DeSantis’s Dissolution of Disney District Stumps Credit Raters

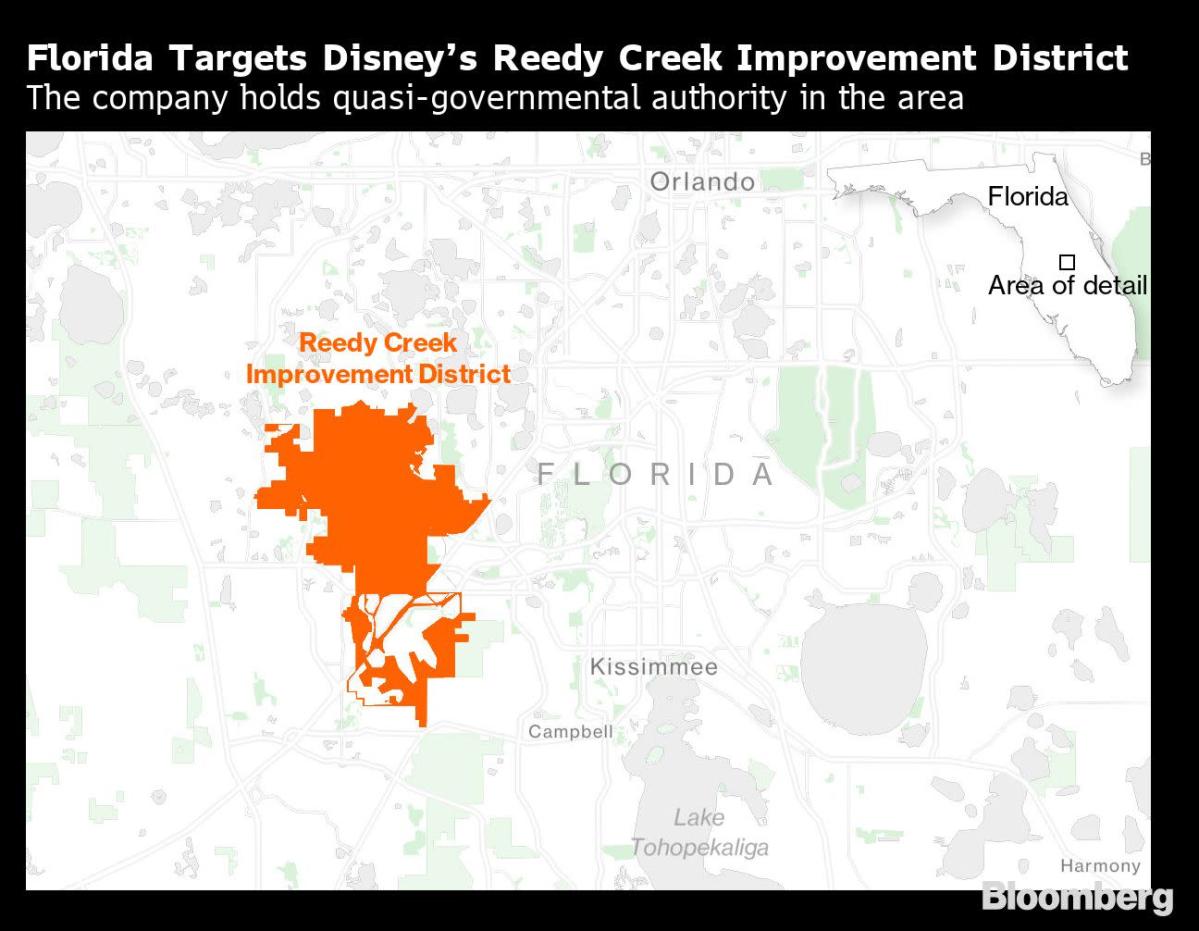

(Bloomberg) — Florida Governor Ron DeSantis’s move to punish Walt Disney Co. by dissolving its debt-issuing district has befuddled two of the major credit rating companies that assign high marks to its municipal bonds.

Most Read from Bloomberg

Moody’s Investors Service and S&P Global Ratings have changed their outlooks on the property tax bonds sold by the Reedy Creek Improvement District to “developing” — a rare designation that doesn’t give bondholders much insight on how their investment will fare. The outstanding securities are rated Aa3 by Moody’s and AA- by S&P, the fourth-highest levels available.

“Developing scenarios do not come up every day,” said Geoffrey Buswick, a managing director in S&P’s U.S. public finance team. “They are typically associated with an event where, depending on the outcome, the committee could see different credit paths.” To put this in perspective, out of the more than 20,000 municipal securities rated by S&P, there are only six that have a developing outlook, according to the company.

This means that depending on how the dissolution pans out, the credit quality of the district’s debt “could improve, remain the same, or weaken,” analysts at Moody’s wrote in an April 26 report. Those at S&P noted there is “at least a one-in-three chance” that the bonds could be positively or negatively impacted by the legislative action, but “future events remain unclear.”

The vagueness speaks to how unusual it is for lawmakers to upend a corner of the $4 trillion municipal-bond market in a matter of days. Florida Republicans introduced the bill that could strip Disney of self-governing privileges on April 19, and in under a week it passed both legislative chambers and was signed by DeSantis.

Reedy Creek has about $1 billion of debt outstanding, which includes property-tax and utility bonds, according to data compiled by Bloomberg.

Read More: What Florida’s Action Against Disney Means: QuickTake

Meanwhile, Fitch Ratings took a stronger stance, moving the bonds to a negative watch. Dissolving the district and transferring its property will be complicated, increasing the likelihood of negative ratings actions, said Michael Rinaldi, Fitch’s head of U.S. local government ratings.

The law says that without further legislative action, Reedy Creek would be dissolved in June 2023, giving stakeholders about a year to decide on next steps — whether it’s transferring responsibilities to other local governments or creating a successor district. But for now, it seems that bondholders and ratings analysts will just have to sit tight.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.