Warren Buffett bought the dip in his No. 1 stock Apple during the tech giant’s sell-off in the first quarter.

Berkshire Hathaway’s Chairman and CEO told CNBC’s Becky Quick that he scooped up $600 million worth of Apple shares following a three-day decline in the stock last quarter. Apple is the conglomerate’s single largest stock holding with a value of $159.1 billion at the end of March, taking up about 40% of its equity portfolio.

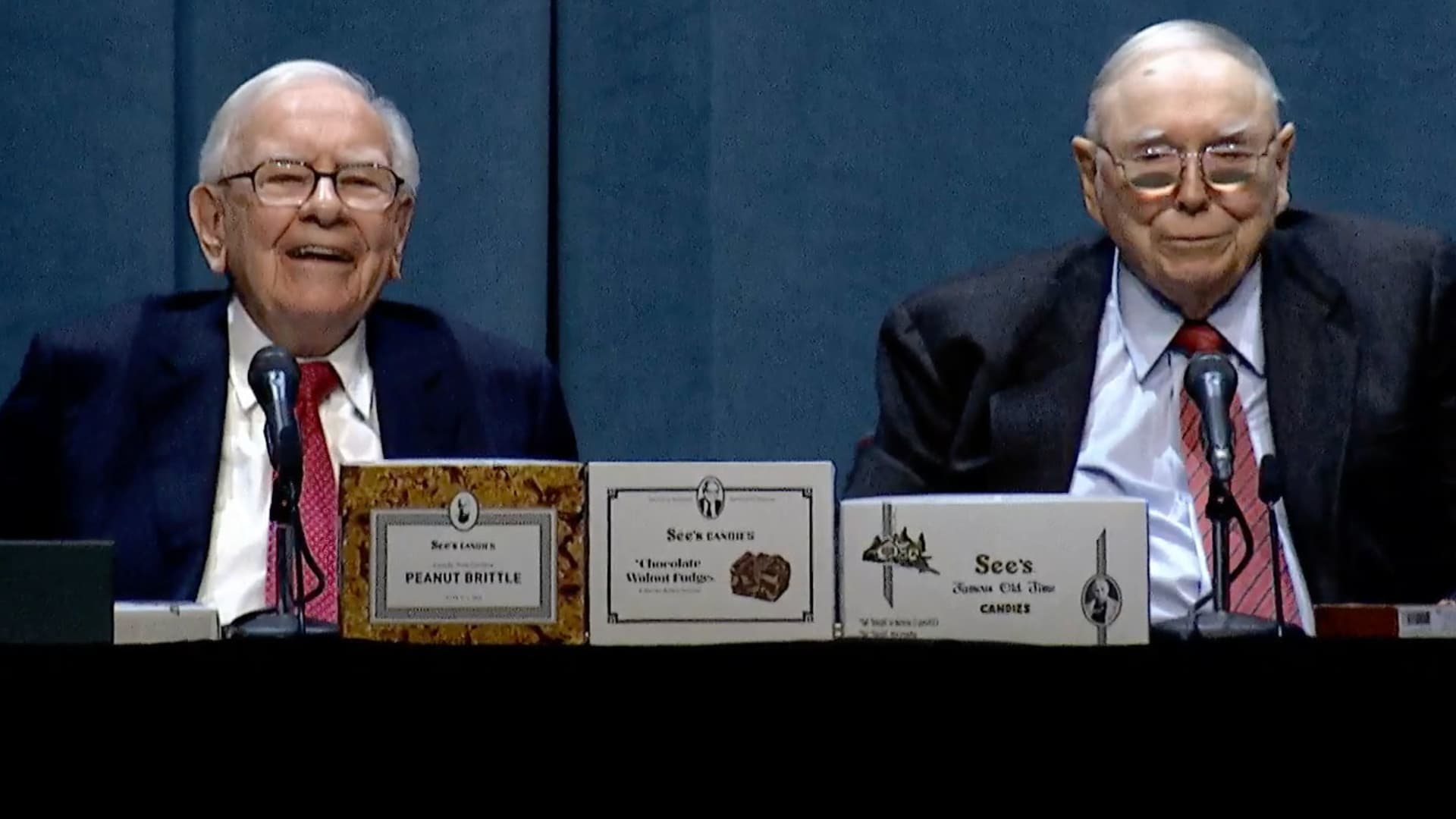

“Unfortunately the stock went back up, so I stopped. Otherwise who knows how much we would have bought?” the 91-year-old investor told Quick on Sunday after Berkshire’s annual shareholder meeting.

There have been plenty of buying opportunities for Buffett this year as Apple shares came under pressure amid fears of rising rates and supply-chain constraints. The stock fell 1.7% in the first quarter with multiple three-day losing streaks throughout the period. Apple once declined for eight days in a row in January and the stock is down nearly 10% in the second quarter.

Berkshire began buying Apple stock in 2016 under the influence of Buffett’s investing deputies Todd Combs and Ted Weschler. Berkshire is now Apple’s largest shareholder, outside of index and exchange-traded fund providers.

Buffett previously called Apple one of the four “giants” at his conglomerate and the second-most important after Berkshire’s cluster of insurers, thanks to its chief executive.

“Tim Cook, Apple’s brilliant CEO, quite properly regards users of Apple products as his first love, but all of his other constituencies benefit from Tim’s managerial touch as well,” Buffett’s 2021 annual letter stated.

The “Oracle of Omaha” said he is a fan of Cook’s stock repurchase strategy, and how it gives the conglomerate increased ownership of each dollar of the iPhone maker’s earnings without the investor having to lift a finger.

Apple said last week it authorized $90 billion in share buybacks, maintaining its pace as the public company that spends the most buying its own shares. It spent $88.3 billion on buybacks in 2021.

Cook was in attendance at Berkshire’s annual meeting last weekend.

The conglomerate has also enjoyed regular dividends from the tech giant over the years, averaging about $775 million annually.