‘This is a daunting time to retire’: In the age of inflation, there are steps you can take to deal with higher prices

For the last two decades, retiree Brad Hansen hasn’t worried too much about inflation and the loss of purchasing power. That’s because inflation averaged only 2.54% from 2000 to 2009 and just 1.75% from 2010 to 2019, far below the historical average of 3.10%, according to InflationData.com.

Now with inflation rising to levels not seen in 40 years, Hansen is remaining calm, even after the Labor Department reported that consumer prices rose 8.3% for the 12 months ended April 2022. Hansen said the recent spike in prices has not yet adversely affected his finances, thanks to having a plan in place.

“We’re not panicky investors in the short term,” said Hansen, who is married and spent his business career in corporate finance, including a stint as a sales manager and president of a bank-owned leasing company. At age 65, the Wisconsin resident has three sources of retirement income: part-time work, income from investments, and Social Security. “We always refer back to the retirement plan that we had previously calculated.”

That plan didn’t call for Hansen to retire on a shoestring budget hoping that everything goes right. Instead, his strategy included some wiggle room, a cushion for when adverse events such as inflation arise. “It starts out with having that plan,” he said.

Hansen worried that if he didn’t have a plan, inflation or other economic shocks would force him into rounds of belt tightening, a search for alternative sources of income, or aggressive investing styles. He wanted to avoid the pressures and stress of trying to find sudden solutions to inflation, and instead carefully budgeted to withstand unforeseen events.

Financial planners tend to agree with Hansen’s approach while also appreciating the difficult predicament retirees and prospective retirees currently face. MarketWatch spoke to several financial planners wrestling with the retirement inflation challenge. They emphasized planning and understanding personalized inflation rates, while also suggesting tactical solutions like bolstering savings and tapping home equity, or delaying retirement, Social Security benefits, and big expenses. One thing they all agreed on is that, in 2022, one of the Best New Ideas in Retirement is to take inflation seriously and develop a comprehensive strategy for the rise in prices.

“This is a daunting time to retire, and higher inflation creates additional uncertainty,” said Jason Branning, a certified financial planner with Branning Wealth Management in Ridgeland, Mississippi.

Austin Rosenthal has been preparing for this moment. He retired a year ago after spending 21 years on Wall Street working for large investment management firms and, like Hansen, has a plan in place. His approach calls for him to live on $80,000 a year from his investment portfolio for the rest of his life and not have to work for a salary ever again. He’s got money in his nest egg from the sale of his house, money in his 401(k) plan that he can’t touch till age 59 1/2, and stock and income from a deferred compensation plan from his former employer.

“I can live off of that money,” said Rosenthal, 43, who was recently profiled in Texas Monthly as part of a story about the Great Resignation. “But again, $80,000 is my budget.”

To live on that income, however, Rosenthal trimmed the fat in his budget: Renting an apartment that costs $1,250 a month and purchasing health insurance for $225 a month (after receiving an advanced premium tax credit) through the Affordable Care Act’s Marketplace. And those two expenses are far below what the average U.S. household spends on housing and healthcare. Housing typically represents 30% of the average household’s expenses and healthcare 7%.

“I’ve been able to lower my two biggest expenses to now, basically, 25%,” said Rosenthal, a resident of Austin, Texas, who these days refers to himself as a digital creator and recently launched Social Musings by Austin, a website featuring his original writing, music and podcast episodes.

What’s more, his plan calls for him to be mindful of other expenses, including food, eating out, transportation and the like. “Have I had to manage certain things because of inflation?” asked Rosenthal. “Absolutely. But I have been able to thus far.”

Rosenthal did not create his plan specifically with inflation in mind. But Massi De Santis, a certified financial planner with DESMO Wealth Advisors in Austin, Texas, said now is the time to create a retirement plan that can evaluate the impact of higher-than-expected inflation.

“Inflation reduces the purchasing power of your wealth over time,” said De Santis. “Since we have limited control over it, we want to reduce inefficiencies elsewhere. So, the first thing I would say for people close to retirement or in retirement is to make sure they have a plan in place that helps them optimize the value of their nest egg.”

Austin Rosenthal is not letting inflation upend his retirement plans.

Austin Rosenthal

What’s your personal inflation rate?

For Branning, the financial planner in Mississippi, the headline inflation rate reflected in the consumer price index is good to know, but what’s really important to understand is your personal rate of inflation. “One thing retirees should consider is that their personal inflation can differ from headline CPI,” he said. “Each retiree has their own personal annual inflation factor that may materially differ from the calculated CPI.”

