Record surge in imports signals supply chokehold stoking inflation is loosening

Trade data bodes well for business investment

Article content

Canada’s imports rose to a record in March, helped by a rush of consumer goods from China and vehicles and automobile parts from the United States and Mexico, suggesting the supply bottlenecks that have plagued the global economy for the better part of two years have begun to loosen.

Advertisement 2

Story continues below

Article content

Statistics Canada’s reported April 4 that imports jumped 7.7 per cent in March from February, the second consecutive gain. The biggest contributor to the increase was a 40-per-cent surge in the value of oil imports, as prices skyrocketed in the aftermath of Russia’s invasion of Ukraine, and Canadian importers sought to stockpile crude from the U.S., Saudi Arabia, and Nigeria.

But Statistics Canada’s tally also showed big increases of imports of automobiles and parts, suggesting the global chip shortage that had slowed North American automobile production was becoming a gentler headwind for carmakers. Imports from countries other than the U.S. rose to a record, led by a 29-per-cent increase in shipments of computers, cellphones, industrial equipment, and consumer goods from China.

Advertisement 3

Story continues below

Article content

A more fluid supply of goods would ease inflationary pressures that have pushed year-over-year increases in the consumer price index to their highest levels in more than three decades. The Bank of Canada accelerated its path to higher interest rates last month, lifting its benchmark interest rate a half point after the latest update of its economic outlook showed that demand was running well ahead of supply.

Governor Tiff Macklem told lawmakers that he remained convinced that supply constraints would ease, but acknowledged that the central bank misjudged how long the disruptions would last. So, any evidence that global trade is getting back to normal is welcome.

“The easing of supply chain issues could be a sign of better things to come for auto production and the manufacturing sector,” Benjamin Reitzes, an economist at Bank of Montreal, said in a note.

Advertisement 4

Story continues below

Article content

To be sure, the global trade environment remains far from normal.

-

Canada’s economy poised to grow in the first quarter, dodging America’s fate

-

Tiff Macklem acknowledges misjudging inflation, pledges to act ‘forcefully’ to bring it down

-

CP Rail revenue sags due to bad winter, lower grain shipments and labour dispute

Canadian exports also surged to a record, as the country’s oil producers, miners, and farmers benefited from higher commodity prices. Exports rose some six per cent, with energy accounting for more than half the gain, Statistics Canada said. Exports of metal ores and non-metallic minerals climbed to a record, led by a 22.5-per-cent increase in shipments abroad of potash, as farmers around the world scrambled to replace fertilizer they would normally source from Russia and Ukraine.

Advertisement 5

Story continues below

Article content

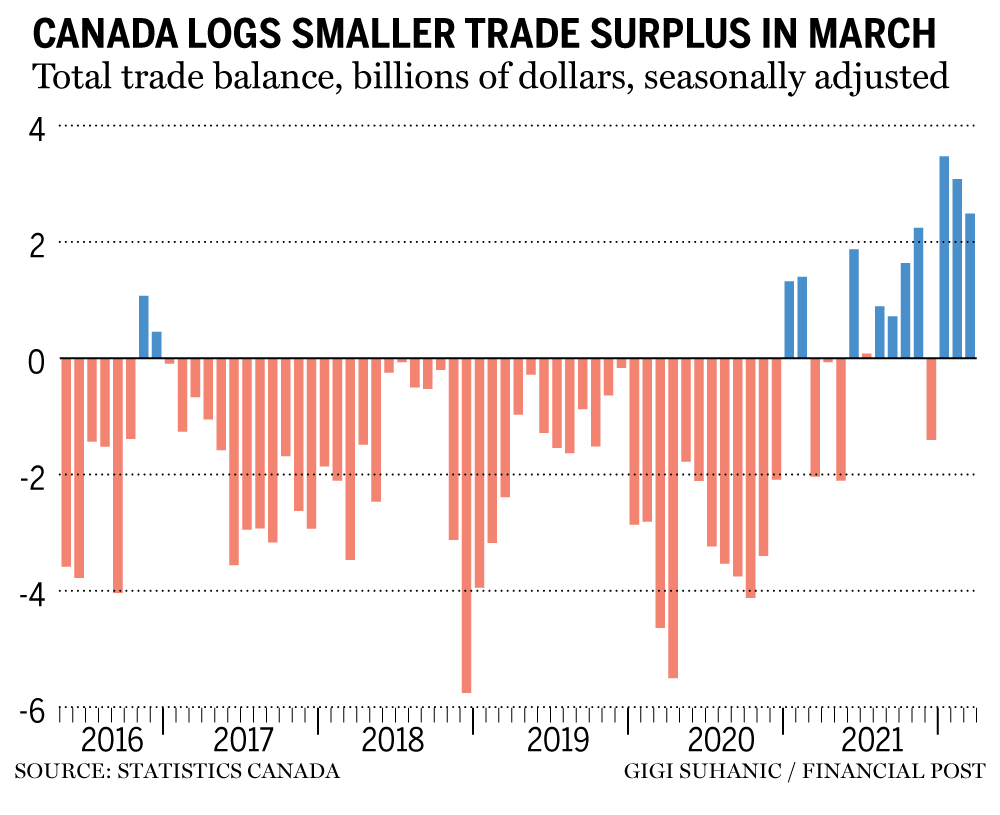

Imports (money out) grew faster than exports (money in) in the first quarter, so trade will be a negative when Statistics Canada tallies gross domestic product. Still, the increase in imports bodes well for business investment, which could lead to productivity improvements that could eventually take some heat out of inflation by increasing the economy’s capacity to generate non-inflationary growth.

But that won’t happen in time for the Bank of Canada to slow its march to a higher interest-rate setting. Randall Bartlett, senior director of Canadian economics at Desjardins Group, estimates that first-quarter growth is tracking at an annual rate of 5.5 per cent even with the drag from trade, much faster than the Bank of Canada’s estimate of three-per-cent.

“The weakness of (first-quarter) trade does not alter our view that the BoC will need to act forcefully at its June meeting,” Bartlett said in a note.

• Email: kcarmichael@postmedia.com | Twitter: carmichaelkevin

Advertisement

Story continues below