Here’s how much a 40-year mortgage would save you each month vs. a 30-year loan. And the ultimate cost.

The U.S. home-financing market has been dominated by the 30-year fixed-rate mortgage loan for decades.

Now some key players in the U.S. housing market think it is time to give home buyers the option of stretching loans out to 40 years. The lower monthly payments might help some borrowers handle home-price inflation. Then again, it may not be worth adding another 10 years of loan payments.

Below is an example of what loan payments might look like for a 40-year fixed-rate mortgage loan, compared with typical 30-year and 15-year loans.

Jacob Passy explained that discussions among government agencies of 40-year mortgage loans have so far centered around loan modifications for struggling borrowers to bring their payments current. But this could point the way to wide acceptance and availability of 40-year loans for all home buyers.

The U.S. has an incredibly liquid mortgage loan market, led by Fannie Mae FNMA,

Potential advantages of a 40-year loan

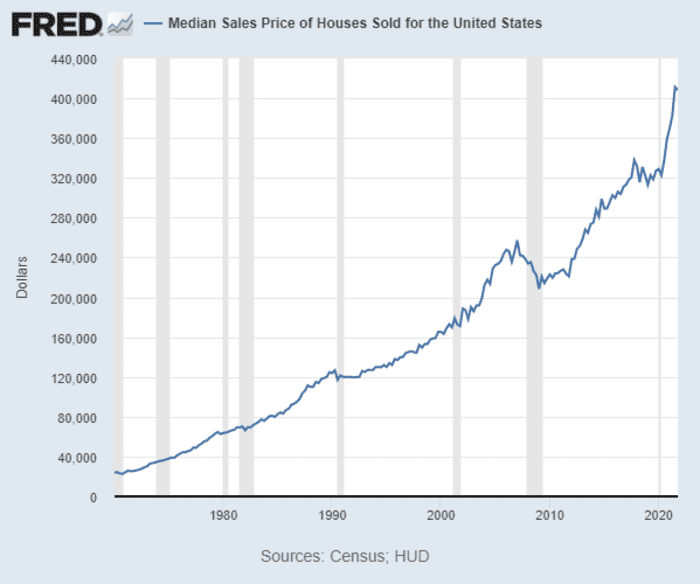

The obvious potential advantage of a 40-year loan is a lower monthly payment. Before we make loan-term comparisons, here’s a chart from the Federal Reserve Bank of St. Louis, showing the movement of median U.S. home-sale prices since 1970:

The St. Louis Fed’s most recent estimate for the median U.S. U.S. home-sale price was published on Jan. 26 and was $408,100, and our examples are based on this number. The multidecade chart shows plenty of pullbacks for the market, including the long and painful one from the first quarter of 2007 through the first quarter of 2009, but otherwise, the direction of the chart is pretty clear, especially when considering the length of most mortgage loans.

Leaving aside special programs for low-income borrowers, which may have low down-payment requirements, our examples will assume a 20% down payment of $81, 620 for a loan amount of $326,480.

The national median price may not apply to an area where you are looking to buy a home, but it should serve well to illustrate the differences of loan terms and to show how the weighting of loan payments to principal and interest shift over time.

Interest rates and amortizing loan payments

Since the current mortgage financing market in the U.S. is dominated by 30-year and 15-year fixed-rate mortgage loans, we will compare both of these with a hypothetical 40-year loan. Adjustable-rate mortgage loans are also available. However, these have varying initial fixed periods.

A big move: Mortgage rates zoom past 4.5% — here’s what home buyers need to know

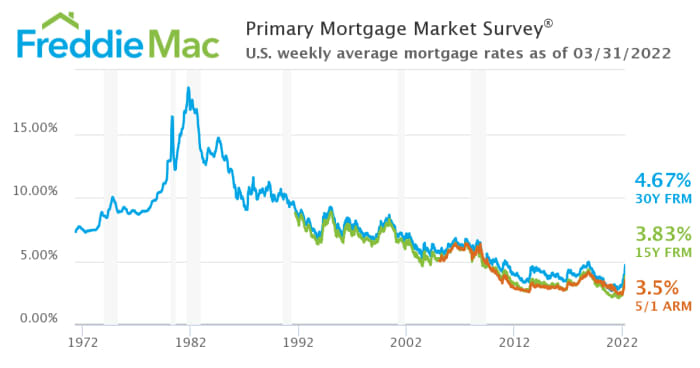

It is also worth considering that despite the recent upward surge in interest rates, residential loan rates are still at historically low levels.

Here’s Freddie Mac’s chart showing the movement of 30-year mortgage loan rates since April 1971, with 15-year loans added in 1991 and adjustable loan rates added in 2005:

According to Freddie’s survey for the week ended March 31, 2022, the average interest rate for a 30-year loan was 4.67% and the average for a 15-year loan was 3.83%.

The following payment examples don’t reflect origination fees or points, or other fees for various services during the loan-origination process. The loan payments also exclude property taxes and insurance premiums, which are typically escrowed and collected by the loan servicer as part of the total monthly payment.

For the 40-year loan, we’re using the same interest rate as a 30-year loan. One reason for this is that no average is available for a 40-year home-purchase or refinance market that doesn’t really exist yet.

Another reason is that a 40-year loan wouldn’t necessarily have a higher rate than a 30-year loan. (As of April 1, the yield on 20-year U.S. Treasury bonds TMUBMUSD20Y,

An amortizing loan payment is one that repays a loan’s principal balance over the term of the loan. So initial loan payments are heavily weighted to interest, and payments toward the end of the loan are heavily weighted to principal.

