Best Oversold Stocks to Buy Now for June 2022

When this happens, it can pull in even the best stocks. That means the bad, unprofitable stocks and the best-in-breed stocks are sold off. And that’s bargain time for long-term investors.

Markets and Big Money in the Last Six Months

When trying to make sense of this market, I like to look to data. So, what does the data say?

Well, my research firm, MAPsignals, follows the Big Money because we believe it moves markets. We created the Big Money Index (BMI), a 25-day moving average of Big Money buys and sells. It recently hit oversold levels (below the green line), meaning selling is driving down markets big time:

Oversold territory doesn’t occur often. But when it has in the past, it’s almost always been a bullish indicator. Look at what’s happened after the BMI hit oversold since 2014:

Since 1990, the BMI has been oversold 21 times. It tends to stay oversold for three weeks, with markets troughing two weeks later, on average. Since 1990, the forward-looking returns on the S&P 500 after hitting oversold are 16% after one year and 29% after two years.

This puts us on the lookout for quality stocks that will rise as buyers return and markets trend upward again. We want fundamentally sound companies with good histories and discounted prices. Here are our best oversold stocks to buy now for June 2022: ODFL, MA, HD, LRCX, and NKE.

Old Dominion Freight Line, Inc. (ODFL) Analysis

Up first is Old Dominion, which is one of the largest North American cargo carriers.

Even though great companies’ stocks can be volatile, like ODFL over the past year, they’re worthy of attention, especially on pullbacks. Check out Old Dominion:

To show you what our Big Money signals look like on a stock, have a look at all the buys and sells in ODFL over the past year:

Looking more broadly, Old Dominion has been a high-quality stock for years. The blue bars in the chart below show when ODFL was a high-ranking stock likely being bought by a Big Money player, according to MAPsignals. When you see a lot of blue, it can be very bullish:

Those blue signals indicate Big Money buying and solid fundamentals. As you can see, Old Dominion’s sales and earnings growth have been strong, making it worthy of attention:

Mastercard Incorporated (MA) Analysis

Next up is Mastercard, the global payments and credit card giant.

Check out these technicals for MA:

It’s been getting bought and sold, as trading has been choppy over the past year:

Now let’s look long-term. Below are the top buy signals for Mastercard since 2006. The Big Money has been on it for a while:

Let’s look under the hood. As you can see, Mastercard has grown sales well and the outlook for future earnings looks good:

Home Depot, Inc. (HD) Analysis

Another growth name is Home Depot, the world’s largest home improvement retailer.

Strong candidates for growth usually have Big Money buying the shares. Home Depot has historically had that. Until December 2021, it was a darling. But recently it’s seen big selling, which could be an opportunity:

Below are the blue Top 20 Big Money signals HD has made since 1990. It’s clearly a Big Money favorite. That’s the JUICE!

Now let’s dig deeper. Sales growth for Home Depot has been impressive. I expect more of the same in the coming years. Its profit margin and minimal debt also bode well for the future. HD also pays a current dividend of nearly 2.7%.

