A major shift in the economic narrative could be underway

The overarching narrative of the markets and economy has been one of strong demand meeting lagging supply, a dynamic that has caused inflation to surge.

While most signs suggest these trends continue to persist, a handful of anecdotes from the past week suggest this narrative could be changing.

Signs that inventories are no longer depleted

Supply chain disruptions have been reflected by depressed inventory/sales ratios. In fact, many businesses have been complaining that sales would be stronger if only they could keep their shelves stocked.

According to a Census Bureau report published Tuesday, business inventories grew 2.0% in March from the prior month. The inventory/sales ratio improved marginally to 1.27, but remained lean relative to historic levels.

In earnings calls last week, however, retail behemoths Walmart and Target suggested this problem could be a thing of the past for them.

“We like the fact that our inventory is up because so much of it is needed to be in stock on our side counters, but a 32% increase is higher than we want. We’ll work through most or all of the excess inventory over the next couple of quarters.” – Doug McMillon, CEO of Walmart“While we anticipated a post-stimulus slowdown in these categories, and we expected the consumers to continue refocusing their spending away from goods and services, we didn’t anticipate the magnitude of that shift. As I mentioned earlier, this led us to carry too much inventory, particularly in bulky categories, including kitchen appliances, TVs, and outdoor furniture.“ – Brian Cornell, CEO of Target

This striking chart from Bloomberg’s Kriti Gupta illustrates just how aggressively some of the big retailers have been about getting their inventories up.

This phenomenon where companies go from being undersupplied to oversupplied is a called the “bullwhip effect.” Bloomberg’s Joe Weisenthal explains:

“Demand booms. Companies aggressively order or even over-order in order to ensure they have inventories. Then demand shifts. Suddenly fears of shortages and empty shelves turn into inventory pileups, gluts and disinflation.”

There are two very important things to note about what’s going on with these retailers.

First, they’re being impacted by the fact that consumers are spending less money on tangible stuff and more money on intangible experiences. In fact, United Airlines confirmed as much on Monday when it revised up its outlook for summer travel.

Second, this has little to do with any unexpected weakness in consumer spending. In fact, Walmart and Target each reported better-than-expected comparable store sales growth. The Census Bureau’s latest monthly retail sales report confirmed consumer strength economy-wide as sales climbed to a new record in April.

“[Customers’] spending capacity continues to benefit from elevated saving rates, high employment, and healthy wage growth,” Target’s Cornell said.

Signs that delivery times are improving

As the demand for goods rebounded, it took longer and longer to get orders delivered.

However, these delivery times appear to be getting shorter.

According to manufacturing surveys from the New York Fed and Philly Fed, suppliers’ delivery times indexes fell in May to their lowest levels in months.

Though, both of these surveys also signaled that manufacturing activity was weakening in the mid-Atlantic. So, it’s possible that these shorter delivery times are more a function of slowing demand rather than improvements in the supply chain.

Signs that labor shortages are receding

Walmart, the largest private employer in the U.S., echoed something recently said by Amazon, the country’s second largest private employer1:

“As the omicron variant case count declined rapidly in the first half of the quarter, more of our associates that were out on COVID leave came back to work faster than we expected. We hired more associates at the end of last year to cover for those on leave, so we ended up with weeks of overstaffing.” – Doug McMillon, CEO of Walmart“With the emergence of the Omicron variant in late 2021, we saw a substantial increase in fulfillment network employees out on leave, and we continue to hire new employees to cover these absences. As the variant subsided in the second half of the quarter and employees returned from leave, we quickly transitioned from being understaffed to being overstaffed, resulting in lower productivity.“ Brian Olsavsky, CFO of Amazon

These statements are very similar, though they reflect phenomena unique to big retail.

At the same time, however, there has been a pickup in anecdotes of hiring freezes and layoffs in the tech industry.2 On Tuesday, The Hollywood Reporter first reported that Netflix would be letting 150 employees go.

