Buy These 2 Beaten-Down Stocks Before They Rebound, Says Wells Fargo

As an indication of how the stock market has suffered so far this year, the 2022 selloff has been unlike anything seen for the last 80 years. While there have been a host of reasons for the market wide rout, the meltdown has been most acute amongst growth stocks.

As Wells Fargo’s Head of Equity Strategy Christopher Harvey puts it, “the sell-off is all about ‘growth’ — but not economic growth. Rather, it is about the growth style, the mispricing of duration, and risk appetite (or lack thereof).”

But given the huge compression in valuations, Harvey thinks that “in some cases Growth valuations quickly are becoming attractive.” In fact, Harvey believes many stocks aren’t likely to head much further down from here, anticipating a bottom will be found “between now and the early summer.”

In the meantime, Harvey’s analyst colleagues at Wells Fargo have pinpointed two stocks which they see as now ready to push higher. Both have performed miserably so far this year – but Wells Fargo sees them moving up by at least 60% from here. We ran the names through the TipRanks database to get an idea of what the rest of Wall Street has in mind for these names. Here’s the lowdown.

TELUS International (TIXT)

Let’s start off in the tech sector, with TELUS International. This Canadian company is a global provider of IT and customer services. For over 600 clients around the world, Telus designs and develops next-generation solutions that assist with companies’ digital transformations. These digital experiences range from AI and bots, platform transformation, big data, cloud contact center and UX/UI design; the distinctive solutions are delivered to clients in order to help them draw in and maintain customers.

The company went public just over a year ago – in February 2021 – with an upsized IPO of 42.55 million subordinate voting shares priced at $25 each. Gross proceeds reached $1.06 billion of which net proceeds to TELUS were roughly $490 million. The stock got off to a good start, rising throughout most of 2021, but like so many, the share price has pulled back significantly in recent times – since October’s peak, shares are down 46%.

On the other hand, revenue and earnings have been climbing steadily since going public and the trend continued in the latest quarterly report – for 4Q21. Revenue reached $600 million, amounting to a 35.7% year-over-year increase, and beating the street’s call by $4.4 million. Adj EPS of $0.28 also beat the $0.24 consensus estimate. For 2022, revenue is anticipated to come in the range between $2.55 to $2.6 billion and adj. EPS in the range of $1.18 to $1.23. Both above Street expectations.

It’s the prospect of further growth in the “mission-critical” field of digital transformations which has attracted Wells Fargo analyst Jeff Cantwell.

“We see significant opportunity ahead of TIXT given its TAM of $225B, of which it has penetrated <1%,” wrote the 5-star analyst. “We believe the company has a long runway to continue to penetrate high-growth verticals, supporting our thesis that the company can generate strong, double-digit top-line growth on an annual basis over the next cycle. In addition, management has highlighted that it is focused on higher-value projects that we believe will be an important driver of incremental revenue growth and margin support over the next two years, particularly in ’23.”

In line with his bullish stance, Cantwell rates TIXT an Overweight (i.e. Buy), and his $35 price target supports growth of ~62% for the coming year. (To watch Cantwell’s track record, click here)

Most on the Street agree with Cantwell’s thesis; the stock boasts a Moderate Buy consensus rating, based on 6 Buys vs. 2 Holds and a single Sell. The average price target stands at $32.10, suggesting shares will appreciate ~49% in the year ahead. (See TIXT stock forecast on TipRanks)

Hyperfine (HYPR)

Let’s pivot now to something entirely different. Hyperfine is a medical device company that makes the world’s first FDA-cleared portable MRI system which can be taken to the patient. The Swoop, as it is called, can also be hooked up to a standard electrical socket, and obtain crucial images – all in a much faster manner than traditional MRI systems. By significantly lowering MRI workflow time and taking patient transport risk out of the equation, the device could potentially yield better outcomes. Furthermore, adoption could be accelerated given HYPR’s system’s much cheaper price.

And there’s a large and growing market to penetrate. The medical imaging segment is worth around $15.9 billion and boosted by macro trends such as the aging population and growing demand for early-stage detection of chronic disease, is anticipated to grow at a mid-single-digit CAGR through 2028.

Hyperfine went public at the tail end of last year via the SPAC route. However, it’s been a trial by fire with shares down 51% year-to-date.

That partly reflects the market souring on more speculative names. In 4Q21, the last reported quarter, Hyperfine generated revenue of just $0.436 million. That said, that was more than double the amount of the year ago period, and Wells Fargo’s Larry Biegelsen expects that figure to push much higher over the next few years.

The 5-star analyst is anticipating revenue of $11 million in 2022, rising to around $30 million in 2023, with the net loss per share moderating from -$1.03 in 2022E to -$0.93 in 2023E.

Explaining his bullish outlook, the analyst highlights several points underpinning the company’s value proposition. These are “1) highly differentiated first-in-class portable MRI technology, 2) market expansion opportunity in the multi-billion-dollar medical imaging market, 3) favorable economics driving penetration in emerging markets, and 4) promising pipeline of additional indications and entry into brain sensing.”

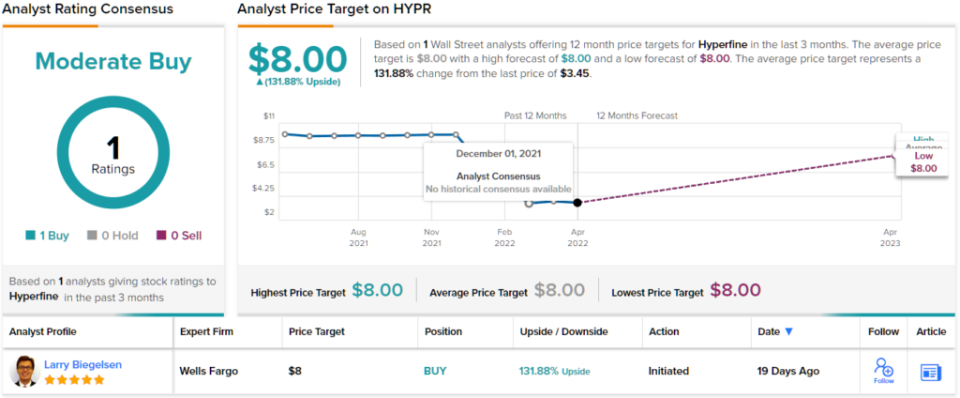

To this end, Biegelsen rates HYPR an Overweight (i.e. Buy) while his $8 price target makes room for 12-month growth of ~132%. (To watch Biegelsen’s track record, click here)

Some companies fly under Wall Street’s radar and HYPR appears to be one right now. Biegelsen’s rating is currently the only one on record. (See HYPR stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.