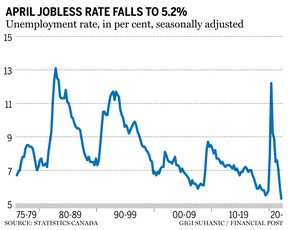

Canada’s jobless rate drops to a new low, ensuring more interest-rate hikes

Kevin Carmichael: It’s possible the country’s labour market is hitting its limits

Article content

Canada’s jobless rate dropped to 5.2 per cent, a modern low, all but guaranteeing another outsized increase in interest rates when policymakers at the Bank of Canada end their next round to deliberations on June 1.

Advertisement 2

Story continues below

Article content

Statistics Canada’s latest monthly survey of the labour market didn’t turn up stunning results like it has over the previous few months. Employment was little changed in April, as absences from illness and disability appeared to offset employers’ desire to hire to keep up with strong demand for goods and services.

It’s possible the country’s labour market is hitting its limits after adding more than 400,000 workers over February and March, an unsustainable pace. In April, Statistics Canada’s household survey implied that employers added 15,300 positions, a statistically insignificant change because it was smaller than the poll’s margin of error. The unemployment rate for workers aged 25 to 54 dropped to 4.3 per cent, the lowest since comparable data became available in 1976.

Advertisement 3

Story continues below

Article content

“Slower momentum was inevitable,” said Brandon Bernard, an economist at Indeed, the hiring website.

The Bank of Canada concluded in April that demand has overshot supply, contributing to the fastest inflation in more than three decades. The central bank raised its benchmark rate a half point in April, and governor Tiff Macklem hinted last month that he and his deputies likely will do so again in June. The policy rate is currently one per cent, compared with 0.25 per cent at the start of the year.

Statistics Canada said average hourly wages increased 3.3 per cent from April 2021, strong by recent historical standards, but still well short of inflation, as the consumer price index surges almost seven per cent over the same period.

Advertisement 4

Story continues below

Article content

“Multiple indicators point to a shrinking labour pool and an overheated market without much room to further expand,” said Tu Nguyen, an economist at RSM Canada, an accounting firm. “The tightening job market adds pressure for the Bank of Canada to further raise interest rates, which will likely reach two per cent by the end of the summer, a much faster pace than previously anticipated.”

-

Strong summer job market a challenge for employers

-

Record surge in imports signals supply chokehold stoking inflation is loosening

-

Canada’s economy poised to grow in the first quarter, dodging America’s fate

• Email: [email protected] | Twitter: carmichaelkevin

Advertisement

Story continues below