Kevin Carmichael: Roaring inflation leaves Bank of Canada little choice but to come on strong

Central banks must now show the system they created works, and the three-decade era of low inflation wasn’t a fluke

Article content

The only positive thing to say about the latest inflation numbers is that they might represent the peak.

Advertisement 2

Story continues below

Article content

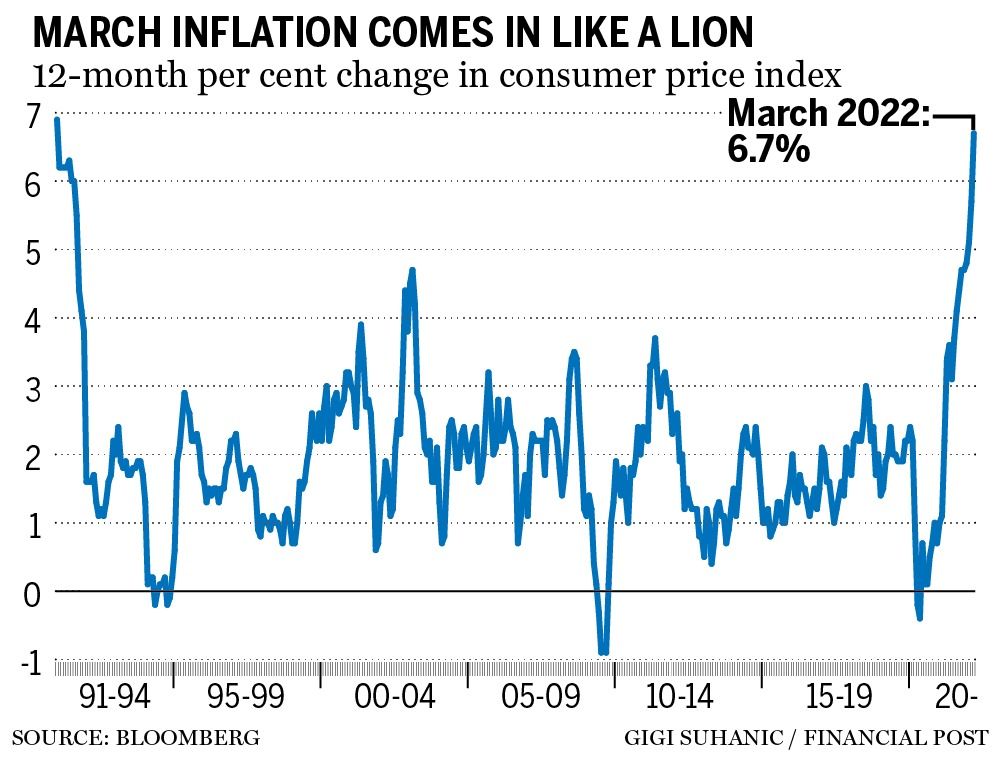

Statistics Canada’s consumer price index, which aggregates hundreds of goods and services to approximate the country’s spending pattern, surged 6.7 per cent in March from a year earlier, the biggest increase since January 1991, and, therefore, the biggest increase since the Bank of Canada started targeting inflation.

It’s an alarming number. The median estimate of Bay Street forecasters was 6.1 per cent. The Bank of Canada in a new forecast last week said the consumer price index would average year-over-year increases of 5.6 per cent in the first quarter; the March number makes the average 5.8 per cent. Inflation will have to cool considerably from its current pace to meet the central bank’s second-quarter prediction of 5.8 per cent.

Advertisement 3

Story continues below

Article content

Math will make things look better starting next month. Year-over-year increases in the consumer price index first jumped above the high end of the Bank of Canada’s comfort zone of one per cent to three per cent in April 2021. Policy-makers were relatively unconcerned because the increase had a lot to do with the way inflation is measured. The index had collapsed in the spring of 2020, when deflation from the COVID-19 recession was the bigger threat, so the increases 12 months later were being exaggerated by “base effects.”

Those base effects should begin working in the opposite direction starting next month. That might help Bank of Canada governor Tiff Macklem quell fears about runaway inflation, as the sight of the headline number going lower might exert a psychological effect on price expectations.

Advertisement 4

Story continues below

Article content

However, there’s little reason to assume that will be enough. The increase in the consumer price index in 1991 was exaggerated by the introduction of the GST. If not for that idiosyncratic event, the March increase would have been the biggest since early 1983, the western world’s last big fight with extreme cost pressures. The broad adoption of inflation targets in the 1990s was inspired by memories of those times. Macklem and his counterparts in the United States and elsewhere must now show the system central bankers created works, and the era of low inflation that existed for three decades wasn’t a fluke.

“We believe the (Bank of Canada) will continue to aggressively increase its policy rate in the second half of the year,” Charles St-Arnaud, chief economist at Alberta Central and a former Bank of Canada staffer, said in a note to clients. “We wouldn’t be surprised to see another (half-point) hike at the July meeting if inflation remains elevated in the coming months.”

Advertisement 5

Story continues below

Article content

Macklem and his deputies on Governing Council increased the benchmark rate a half-point last week, an aggressive move meant to send a message that they are serious about getting inflation in control. The change put the policy rate at one per cent, and Macklem said he’s prepared to go above three per cent if that’s what it takes to get annual increases in the consumer price index back to the target of about two per cent.

