Cobalt tops Critical Materials Risk Index

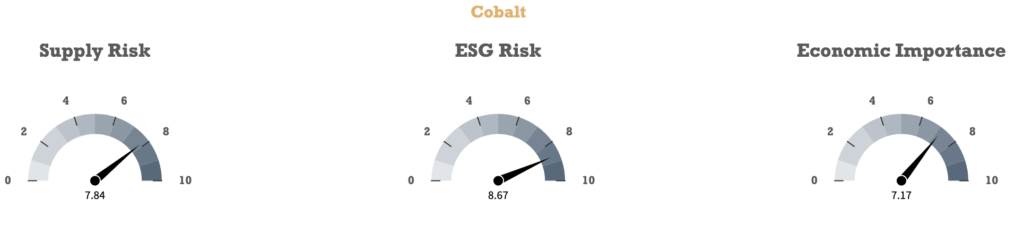

Cobalt leads the index also because its extraction is linked to ongoing social issues in Central Africa, which raises ESG concerns among battery makers as the metal plays a key role in lithium-ion batteries, aerospace, and other critical applications.

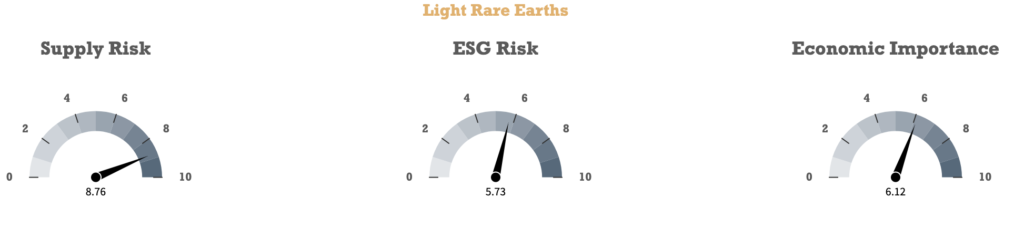

The Risk Index examines 40 critical metals and minerals against variables selected to quantify supply risk, ESG risk, and economic importance. The data are normalized and weighted to produce three sub-indices which are then used to calculate a material’s overall rank.

The second spot, right after cobalt, is occupied by heavy rare earths such as europium and dysprosium, which are mostly refined in China with only one plant outside the Asian giant located in Malaysia. For this reason, REEs supply risk is actually higher than that of cobalt but since their economic importance and ESG risks are a little bit lower, they didn’t rank as high as the silver-grey metal.

Since similar circumstances apply to niobium and light rare earths, they occupy the third and fifth spots in the Index with very high supply risks and lower ESG-associated risks, as well as not so high economic importance.

In the middle of these is magnesium, a material needed to harden aluminum alloys used to make automobiles and building supplies. Supply risks, mainly linked to China and Russia being the largest global producers of the element, place it in the fourth spot of the Risk Index.

Graphite, chromium, antimony, and vanadium complete the top 10, most of them scoring high due to the risks associated with their respective supply chains, with aluminum being the only outlier in its sixth spot and scoring high due to its economic importance.

“While it’s no surprise that cobalt, rare earths, and niobium top the global list, it’s important to remember that what makes a material critical is very much subjective, and depends on your position in the value chain,” Jack Bedder, co-founder of Project Blue, said in a media statement.