Here’s a comparison of the monthly principal and interest payments for our hypothetical 40-year mortgage loan and 30-year and 15-year loans of $326,480, based on a 20% down payment for a home purchase of $408,100, the national median price according to the most recent data available from the St. Louis Fed:

| Term | Interest rate | Monthly P&I | Total interest paid | Total interest paid – first 5 years | Total interest paid – first 10 years | Equity built after 5 years | Equity built after 10 years |

| 40 years | 4.67% | $1,504 | $395,244 | $74,500 | $144,875 | $97,336 | $117,177 |

| 30 years | 4.67% | $1,687 | $280,970 | $73,133 | $138,890 | $109,729 | $145,215 |

| 15 years | 3.83% | $2,387 | $103,218 | $54,430 | $90,151 | $170,423 | $277,936 |

All dollar figures have been rounded.

The table has comparisons of total interest paid for the life of each loan. Obviously the interest totals are higher as the terms get longer. But there are also comparisons for the first five years and the first 10 years of interest payments for each loan, and comparisons of the amount of equity built up in the first five and 10 years, including the down payment.

In this example, the amount of interest paid for the life of the 40-year loan would exceed the loan amount. It comes close to doubling the price of the home.

You can also see that with the 15-year loan, you would build up equity of nearly 70% of the purchase price after 10 years.

Advantages and disadvantages

The 40-year loan has the lowest monthly payment of $1,504. But it represents “savings” of only $183 a month from the 30-year loan. When considering the total price of the home in this example, adding another 10 years to the life of the loan seems a steep price to lower the payment by less than $200 a month.

It’s easy to say that for someone buying a home, the 40-year loan doesn’t appear to be such a good deal. But for a homeowner struggling to make their monthly payments who is offered a 40-year loan modification, the lower payment might make all the difference.

The comparison of 30-year and 15-year numbers is more extreme. The monthly payment for the 15-year loan is $700 higher. Some home purchasers can afford the higher payment. The advantages of the 15-year loan are that total interest paid for the of the loan is $103,218, compared with $289, 970 for the 30-year loan. Fifteen years can seem to go by quickly, and it’s a thrilling feeling to stop making the payments.

You can run your own comparisons of 15-year and 30-year loans, as well as well as other periods and adjustable-rate loans using MarketWatch’s mortgage calculator.

A counter-argument to the 15-year loan might include opportunities lost. The 30-year loan has an interest rate of 4.67%, and one could expect over the long term to benefit from a much higher rate of return from a broad investment in the stock market. But that raises the question of whether the $700 in monthly cash freed up by the 30-year loan will be invested. It might be tempting to spend that money on a more expensive vehicle than you would otherwise buy.

The decision on which home to buy and the loan-term decision must factor in a family’s needs, including space, saving and investing for retirement and education, and myriad household expenses.

A home purchaser should at least understand how the different loan types work.

Digging deeper into amortization

Looking at the amortization breakdown is another way of illustrating how much you are paying to finance your home. For example, with the 30-year loan, interest makes up $1,271 of your first monthly payment $1,687 (again, the figure is rounded). Here’s a comparison of the principal portion of the monthly loan payment for the three loan types during the first month and further down the line:

| Term | Interest rate | Monthly P&I | Principal portion – first month | Principal portion – month 60 | Principal portion – month 120 |

| 40 years | 4.67% | $1,504 | $233 | $293 | $370 |

| 30 years | 4.67% | $1,687 | $417 | $524 | $662 |

| 15 years | 3.83% | $2,387 | $1,345 | $1,623 | $1,966 |

Together, the tables show how much more quickly your loan balance is paid down (or your equity is built up) with the shorter loan periods.

Final thoughts and a warning

When purchasing a home — especially your first home — everything needs to be on the table. A long-term discussion should encompass all major financial goals and needs, including retirement saving, education, future medical expenses and even which cars, trucks or SUVs you plan to or need to purchase. You might also take a hard look at your initial estimate of how much space you need. How much of that is for storage? What are you storing? If you store less, you might pay less.

Vehicle purchases are typically financed, and for many couples can feature monthly payments that approach monthly home loan payments. So a hard look in the mirror is necessary. There are so many different needs to be considered when purchasing a vehicle, including work — you might need an expensive truck. Or you might need to be seen driving a nice late-model car to make a good impression if you are selling real estate, for example.

But some people might be able to delay the purchase of a new vehicle, which can ease pressure when making what might be a multi-decade home-financing decision.

Shock warning

Property taxes are calculated in different ways, depending on which state you live in. In some states, the taxes are based on the home sale price or the property tax assessor’s current estimate of a home’s value, with annual increases possibly limited to low percentages. This could mean that a home buyer will pay much higher property taxes than the seller was paying.

Early in your home purchase decision process, be sure to make your own estimate of what your property taxes will be, rather than relying on the lender or title company’s estimate, which may be based on the previous year’s property taxes. You can contact the county property appraiser for assistance with this estimate.

Another factor to consider is homeowner’s insurance, including extra coverage that may be required if you are in a flood zone or in an area prone to other hazards, such as hurricanes. If you are moving south from a state in the Northeast or Midwest, for example, you may encounter a far different — and far more expensive — insurance market than you have previously faced.