The bond market has crashed. Why one strategist says embrace the pain and get back in.

Investors are more or less trained to think about assets in stock-market terms. That is, a correction is a 10% drop from its peak, and a bear market is 20% drop, etc.

But not all assets are equal. In a market as volatile as, say, bitcoin BTCUSD,

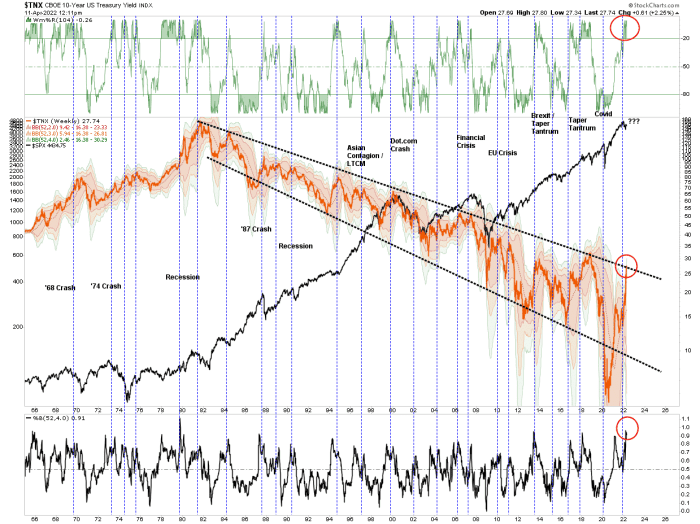

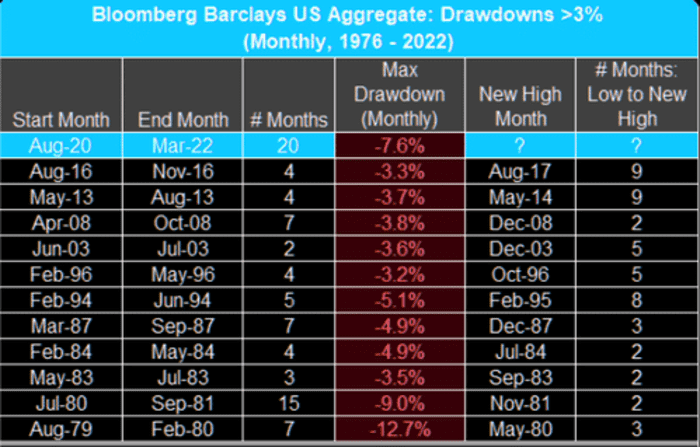

And the 11% drop in the Bloomberg U.S. aggregate bond index from its peak is the largest drawdown since the bond bull market began more than 40 years ago. “Folks, this was a bond crash,” says Kevin Muir of the Macro Tourist blog. “There is no other way to describe it.”

So the natural discussion after a crash is whether, or when, fortunes will reverse. Lance Roberts, the chief investment strategist of RIA Advisors, is making the case that time is now.

Roberts argues the U.S. economy is more leveraged than ever, with the average consumer needing $6,400 a year in debt to maintain the current standard of living. “Such is why, with the heavy requirement of cheap debt to support the standard of living, sharp rate increases have an almost immediate impact on economic activity,” he says.

Technically speaking, he adds, the yield on the 10-year Treasury TMUBMUSD10Y,

Roberts says while yields can temporarily move higher, there’s a point where something breaks, which will cause deflationary pressures to reassert themselves. Roberts notes that previous bond bear markets have been met with new highs, in as little as two months.

“While buying bonds today may still have some ‘pain’ in them, we are likely closer to a significant buying opportunity than not,” he says. “More important, if we are correct, the coming bull market in bonds will likely outperform stocks and inflation-related trades over the next 12-months.”

The buzz

Microsoft MSFT,

Google owner Alphabet GOOGL,

Wednesday’s slate of earnings includes Boeing BA,

Mattel MAT,

European natural-gas contracts surged after Russia cut supplies to Poland and Bulgaria.

Economists at Barclays slashed their first-quarter gross domestic product estimate by 1.2 points, to 0.5%, ahead of Thursday’s release.

The market

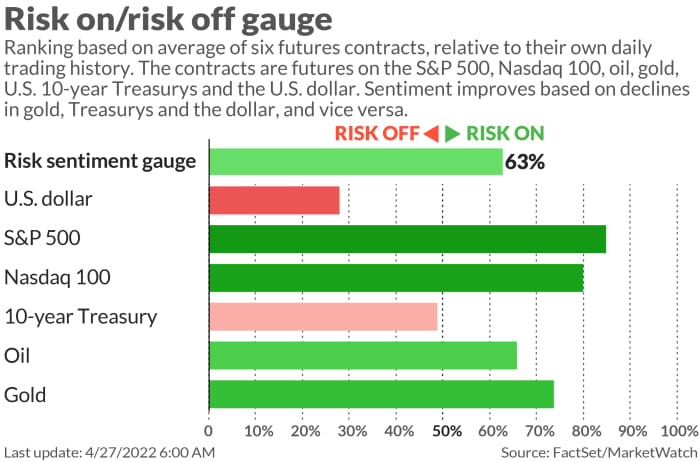

U.S. stock futures ES00,

The yield on the 10-year Treasury TMUBMUSD10Y,

Top tickers

Here were the most active stock market tickers on MarketWatch as of 6 a.m. Eastern.

Random reads

Why the Los Angeles Times is protesting a sheriff’s leak investigation against one of its reporters.

Elon Musk’s other business, SpaceX, launched four astronauts into space for NASA.

Back on Earth, CERN’s particle accelerator has restarted after a three-year hiatus.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.