Is it now or never for a stock rally? Fund managers cash pile is the biggest since 2001, says Bank of America

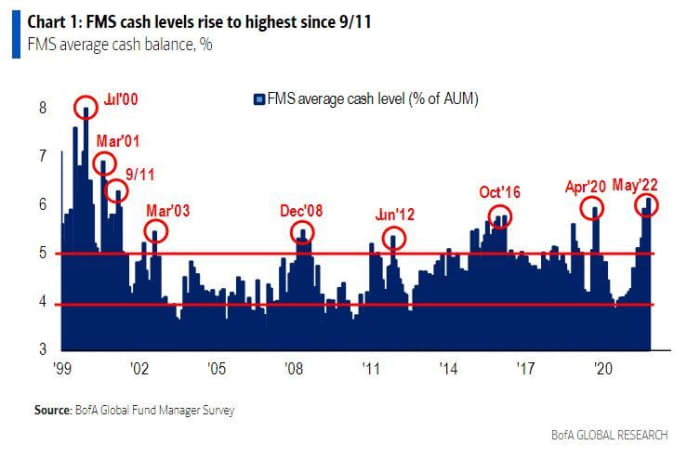

Fearing stagflation and higher interest rates, global money managers have been amassing cash at a level not seen in two decades.

That’s according to an “extremely bearish” May survey of global money managers released from a team of Bank of America strategists led by Michael Hartnett on Tuesday. Entitled, “If they can’t rally now…” the survey revealed the highest levels of cash for those managers since the immediate aftermath of the Sept. 11, 2001 terrorist attacks in the U.S.

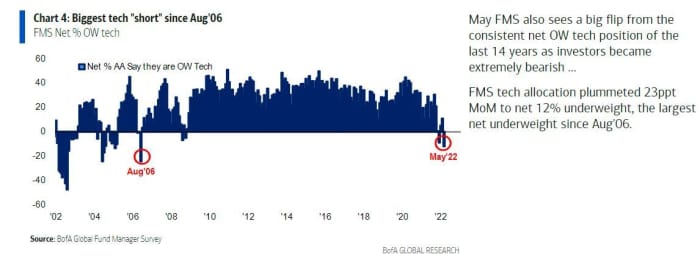

The survey showed investors are now expecting 7.9 Fed interest-rate hikes in this tightening cycle, from 7.4 in April. And equity allocation is catching up. Managers are the most short, or bearish, on interest-rate sensitive tech stocks since August 2006, and the most underweight on equities since May of 2020.

Read: Here’s what just happened that triggers stock market drops 71% of the time, warns Credit Suisse

The S&P 500 SPX,

The Nasdaq Composite COMP,

But strategists don’t see markets having reached “full capitulation” yet, with stocks “prone to an imminent bear rally,” and lows not quite reached. That’s been a fierce topic of debate among Wall Street market strategists and analysts. Capitulation happens when a significant proportion of investors succumbs to fear and sells over a short period of time, and is normally followed by a bounce.

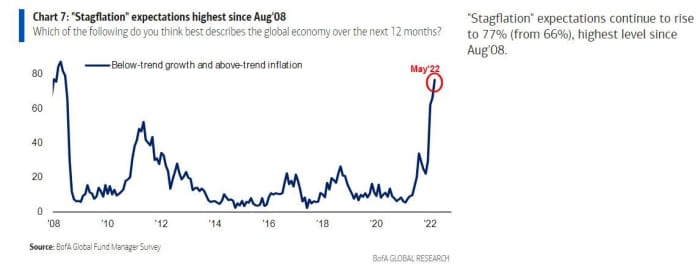

The survey also showed more record highs seen for stagflation expectations, at the highest level since August 2008.

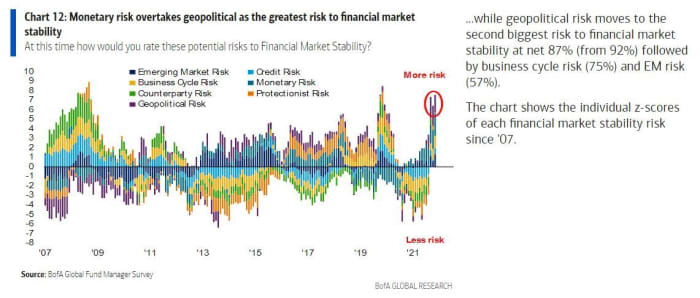

Monetary risk or hawkish central banks has become the biggest so-called “tail” risk for investors, and has overtaken geopolitical as the biggest risk to financial market stability.

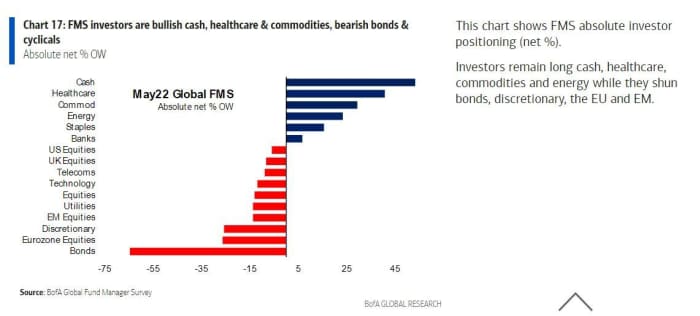

As for where investors are putting their bullish hopes and money, the below chart shows healthcare and commodities, along with cash are most wanted right now: