Here’s how far the S&P 500 has to fall to enter another stock-market correction

Stocks were enjoying a bounce Wednesday afternoon, providing some breathing room for the S&P 500 after it came close to entering its second market correction of 2022.

The large-cap benchmark was up less than 1% to trade near 4,210 in early afternoon activity, after ending Tuesday at 4,175.20 in a tech-led selloff that dragged it down by 2.8%. Stocks have seen volatile day-to-day and intraday swings in recent sessions.

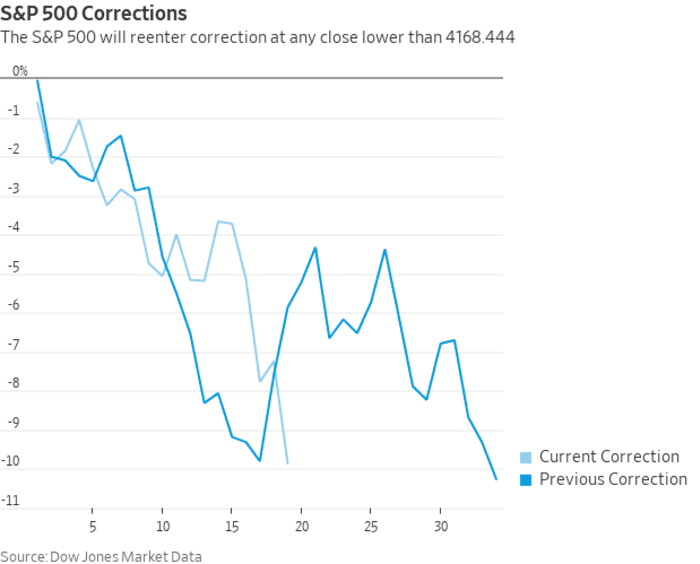

A close at or below 4,168.44 would see the S&P 500 SPX,

The S&P 500 previously suffered a correction on Feb. 22, when it closed at 4,304.76, down 10.25% from its early January record close. Stocks extended a slide in early March as investors reacted to Russia’s Feb. 24 invasion of Ukraine, which sent oil prices soaring to nearly 14-year highs and stoked geopolitical anxiety.

A closing low of 4,170.70 on March 8 marked the bottom of that move. The S&P 500 exited the correction on March 29, when it finished at 4,631.60, up 11.05% from the March 8 closing low.

Exits from correction territory have tended to see the index continue to gain ground in subsequent weeks and months, though not always.

See: S&P 500 exits correction: Here’s what history says happens next to the U.S. stock-market benchmark

It has been 20 trading days since the S&P 500 exited its previous correction. While it doesn’t appear likely at the moment, a fall into correction today would mark the shortest re-entry since November 2008, in the heart of the 2007-09 financial crisis, when the S&P 500 dropped back into correction territory just seven days after exiting one, Dow Jones Market Data noted. That correction later turned into a bear market.

Stocks have suffered in April as investors adjusted expectations around the Federal Reserve and the prospect of a series of outsize rate increases and an aggressive wind-down of the central bank’s balance sheet as it attempts to rein in inflation running at its hottest in more than 40 years.

Read: What’s next for the stock market as investors grapple with Fed near ‘peak hawkishness’

Disappointing earnings from some formerly highflying megacap tech-related names have also helped fuel a selloff, deepening a bear market for the Nasdaq Composite COMP,

The Nasdaq Composite ended Tuesday down more than 22% from its record close set in November. It entered a bear market last month. The Dow Jones Industrial Average DJIA,

—Mike DeStefano contributed to this article.