As news of soaring gas prices splashed across headlines, Yasmine Camilla saw her energy bill double “almost overnight.” Filling up the tank now costs 30% to 40% more, she says.

But this rising cost of living is something she would never have noticed eight months ago.

“I had always just filled up my car when I needed petrol,” said the 36-year-old, who is based in London, England.

“I would just think, well, [the payment] will go through because my debt was on credit cards, and I always had some money in my bank. But the detriment would always be that the money in my bank would run out, and then I would start using the credit cards,” she told CNBC Make It.

At one point, she said she had 10 debit and credit cards in total – and was $50,000 in debt.

Today, her spending habits paint a different story.

When I fill up my car with petrol, rather [than] filling up and then paying for the amount in my car, I fill the petrol up based on how much cash I have…

Yasmine Camilla

After realizing that energy and gas prices have spiked, she started putting aside more money each month. Instead of paying with a debit or credit card, she only pays with cash now.

Videos under the #cashstuffing hashtag have garnered over 360 million views as of Wednesday.

“When I fill up my car with petrol, rather [than] filling up and then paying for the amount in my car, I fill the petrol up based on how much cash I have … it’s more controlled and planned,” the TikTok creator said.

“I can decide to cut budget out from some other place, maybe slow my savings down for now until I get a pay raise.”

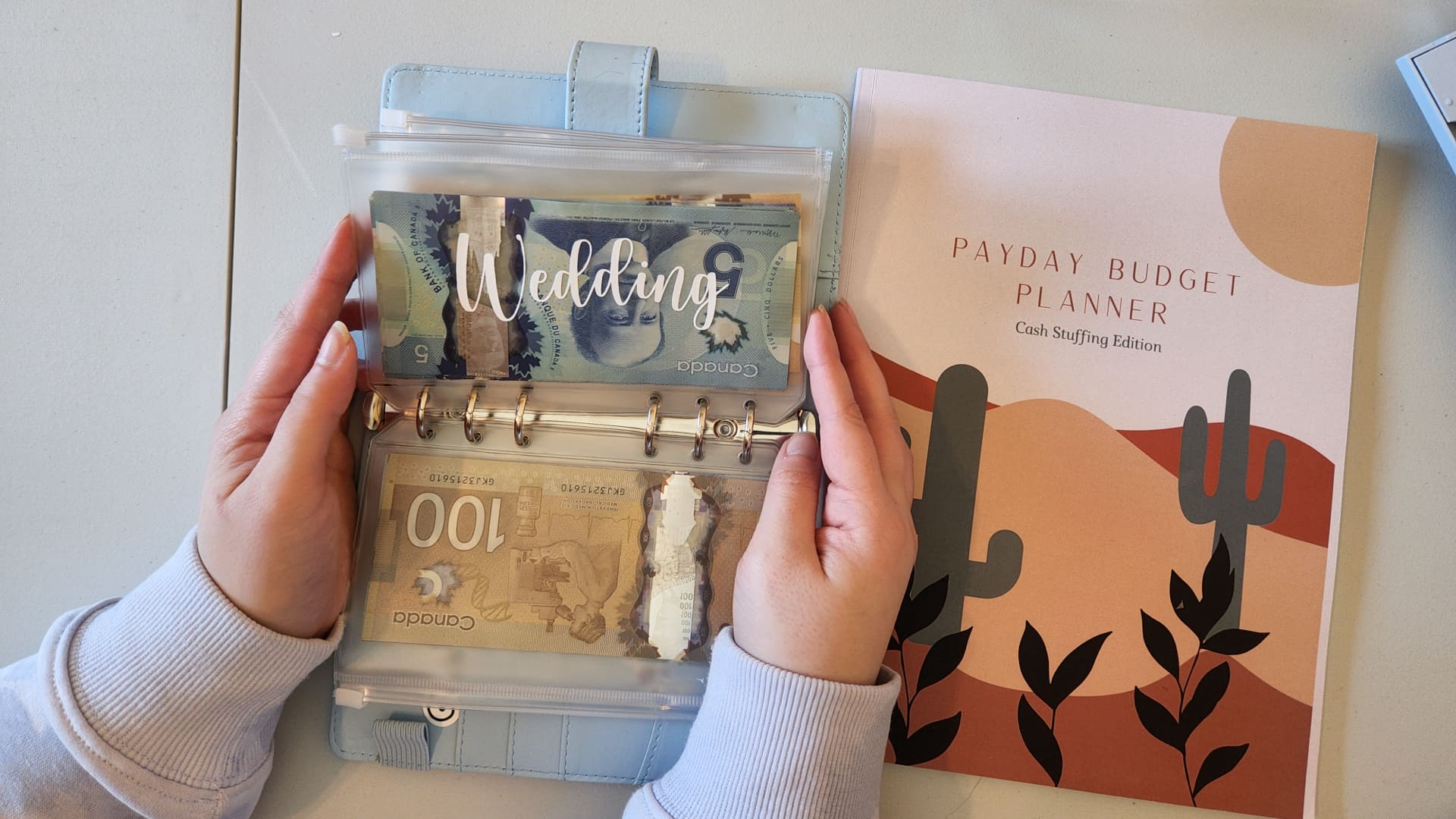

The videos mostly feature colorful, personalized cash binders with compartments labeled for different categories — such as rent, food, savings and sinking funds.

Yasmine started cash stuffing in September. She said it has helped her pay attention to every expense and restrict spending. She claimed it’s even managed to help her clear her debt in five months and accumulate savings – something Yasmine said she “never, ever” had in her life.

