The Denver, Colorado-based company became last month the sole owner of Yanacocha, Latin America’s largest gold mine, after acquiring Sumitomo’s stake for $48 million. Newmont had previously bought partner Buenaventura’s interest in the mine for $300 million.

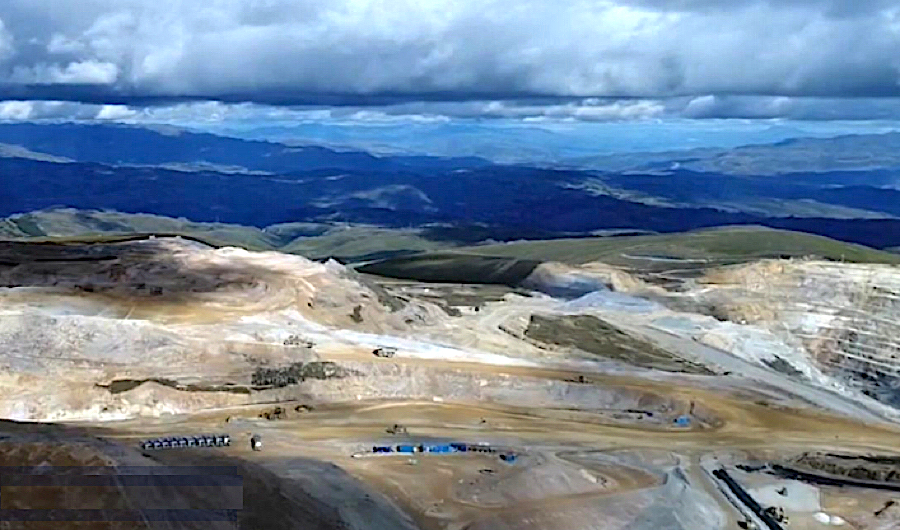

Yanacocha produces about 350,000 ounces of the precious metal a year, but oxide resources of the open pit are close to being depleted, which is why Newmont plans to continue mining sulfide material underground.

The first phase of the expansion focuses on developing the Yanacocha Verde and Chaquicocha deposits. The second and third phases, the company has said, have the potential to extend the mine life for “multiple decades.”

Social risk

Newmont, which committed $500 million to invest in the expansion so far, has said the sulfides project is one of the most important ones planned in Peru for the next five years.

The final decision, however, may hinge on how the government deals in the coming months with rising conflicts affecting mining operations.

Two of Peru’s largest copper mines have suspended production so far this year amid escalating conflicts with nearby indigenous communities.

MMG’s Las Bambas remains halted and on Tuesday government mediators failed to broker a deal that would allow the restart of operations at the copper mine.

Southern Copper is back to full capacity at its Cuajone operation since early May and the company prepares to engage in formal talks with community members whose protests shut the mine for almost two months.

Newmont may also reconsider moving forward with its Conga gold project, which the company officially abandoned in 2016 due to community opposition.

“There is the opportunity to one day return to Conga,” Palmer said, adding that stakeholders would need to support the project.