Stock market’s ‘ultimate lows’ are still ahead as investors have not yet capitulated, says B. of A.

Investors haven’t capitulated in this year’s beaten-up stock market, according to strategists at B. of A. Global Research.

With recent fear and “loathing” suggesting that stocks are prone to a bear-market rally, “we do not think ultimate lows have been reached,” B. of A. investment strategists said in a research report dated May 12. “True capitulation,” they said, is “investors selling what they love.”

U.S. stocks rallied Friday, with the S&P 500 SPX,

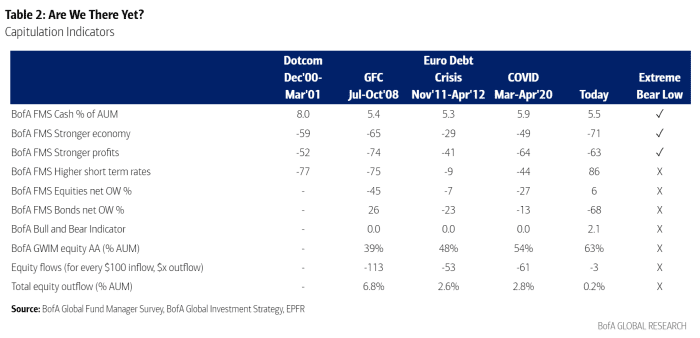

The “exodus” has begun, but only three of the 10 “capitulation indicators” tracked by B. of A. have been checked off, according to the strategists. Those three include cash levels and investor expectations for profit and economic growth, the report shows.

Below is the checklist for those indicators, some of which are tied to the bank’s global fund manager surveys. It shows how today’s market stacks up against the bursting of the dot-com bubble, the global financial crisis, Europe’s debt crisis and the quick, steep fall sparked by COVID-19 fears in 2020.

Capitulation indicators linked to interest-rate expectations, equity flows, stock allocations of Bank of America Corp.’s private clients and asset allocations to equity and bonds seen in B. of A.’s fund manager surveys, have not yet been checked off.

Rate cut expectations are always seen at bear-market lows, the strategists said.

Investors have been expecting interest rates to rise, as the Federal Reserve has signaled it will continue to raise its benchmark rate to combat high inflation.

For every $100 of inflows in the past few weeks, the strategists have seen “just $4” of redemptions, according to the report. That compares with more than $50 of outflows for every $100 of inflows in past bear markets, the strategists wrote.

So far equity redemptions amount to 0.2% of assets under management, or AUM, their note shows. The strategists said outflows were around three to six percent of assets under management at prior lows.

To meet B. of A.’s capitulation criteria, fund managers would need to underweight stocks, with lows requiring a -20 to -30% allocation to equities and investors closing underweight bond positions, the strategists said. Also, private clients in Bank of America’s global wealth and investment management unit pulled back their equity allocations to at least 56% in prior bear-market lows, they wrote in the report.