some catching up to do.

The key line

“With the economy moving into excess demand and inflation persisting well above target, the Governing Council judges that interest rates will need to rise further.”

Advertisement 5

Story continues below

Article content

-

Bank of Canada raises interest rate: Read the official statement

-

What a supersized rate hike by the Bank of Canada will mean to your mortgage

-

Bank of Canada survey shows most businesses think it will take at least two years to get inflation under control

The takeaway

The Bank of Canada erred on the side of growth in the early phase of the pandemic, making a conscious decision to risk stoking inflation hotter than its target in order to bring about a faster recovery.

If policy-makers had anticipated the fragility of supply chains, droughts in major farming regions, and a war in Europe, they might have done things differently. Another surprise: labour markets survived an epic recession far better than anyone anticipated in early 2020.

The result is more demand than supply. The central bank now must err on the side of constraining growth to get back to its inflation target of two per cent. Another half-point increase on June 1 is definitely possible.

• Email: [email protected] | Twitter: CarmichaelKevin

Advertisement

Story continues below