CEO of Robinhood rival shines fresh light on what retail investors are doing. Wall Street needs to pay attention.

From the start of the COVID-19 pandemic two years ago, a newish crowd of retail investors emerged, pouring extra cash into equity markets and steering Wall Street into places they never dreamed, such as meme stocks.

Our call of the day, from the founder and chief executive officer of competitive stock trading app Zingeroo, says institutional traders would be wise to keep paying attention to an increasingly sophisticated retail investor.

Prepandemic, notes Zingeroo’s chief Zoë Barry, the retail crowd represented 10% of the volume that was traded and didn’t share trading ideas — often seen in the Gen. X and older crowd. That figure then hit a high of 25%, and with it came much chattier investors.

“[Wall Street] completely underestimated what it would be like if 25% of the volume turned in a certain direction and turned away from institutional,” Barry told MarketWatch in a recent interview.

“ “…Gen. Z has actually started sharpening their pencils and doing the research as to what to do in a bear market.” ”

“And now Wall Street is all over sentiment data and they’re looking at what people are seeing, but they also want the core trading numbers because there’s a gap between what people chatter about and say online, versus what they actually trade,” she said.

As a former analyst at Dawson Capital, Barry said she wants to know what traders are saying versus what they’re trading, and why there are inflows on certain stocks. “If I were an institutional, I would be very, very wary of shorting a stock that has the potential to be a heartthrob of retail investors,” she said.

Barry’s app, which launched last autumn, is a rival to Robinhood HOOD, but features “bullpens” — chat groups to discuss investing topics — and “zones,” where performances can be benchmarked against others, while trades can be verified by “trading cards.”

The serial entrepreneur said 80% of Zingeroo’s users are millennials and Gen. Z, with the rest Gen. X plus. The younger crowd, she said, views trading activity as their so-called “M.B.A.” — investing in themselves and their own financial diversity.

“I think young retail investors are beginning to have a longer-term outlook than just you know, what is happening this week in the markets. I think that’s an overall positive for them,” she said. “They’re investing in the stock market and they’re investing in themselves and increasing their financial literacy and that’s positive.”

And in the first part of the quarter, there was lots of chatter about young investors being lost in the wilderness of a bear market. “And what we saw was Gen. Z has actually started sharpening their pencils and doing the research as to what to do in a bear market,” said Barry.

As for differences between generations, she said the Gen. X plus category will auto liquidate via stop losses, millennials tend to buy the dip, while Gen. Z is even more sophisticated. For example, she noted recent action on the SQQQ SQQQ, a three-times leveraged inverse exchange-traded fund that tracks the Nasdaq-100, and called that “definitely unusual behavior for a retail investor.

“They basically said we’re not sure which of the growth stocks are going to be impacted most, so I’m not smart enough as a retail investor to pick exactly what stock will pull back,” said Barry. They are also not worried about catching the exact bottom of a market, but instead are looking at stocks they think will have a greater chance of being a future fundamental success.”

And this crowd “understands the future tools that are happening right now,” and are overall more bullish on themselves, their future potential and the economy overall, despite the geopolitical meltdown and rising inflation, said Barry.

The buzz

Twitter TWTR shares are up 25%, on news Tesla CEO Elon Musk has taken a 9.2% stake. Tesla TSLA deliveries, meanwhile, rose in the first quarter, but missed Wall Street expectations, though JPMorgan hiked its price target.

Starbucks SBUX announced a halt in stock buybacks, coinciding with Howard Schultz’s return as chief executive.

The U.S. and Europe are readying more sanctions against Russia, amid horrifying images and reports of unarmed Ukrainians executed in Bucha, Kyiv and elsewhere.

Read: Russia war could further escalate auto prices and shortages

Ukrainian President Volodymyr Zelensky made an impassioned Grammys appearance, for his country. The controversy-free awards ceremony honored Jon Batiste for album of the year, among other highlights.

JPMorgan CEO Jamie Dimon said the ongoing war is bad news for the global economy.

Amid lockdowns in China, authorities have reported a new subtype of the omicron variant.

Factory orders are ahead in a thin data week that will include Federal Reserve minutes. And San Francisco Fed President Mary Daly said the case for a half-point interest-rate increase in May has gone up.

The markets

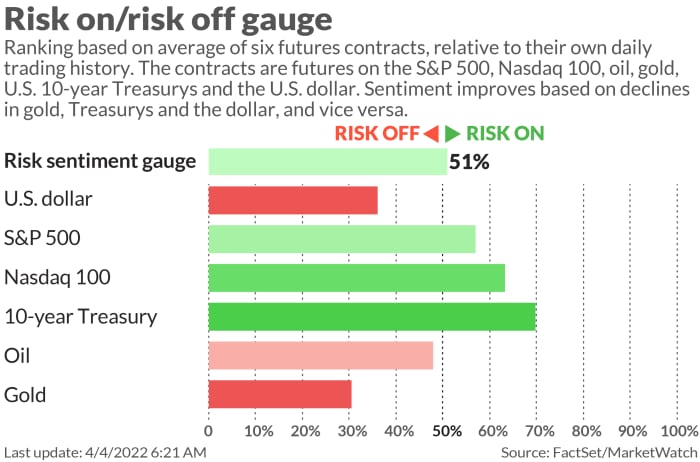

Stocks DJIA SPX COMP are mixed, with oil prices CL00 BRN00 climbing as investors mull possible increased sanctions on Russia. Curve inversion sticks around, with the yield on the 2-year note BX:TMUBMUSD02Y higher than the 10-year BX:TMUBMUSD10Y. Bitcoin BTCUSD is easing off a recent run.

The chart

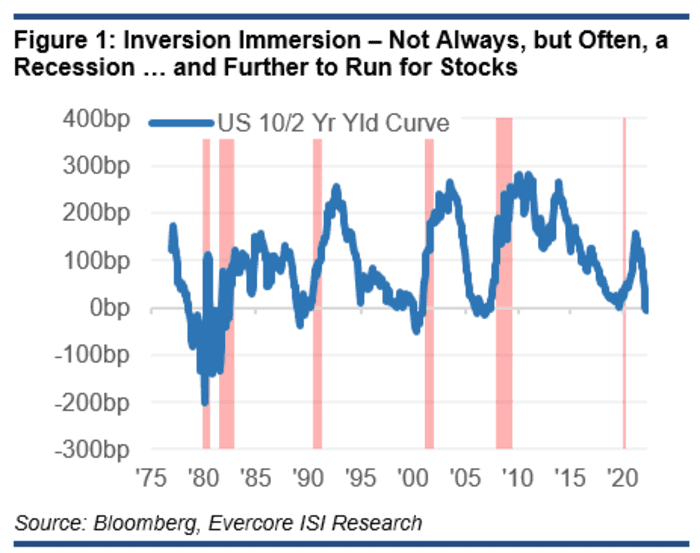

“One consistent theme, is strong returns from the point of yield curve inversion to the eventual stock market top. It’s also worth noting that if the 1/4/22 S&P 500 high stands, that would mark the first stock market peak before inversion in 40 years,” said a team of strategists at Evercore in a note. Here’s that chart:

Note, Goldman Sachs also weighed in on this topic in a recent research report, noting that S&P 500 returns have typically been positive in the two years following yield curve inversion, except in the high-inflation period of 1973, when it ultimately entered a bear market.

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern Time:

Random reads

German man accused of getting 90 COVID-19 vaccinations, to sell his cards to those who wanted to avoid jabs.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.