Altria stock dives as a ‘Cold War’ developing with Philip Morris prompts analyst downgrade

Shares of Altria Group Inc. took a dive Tuesday, after the cigarettes seller was downgraded at Bernstein, which cited increasing concerns over competition with its former subsidiary, Philip Morris International Inc.

Altria’s stock MO,

The pullback comes after Philip Morris PM,

The deal news prompted Bernstein analyst Callum Elliott to cut his rating on Altria to market perform, after being at outperform since January 2021. He lowered his stock price target to $53 from $58.

Elliott said that for Philip Morris International (PMI), expansion in the U.S., where Altria generates all its revenue, has been an “optionality,” but an acquisition of Swedish Match would make that expansion a “core pillar” of Philip Morris’ thesis. In PMI’s first quarter, revenue generated in the Americas made up just 5.5% of total revenue.

Buying Swedish Match would give PMI a “ready-made” distribution network in the U.S., which Elliott believes “significantly reduces” the likelihood that Altria dominates the U.S. next-generation products (NGP) space for the medium- and long-term.

“Over the past few months we have become increasingly concerned about the deterioration in relationship between Altria and its former subsidiary PMI, with a Cold War of sorts developing between the two,” Elliott wrote in a note to clients.

His concerns intensified after Altria said in February that it would compete directly with PMI in heated tobacco.

“[Y]esterday, these concerns ratcheted up to fever pitch, with news that PM is in advanced discussions to acquire Swedish Match. DEFCON 1,” Elliott wrote.

He said he even contemplated a double downgrade of Altria, to underperform, but figured that “tactically,” he expects the defensive characteristics of Altria’s stock may continue to benefit investors in the near term, given the volatility in the stock market and in economic conditions.

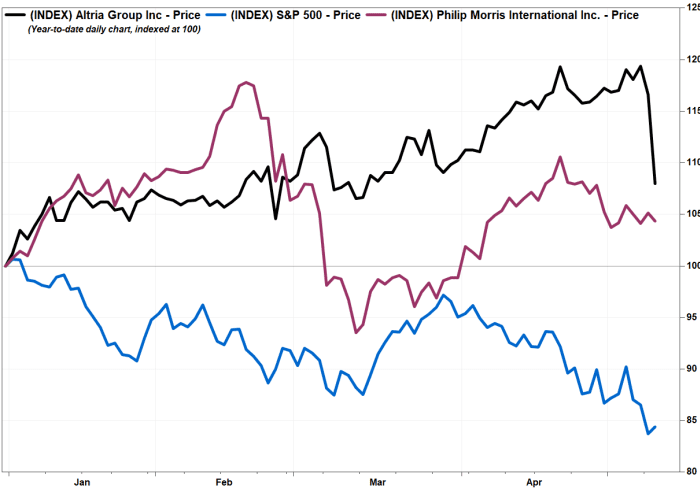

Despite the pullback, Altria’s stock was still up 7.6% year to date, while the S&P 500 was down 15.7%.

“Make no mistake though, this is NOT good news for long-term shareholders,” Elliott wrote.