How ‘cash stuffing’ works

The concept is not new. Cash stuffing is similar to the envelope system of budgeting.

Tania Brown, a certified financial planner and financial coach at SaverLife explains it this way.

“Before there were banks and ATMs, people paid for stuff with cash. They would put what they owed into envelopes, label it with what they needed to pay,” she said. “This is a pretty old concept, which have just been revived.”

With recession risks rising and inflation heating up, it’s no surprise that people have to be “more in control of spending than ever,” said Brown.

“Before, you could go a little bit over your budget and be okay. But with everything going up and going over your budget … the importance of sticking to a strict budget is more important.”

Besides, a budget is no longer one that you can “set-it-and-forget-it” anymore, she added.

“Depending on where you live, every single week, you have to revisit your budget, because prices go up tremendously. The most important thing is to protect the essentials that are needed for you to live.”

Every single expense of our budget went up … inflation really is hitting us from every angle that you could think of.

Sherlise

@mommytrader7

This is where cash stuffing appears to be working for those who are already in the habit of assessing their monthly budgets.

TikToker Shelise is grateful that she started cash stuffing 7 years ago, “versus now when things are really, really tight.”

“Every single expense of our budget went up … inflation really is hitting us from every angle that you could think of,” she told CNBC.

Limiting daily expenses to cash-only has always been a “great motivator” for her as it’s something that she can hold in her hands.

“You can have a visual, you can touch and see it,” said the stay-at-home mom.

But as food prices soar, it’s also helped her to better allocate her money toward necessities like groceries.

“What we do is, we list out all of our necessities — such as food, gas, mortgage, utilities, water. And we list out how much money we have to work with and we really just prioritize what’s most important,” explained Brown, the financial planner.

“We sacrifice a little bit of the vacation or buying of clothes because food, property taxes and gas have gone up so much … and those need to be paid. We don’t have a choice.”

For Lisa, who goes by BeeBudgeting on TikTok, it’s the cost of gas that has required more attention during her monthly budgeting – and cash stuffing has helped “tremendously.”

“I’ve had to re-adjust my expenses quite a few times to accommodate for how much gas I was using. [Three months ago] I was able to budget only $60 every paycheck to go towards it… I’m now spending $120,” the Canadian said.

As costs rise, the cash stuffing or envelope system allows increases in overall spending to be “more apparent,” said Diahann Lassus, a certified financial planner.

“Inflation shows up more quickly when an envelope’s targeted amounts aren’t sufficient and it requires taking the time to understand where the money is going.”

Like Camilla, Shelise said she would have countered inflation in the past by using credit cards or payday loans, which she was in the habit of doing in the past.

“The thing was, [my husband and I] made enough money. We just didn’t know where the money went.”

Plan ahead

Cash stuffing has also helped individuals prepare for harder times ahead. For Shelise, that means projecting future expenses that can be tucked away safely in envelopes.

“Christmas comes around the same time every year, my daughter’s birthday is on the same day every year. I can have an envelope for her school activities and put a little bit of money away. When these things come up, I can just go right to it and say: ‘Here’s some money for this,'” she said.

“It helped me to really understand I could be prepared ahead of time if I start now.”

With recession risks and inflation heating up, a budget is also no longer “a set-it-and-forget-it” anymore, said Tania Brown.

Photo: @BeeBudgeting

Shelise stressed that it’s not too late to start practicing cash stuffing now, even if it means just “getting one month ahead of bills.”

“I’m actually kind of beating inflation if I can pay off my credit card now versus letting that interest pile up.”

Lassus agreed, saying that it’s during such times that “variable interest rates go up.” She was referring to how interest rates fluctuate over time.

“Costs for credit cards, car loans or other large purchases can become more expensive. It is so important to stay within a budget during times of high inflation so that debt doesn’t become a bigger issue later.”

How to get started

If you are planning to embark on cash stuffing, here are some things to take note of before you do:

1. Start small

When it comes to finances or budgeting, it can be “really overwhelming,” said Shelise. She recommends people to start cash stuffing within their “four walls,” or where they live.

“Just list four or five expenses that you can start with … maybe your mortgage, water and electric bill, food and gas for your car. Get a simple binder and just work on being consistent every time you get your paycheck.”

Brown added that the cash stuffing method is not “a quick fix” and she suggests picking just one area of overspending for a start.

“If you find it really helps you to maintain control of your spending in that area, then expand into another area where you’re struggling. It doesn’t have to be all-or-nothing.”

2. Safety first

It may seem satisfying to have binders filled with money, but you should also be careful of leaving huge amounts of cash around at home.

“Here in the U.S., homeowners’ and renters’ insurance typically only cover a certain amount of money if it’s destroyed or lost. I would caution people to check with their insurance companies to how much of that cash is recoverable,” said Brown.

To protect her cash – and reap the interest rates of banks – Shelise deposits her savings every time she accumulates $500 to $1,000. She then places fake money, which she purchases on Amazon, back into her binders as a placeholder.

“I could still have something in my hand that I can touch. But I don’t have the actual money just sitting around.”

3. It takes work

There’s no doubt that cash stuffing is more time consuming than paying with a a debit or credit card, which can be a frictionless experience.

Brown said: “When you think about the time that you have to take to create the budget, go to a bank to pull out the money … then come back home, divide the money, put the money into envelopes. Do you have the time to spend on this?”

You have to have some strict rules … you have to be able to trust yourself.

Tania Brown

Certified financial planner