For example, as of March 2022, buying a new car cost about 12% more than the prior 12 months, said Branning. The March 2022 headline CPI annual increase was 8.5%, which included a 35% increase for used cars or 12% for new cars.

“But a retiree’s personal inflation may be lower by 1% to 3% than headline CPI depending on retiree spending,” he said.

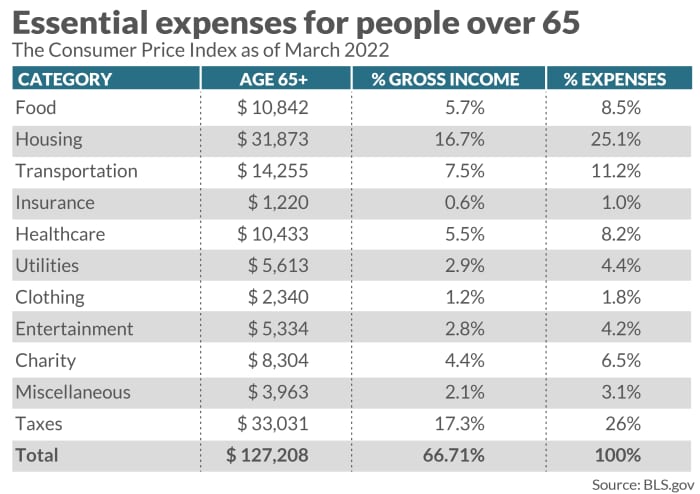

And while the CPI indicates a big jump in inflation, two expense categories for many retirees 65-plus and those who spend at least $100,000 per year in retirement have not changed at all, Branning said.

“Taxes make up 26% of spending and housing, 25%,” he said. “So, if a retiree did not change their housing and their taxes were constant, potentially, only about half of their expenses will see inflationary effects.”

Delay, delay, delay

If you haven’t retired just yet, De Santis, the financial planner in Austin, recommends being conservative with your plans as long as inflation is higher than average. “One way to do this is with a one-two-three plan,” he said. “Plan to retire one year later, increase savings by 1% for the next two years, and reduce planned spending in retirement by 3% of what you have budgeted.”

Small changes, he said, can have a large impact over the next 25 to 30 years. De Santis added that working longer, or working part time if you’ve already retired, are two ways to reduce the ill effects inflation might have on one’s finances.

Jeremy Keil, a certified financial planner with Keil Financial Partners in New Berlin, Wisconsin and host of the Retirement Revealed podcast and blog, recommends, if possible, delaying or suspending your Social Security retirement benefits.

Social Security retirement benefits are increased by a certain percentage for each month you delay starting your benefits beyond full retirement age, though the benefit increase stops when you reach age 70. This increase is often referred to as delayed retirement credits.

“Every year of waiting on Social Security boosts your payout by roughly 8%, which oddly enough is roughly the amount of inflation over the past 12 months,” said Keil. “And you get a cost-of-living increase on your payout and on the increase, too. It’s somewhat like compound inflation: you earn a higher payout, on the higher payout.”

This is exactly what Hansen, the retired corporate finance executive, and his wife are doing. The lower earner claimed their benefit based on their work record, but the higher earner plans to wait until age 70 to apply for their retirement benefit. “We did the classic thing,” he said. “We started Social Security on the lower amount and then kept the second one to take later. Let the higher amount grow by the 8% over the next four years, which is a much bigger difference, but you have to plan for that.”

A much lesser-known tactic is this: If you have reached full retirement age, but are not yet age 70, you can ask Social Security to suspend your retirement benefit payments. By doing this, you will earn delayed retirement credits for each month your benefits are suspended which will result in a higher benefit payment to you, according to the Social Security Administration. A simple request at any time before the age of 70 can turn the Social Security payments back on or the payments will automatically resume at the higher amount on your 70th birthday.

De Santis said delaying or suspending Social Security may be a good idea for some pre-retirees and retirees because it is inflation-protected, and by delaying you will be protecting a larger source of income. “But for others, waiting may not be the best option, if they don’t have a good base in the bridge years,” he said.

For some, the answer to the current spike in inflation is to delay some expenses. “It seems that a lot of inflation is concentrated in housing and car prices,” said Keil, the certified financial planner and podcaster. “If you can wait out that car purchase or home renovation you might give yourself a chance to allow those high inflation categories to come back to reality before you pull the trigger.”