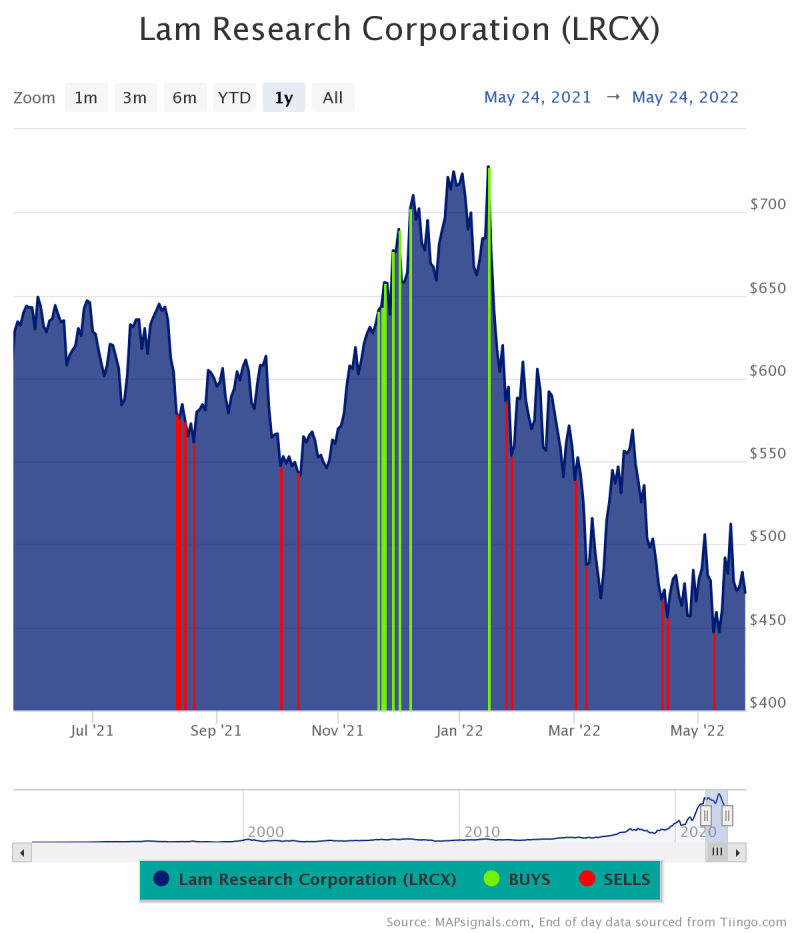

Lam Research Corporation (LRCX) Analysis

Number four on the list is Lam Research, which is a top supplier of processing equipment for the semiconductor industry.

Here are the technicals important to me:

Except for a semi-sustained rise late last year, LRCX has seen more Big Money selling than buying:

But Lam Research is a Big Money favorite, and it pays a current dividend of more than 1.2%. Below are the Big Money Top 20 buy signals for LRCX since 2014:

Let’s look under the hood. Despite the price slide, Lam Research sales have jumped quite a bit, and earnings are expected to keep growing:

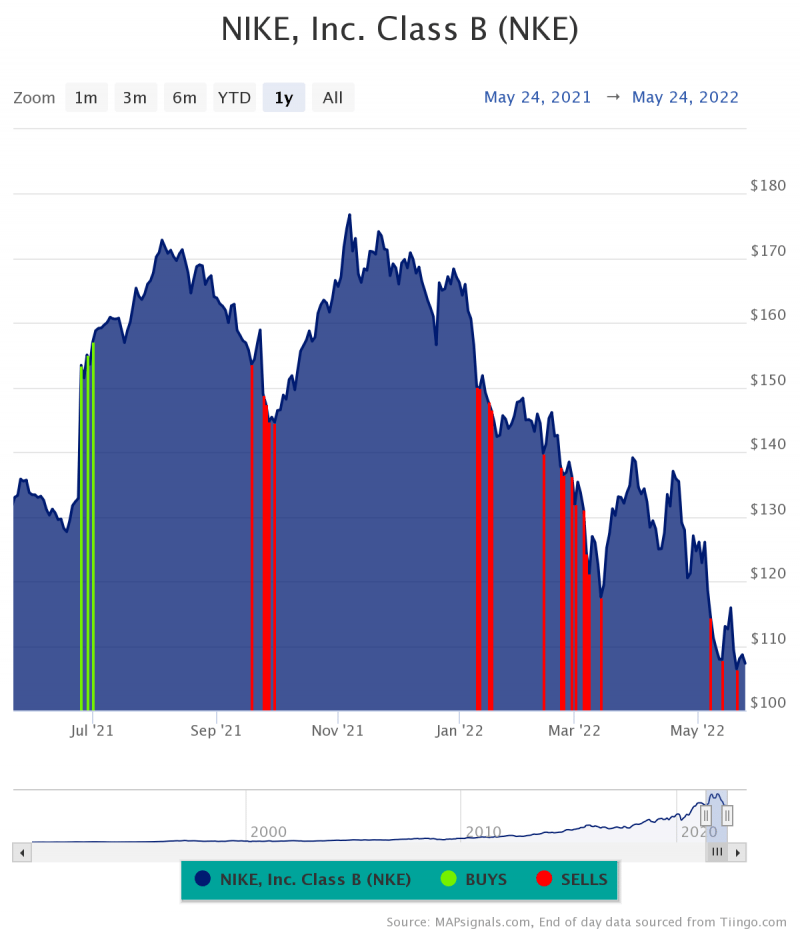

NIKE, Inc. (NKE) Analysis

Our last growth candidate is NIKE, the gigantic shoe and athletic wear company. Last summer it was being bought up, but since then there’s been lots of Big Money selling as discretionary stocks have been pinched due to recession fears:

Check out these technicals:

But NKE is a high-quality stock since it’s made the MAPsignals Top 20 report. As you can see below, it’s been a Big Money favorite for years. Right now, it’s on a pullback and could be an opportunity:

Now let’s look below the surface a bit. Sales have been growing and the earnings outlook is solid:

Bottom Line and Explanatory Video

ODFL, MA, HD, LRCX, and NKE represent the top oversold stocks for June 2022. They’ve been sold a lot lately…perhaps too much. Strong, fundamentally-sound stocks seeing near-term sell signals are worthy of extra attention because of their long-term potential.

To learn more about MAPsignals’ Big Money process please visit: www.mapsignals.com

Disclosure: the author holds long positions in HD, LRCX, and NKE in personal and managed accounts.

Contact

https://mapsignals.com/contact/

This article was originally posted on FX Empire