Brutal Stock Selloff Is a Multitude of Bear Cases Coming True

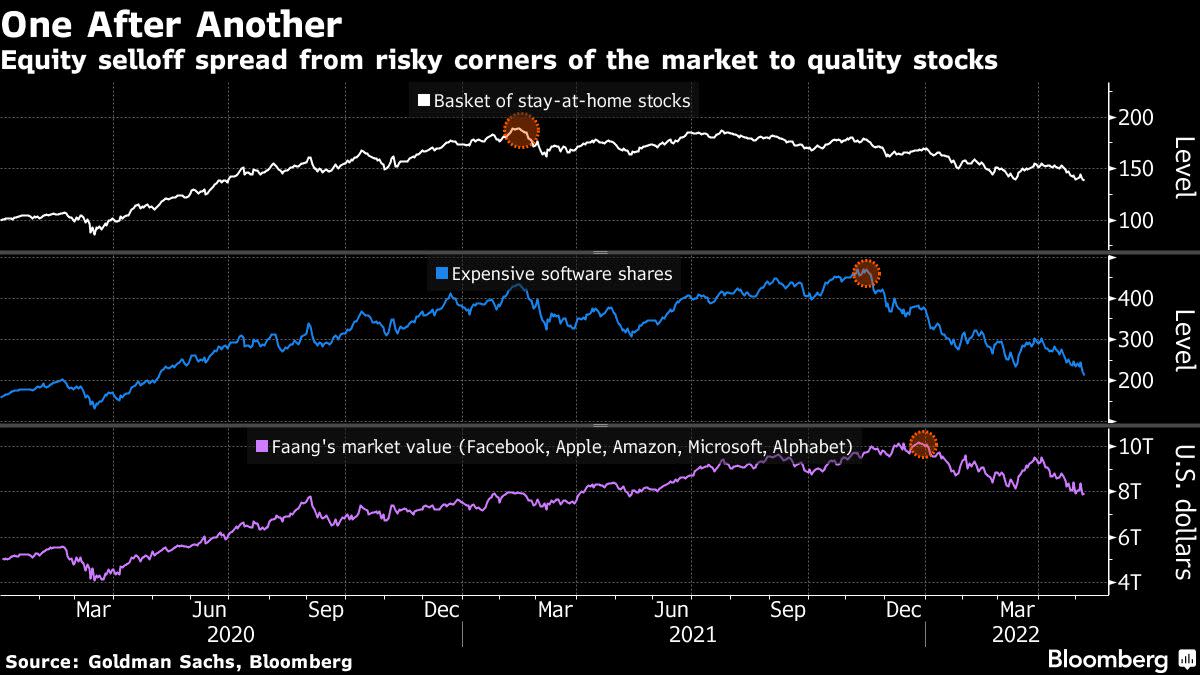

(Bloomberg) — First it was a rout in the stay-at-home names that surged in the pandemic. Then speculative software makers with barely any earnings went south. Now the giant technology names whose sway on benchmarks has been decried by bears for years are dragging the market down.

Most Read from Bloomberg

Dizzying as the downdraft has been, you can’t say you weren’t warned.

It’s axiomatic in markets: you never see it coming. But this selloff is an argument that sometimes you do. People have been saying for months that inflation would surge, forcing the Federal Reserve into action. Wall Street veterans like Charlie Munger spent 18 months lambasting the Robinhood crowd for its infatuation with speculative flotsam. Warnings the market would bend under its trillion-dollar tech monopolies have never been hard to find.

While the timing was often wrong, it’s hard to say those views aren’t playing out now, with the S&P 500 falling for five straight weeks, its longest retreat in a decade. The index has slumped 14% from a record on the year’s first trading day, wiping about $6 trillion from its value.

“The normal signs of excess have been out there for a while, whether it be in valuation, whether it be in all the speculative overshooting of some of these stock that have great stories but not a real solid business underneath them,” said Michael Ball, managing director of Denver-based Weatherstone Capital Management. What starts as a trickle “turns into a bigger outfall as everybody starts to say ‘I need to take off risk’ and nobody wants to take the other side.”

Saying the market is acting in a predictable way sounds crazy after the week that just ended. Hawkish pronouncements by the Fed on Wednesday were occasion for a 3.4% surge in the Nasdaq 100, before the whole gain was unwound a day later. Treasury yields buckled and jumped, making Thursday only the fourth time in 20 years that the main stock and bond ETFs both lost 2% at the same time.

Through a broader lens, the results look a little less disorderly. For the Nasdaq 100, which traded at almost 6 times sales as recently as November, the bull market is over, its five-month loss exceeding 23%. More speculative companies as proxied by funds like Ark Innovation ETF (ticker ARKK) are nursing losses of twice that. Faddy groups like special purpose acquisition companies have suffered similar dents, while losses in the older-school industries repped by the Dow Jones Industrial Average are lower by a relatively tame 10%.

“In a lot of ways, it’s following a typical playbook,” said Jerry Braakman, chief investment officer and president of First American Trust in Santa Ana, California. “Market leadership is the losing leadership. That’s when the panic sets in.”

Of course, just because it makes sense doesn’t mean everyone was ready for it. Dip-buyers were in evidence through the start of this month, with bounces like Wednesday’s giving bulls hopes. Until April, investors had kept funneling money into equity funds, sticking to their dip-buying strategy.

“Investors tend to say, ‘this time is different,’” said Sam Stovall, chief investment strategist at CFRA. “Investors get tired and say, ‘I’m not going to fight the tape, because even with higher multiples, the market just wants to keep going up.’”

That’s not what’s happening now. The five tech giants, Meta Platforms Inc., Apple Inc., Amazon.com Inc., Microsoft Corp. and Alphabet Inc., at one point accounted for a quarter of the S&P 500, boasting an influence that’s greater than any comparable group of stocks since at least 1980.

Now that the group, known as the Faangs, has seen their total value shaved by 23% from the December peak, a drag that the market has no chance of shaking off. The S&P 500 is mired in its second-longest correction since the global financial crisis.

Meme stocks, such as AMC Entertainment Holdings Inc. and GameStop Corp., also crashed. A Bloomberg basket of these shares tumbled more than 60% from its 2021 peak to this year’s trough.

Day traders, who rose to prominence during the pandemic, managed to lose more than $1 billion from November 2019 to June 2021 dabbling in options on stocks mentioned on Reddit’s WallStreetBets trading forum, according to a recent study. And signs are building that the retail crowd is retreating from the market.

“When we look at the selloff that we’ve seen not just in the past week but the last couple of weeks, it’s starting to make a lot of sense,” said Art Hogan, chief market strategist at National Securities. “We’re finally getting to that point where everything is for sale, regardless of the quality of earnings. And that typically is what happens toward the end of a selloff, not the beginning.”

To Sylvia Jablonski, co-founder of Defiance ETFs, all the bearishness means now is time to go bottom fishing.

“When you see this type of broad-based selling across every single sector, asset class, crypto, the future of technology, the quality darlings, that tells me that we are likely closer to a bottom than we are to an additional major correction,” she said. “Multiples have come in, the froth is certainly off of the market, and that leads to investment opportunities.”

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.