De Santis shares that opinion. “By all means, if you have already booked a vacation, go for it, but postpone large-ticket items for a bit if you can,” he said. “Don’t pay a premium over MSRP for a new car if you can wait to purchase one.”

Branning also thinks retirees can control their discretionary expenses. “Most discretionary expenses are delayable,” he said. “Now may be the time to consider delaying or reducing these expense types in light of inflationary pressures and some downside pressure on stock and bond valuations.”

And, if you’re withdrawing money from your retirement accounts to fund some of your living expenses, Keil recommends foregoing any planned spending increase. “Take out the same amount of money as you did last year and use this opportunity to ‘tighten your belt’ and try to make your existing money go farther,” he said.

Rejigger or recapitalize your investments

Inflation is rising, but so too are interest rates. The yield on the five-year Treasury bond is floating around 3%, compared to 0.81% last year. And the yield on a one-year CD is 1.25%.

Meanwhile, the stock market is falling. The Standard and Poor’s 500 index was recently down about 16% for the year.

So, how might you reposition your investments given that rates are rising, and the market is falling?

First, Keil recommends always making sure you have enough money in short-term accounts so that you aren’t relying on your long-term stock and bond investments for daily expenses.

Next, he recommends getting the best interest on your short-term money. One such place: Series I Savings Bonds. Right now, the current annual rate on those bonds (which both Hansen and Rosenthal already own) is 9.62% for six months when your I bond renews or is purchased from May-November. According to Keil, the 9.62% interest for six months means your $100 purchase will turn into $104.81 in six months. “Combine that with the 12-month holding period and the three-month ‘prior interest penalty’ and it means your purchase of I bonds in May-November 2022 will guarantee a return of 4.81% 12 months from now, and will most likely be higher than that — depending on the six-month renewal rate,” he said.

I bonds, as well as Treasury Inflation Protected Securities (TIPS), and other inflation-protected bond funds should be a sizable portion of the fixed income portfolio for retirees, said De Santis. “Look for funds that offer exposure to investment-grade bonds or municipal bonds that hedge inflation with inflation swaps,” he said.

““Every year of waiting on Social Security boosts your payout by roughly 8%, which oddly enough is roughly the amount of inflation over the past 12 months.””

Meanwhile, Branning recommends investing in short-duration bonds or building an individual bond ladder for up to five years. Duration, according to PIMCO, is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. The shorter or lower the duration, the less its value will fall when interest rates rise. A bond ladder is a strategy where you purchase bonds with different maturity dates.

Retirees can put in place a bond ladder of individual government bonds or bullet maturity ETFs, said Branning. “This bond structure offers immunization as rates rise, but inflation will dampen real returns,” he said.

In Hansen’s case, he and his wife did review their portfolio to make sure they were in the right investments. “Are they really diversified or are they actually moving in lockstep?” he asked. In addition, Hansen is also fond of building a bond ladder. “Then I’m reinvesting if rates are up or down,” he said.

Pre-retirees and retirees do need to consider what real interest rates, the difference between the nominal yield on an investment and the rate of inflation, are, Hansen said. And given the current real interest rate environment, he believes that some entities will offer – if only for a brief period of time — tax-free bonds with attractive yields. “Depending on your portfolio, you have to grab those while they blip up,” he said.

As for stocks, Branning noted that stocks, over long periods historically, have exceeded inflationary pressures. “Many times in history, inflation can go through abrupt spikes, then moderate,” he said. “Retirees may need to tolerate higher equity allocations than they like and consider rebalancing stock exposures to lower valuation stocks and internationally.”

For some retirees, there is one big asset they can leverage in this inflationary environment. Homeowners have the option to tap the equity in their home to mitigate and manage the adverse effects of inflation on one’s budget. “If you’re a homeowner you are sitting on a highly appreciated asset,” said Rosenthal, the former Wall Street worker.

Branning recommends obtaining a home equity conversion mortgage (HECM), a reverse mortgage backed by the FHA and issued by an FHA-approved lender.

“HECMs offer retirees who own their homes the ability to tap into home equity if they need it,” he said. “By installing a HECM expanding line of credit, the non-recourse loan line grows over time. Higher interest rates will increase the line of credit more rapidly than when rates are low or stagnant. This expanding line of credit can help with inflationary pressures by allowing homeowners to access liquidity if inflation is persistently higher and long-lasting. In this case, a retiree may need another source of stable income to draw from in the future.”

On balance, there are tactics that can help retirees confront inflation. Ultimately, Hansen believes this: “You don’t invest your way out of this. You plan.”