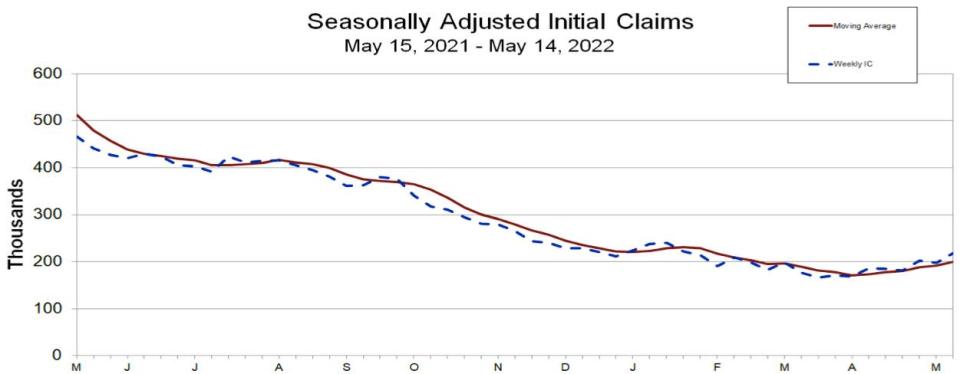

One of the most popular ways to track labor market health is the tally of initial claims for unemployment insurance benefits, which gets reported weekly. While the level of claims remain near 50-year lows, there has been a slight uptick in recent weeks.

In the week ending May 14, initial claims rose to 218,000, up 21,000 from the prior week. It’s the highest level since January.

What this could mean for inflation

Because supply chain disruptions have persisted for longer than many anticipated, the resulting shortages have caused inflation to be much hotter than what many expected.

And so, the Federal Reserve has responded by tightening monetary policy. They believe that tighter financial conditions should cool the labor market, which should cool wage growth, which in turn should cool demand to a level that’s more in line with supply. This should ultimately cool inflation.

The presence of bloated inventories and shorter delivery times would suggest supply chains are no longer a problem. And hiring freezes and layoffs suggest wage growth should cool. Assuming these anecdotes turn into economic trends, inflation should come down soon after.

Zooming out

Again, the headlines from last week are anecdotal, and the moves in the economic data are pretty small.

Then again, most big trends start as anecdotes and small shifts in the data.

As the story of the economy unfolds, we’ll be keeping a close eye on layoffs, initial claims, inventories, supplier delivery times, order backlogs, and of course all of the various ways inflation is reported.

More from TKer:

Rearview ?

? ? Stocks keep falling: The S&P 500 declined 3.0% last week, marking its seventh straight week of losses. The index is now down 18.7% from its January 3 closing high of 4796.56. The S&P also touched an intraday low of 3,810.32 on Friday, which is 20.9% below its January 4 intraday high of 4,818.62. For more on market volatility, read this and this. If you wanna read up on bear markets, read this.

? Powell is hawkish: Federal Reserve Chair Jerome Powell warned that the central bank’s efforts to cool inflation may make for a bumpy ride in the economy. “There could be some pain involved in restoring price stability,“ he said at a Wall Street Journal event on Tuesday.

?? Economic data breaks records: Retail sales climbed to a new record in April. Industrial production activity in April also rose to a new record level. For more on these reports, read this.

? Retail earnings whiff: As discussed above, Walmart and Target both reported decent sales growth. However, both companies struggled with rising costs and their earnings disappointed as a result. Walmart shares plunged 11.3% on their news. Target shares crashed 24.9%.

? Mortgage rates tick down from their highs: The average rate for the 30-year fixed rate mortgage declined to 5.25% from 5.30% the week prior, according to Freddie Mac.

? Home sales slip: Sales of previously-owned homes fell 2.4% in April to an annualized rate of 5.6 million units, according to the National Association of Realtors (NAR). “Higher home prices and sharply higher mortgage rates have reduced buyer activity,” NAR chief economist Lawrence Yun said. “It looks like more declines are imminent in the upcoming months, and we’ll likely return to the pre-pandemic home sales activity after the remarkable surge over the past two years.“

Up the road ?

These days, it’s all about what’s going on with inflation. So, all eyes will be on Friday’s release of the core PCE price index, the Fed’s preferred gauge of inflation. Economists estimate the metric increased by 0.3% in April from the month prior, reflecting a 4.9% jump from the prior year.

The April durable goods order report will be released on Wednesday. Orders tied to business investment were at a record level in March. Will the April report be just as strong?

1. These ranks come from the Fortune 500 list.

2. Layoffs.fyi has been tracking many of these tech and startup layoffs.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube