Eramet plans more lithium plants in South America

The project is expected to produce 24,000 tonnes of Lithium Carbonate Equivalent (LCE) by the second half of 2025 and run at full capacity from 2026 onwards.

Eramet is also keen to explore opportunities in Chile or Bolivia to deploy its brine extraction technology as an environmentally sustainable route for lithium production.

Argentina sits atop the “lithium triangle” a region shared with neighbouring Chile and Bolivia, which contains nearly 56% of the world’s resources of the metal, according to the most recent figures from the United States Geological Survey (USGS).

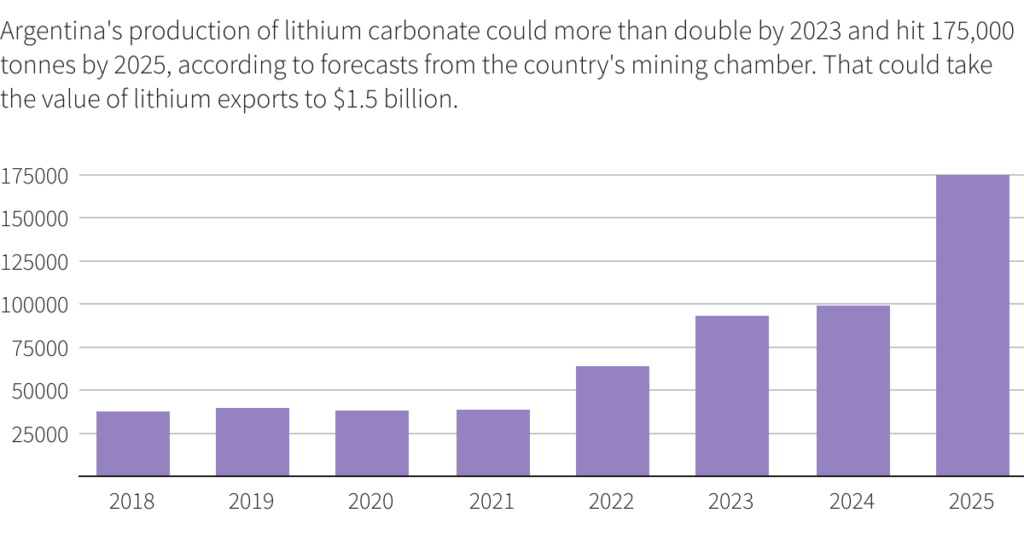

This means, according to productive development minister Matías Kulfas, that the country has the potential to become the world’s third or fourth biggest lithium producer.

Argentina’s northern provinces are emerging as a hub for greenfield lithium projects, attracting majors and juniors alike.

The nations’ lithium portfolio includes 23 projects in various stages of development, including Ganfeng Lithium and Lithium Americas’ under construction Caucharí-Olaroz. The project is expected to become Argentina’s top producer with 40,000 tonnes of lithium carbonate equivalent (LCE) a year, starting in second half of 2022.

Australia’s Orocobre and US miner Livent Corp, which have supply tie-ups with Toyota Corp and BMW respectively, operate the two producing lithium mines in the country.

Rio Tinto completed in March the acquisition of the Rincon lithium project in Salta, which holds reserves of almost 2 million tonnes of contained lithium carbonate equivalent, sufficient for a 40-year mine life.

Posco vowed to invest $4 billion in a project at a salt flat called Salar del Hombre Muerto, located on the border between the Salta and Catamarca provinces.

Australia’s Lake Resources (ASX: LKE) is also present in the area, with its flagship Kachi lithium project. The asset, which is expected to initially produce 50,000 tonnes per annum from 2024, recently secured Ford as a client.

The automaker aims to buy 25,000 tonnes annually of the white metal and represents a major bet on direct lithium extraction (DLE), a technology that filters lithium from brines and uses far less acreage than open pit mines and evaporation ponds.

EVs are key elements of the European Union plans to cut emissions. Member states are trying to reduce reliance on battery supplies from Asia through projects with Europe-based car makers and battery specialists.

It is expected Eramet’s projects will help the bloc secure supplies of lithium and other battery metals for local use.

Eramet has also partnered with German chemical group BASF to study the refining of nickel and cobalt from the mine the French miner operates in Indonesia.

The company estimates it could cover 20% of the EU’s nickel requirements in 2030, along with 25% of the bloc’s lithium needs and 12% of its cobalt demand.

(With files from Reuters)