It could be difficult to keep expectations anchored at two per cent. Almost everything was more expensive last month than in March 2021, with the notable exceptions of mortgage and telephone costs.

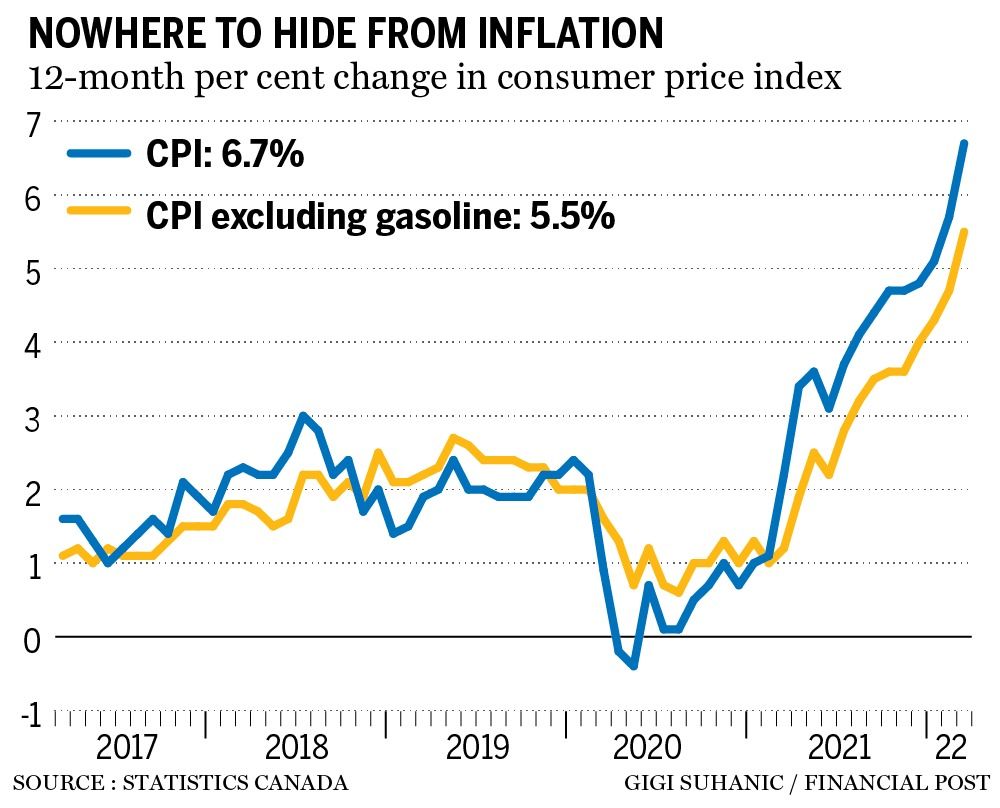

Gasoline was the major driver, accounting for almost 40 per cent of the year-over-year increase, according to Statistics Canada. Costs related to housing were the other significant factor. Still, excluding gasoline, the consumer price index increased 5.5 per cent from March 2021, the most since the agency introduced its aggregate in 1999. The figure was 4.7 per cent in February, suggesting inflationary pressures spread and grew more intense last month.

Advertisement 6

Story continues below

Article content

Globalization helped central bankers contain inflationary pressure for much of the past few decades. Freer trade and finely tuned supply lines extending between the lowest-cost producers and the most avaricious buyers helped generate impressive growth rates with remarkably little inflation. That tempted the central banks in advanced economies into keeping interest rates low, encouraging a credit boom that ultimately led to the Great Recession. That episode raised important questions about financial stability, but inflationary pressures remained docile.

Now, those global interdependencies are the cause of much of the pain. Supply is unusually constrained. The pandemic upset production and transportation, and the bottlenecks are still being worked out. Drought and other extreme weather events hurt yields in some of the world’s major farming regions last year, including the Prairies. The war in Ukraine has made a bad situation worse.

Advertisement 7

Story continues below

Article content

-

Canada’s inflation rate comes in much hotter than expected

-

Get ready for interest rates to rise ‘very, very quickly:’ CIBC’s Benjamin Tal

-

Kevin Carmichael: Brace for more big hikes because the Bank of Canada is far from finished

-

What ‘higher and faster’ Bank of Canada rate hikes could mean for homeowners

At the same time, demand is stronger than few imagined it could be so soon after an epic recession. Unprecedented emergency benefits left households with plenty of money to spend in the aftermath of the recession, and unemployment in Canada is at a record low. The pandemic stimulus is mostly gone, but the economy is still plenty strong enough to handle higher borrowing costs.

“The central banks need to take it down another notch,” said Tom O’Gorman, director of fixed income at Franklin Templeton Canada.

That’s what Macklem is trying to do. He’s been fighting a narrative that the Bank of Canada is behind the curve on inflation. His critics ignore that he intended to run the economy hot to help bring about a faster recovery from the COVID-19 recession. That strategy worked, but it didn’t anticipate severe supply disruptions and a war in Europe. The central bank will have to continue to be aggressive in the months ahead. It has little choice.

• Email: kcarmichael@postmedia.com | Twitter: carmichaelkevin

Advertisement

Story continues below