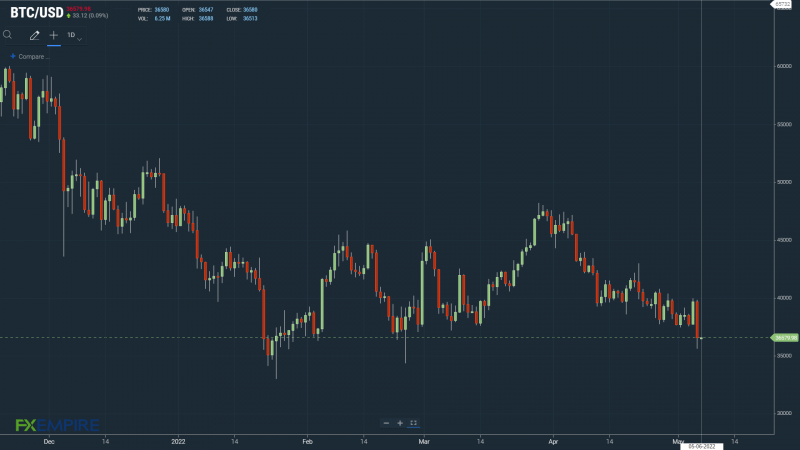

Bitcoin (BTC) Goes Sub-$35,000 as Investor Sentiment Wanes

Key Insights:

-

This weekend, Bitcoin (BTC) fell back to sub-$35,000 for the first time since February.

-

There was no weekend relief rally in the wake of Thursday’s sell-off, with the broader crypto market also on the slide.

-

Bitcoin’s technical indicators continue to flash red, with Bitcoin sitting well below the 50-day EMA.

On Saturday, bitcoin (BTC) fell for a third consecutive day, with the crypto market finding little support following Thursday’s Fed-driven sell-off.

Investor sentiment towards inflation and Fed monetary policy continued to hit riskier assets going into the weekend. With no direction coming from the US markets until Monday, the bears remain in control.

On Saturday, BTC fell by 1.50%. Following a 1.47% decline on Friday, BTC ended the day at $35,469.

Thursday through to Saturday, the crypto total market cap fell by $180 billion to $1,608 billion.

Bitcoin Fear & Greed Index Hits Reverse

This morning, the Fear & Greed Index slid from 23/100 to 18/100. The decline saw the Index fall deeper into the “Extreme Fear” zone.

Last month, the Index hit a month high of 53/100 on April 05, which coincided with Bitcoin revisiting $47,000 levels before hitting reverse.

The “Extreme Fear” zone reflects investor expectations of further price deterioration and is aligned with the technical indicators.

Bitcoin Price Action

At the time of writing, bitcoin was down by 2.27% to $34,666. A bearish start to the day saw BTC slide through the First Major Support Level at $34,828.

Technical Indicators

Bitcoin will need to move through the First Major Support Level at $34,828 and the day’s $35,478 pivot to target the First Major Resistance Level at $36,119. Bitcoin would need broader market support to break out from $35,500.

In the event of an extended rally, bitcoin could test the Second Major Resistance Level at $36,119. The Third Major Resistance Level sits at $38,062.

Failure to move through First Major Support Level and the pivot would bring the Second Major Support Level at $34,186 into play. Barring another extended sell-off, bitcoin should avoid sub-$33,500. The Third Major Support Level sits at $32,895.

Looking at the EMAs and the 4-hourly candlestick chart (below), it is a bearish signal. Bitcoin sits below the 50-day EMA, currently at $37,518. This morning, we saw the 50-day EMA pull back from the 100-day EMA, delivering downside pressure. The 100-day EMA also fell back from the 200-day EMA, BTC negative.

A move through the 50-day EMA would support a look at $38,000.

This article was originally posted on FX Empire