Warren Buffett busts a myth about Warren Buffett

Warren Buffett’s Berkshire Hathaway loaded up on stocks as stock prices fell earlier this year.

On Saturday, Buffett revealed that the company bought $51.1 billion worth of stocks during the first quarter. In a slide presented at Berkshire Hathaway’s annual shareholders meeting on Saturday, he noted the buying included a stretch between February 21 to March 15 where the company plowed $41.0 billion into the market. Berkshire spent a whopping $4.6 billion on March 4 alone.

“We spent $40 billion in a hurry, in three weeks,” Buffett said. “Now we’re back, somewhat, in our more lethargic mood.”

The first quarter saw the S&P 500 plummet by as much as 13.7%, hitting a low of 4,114 on February 24, before recovering a bit to end the quarter down 4.9%.

Berkshire’s trading activity seems to echo one of Buffett’s most famous quotes: “Be fearful when others are greedy, and be greedy when others are fearful.”

But, don’t assume that this buying is Buffett signaling to the world he believes the stock market has bottomed.

‘We have not been good at timing’

Buffett’s reputation as a value-oriented investor with a track record of market-beating returns may have some folks thinking the “Oracle of Omaha” is a successful market timer (i.e., someone who makes trades based on the belief that prices have peaked or hit rock bottom).

Indeed, one of his most prominent calls to buy stocks occurred during some of the darkest hours of the financial crisis.

However, he made clear on Saturday that he is no market timer.

“We haven’t the faintest idea what the stock market is gonna do when it opens on Monday — we never have,” Buffett said.

He reflected back on the financial crisis, noting that Berkshire “spent about $15 or $16 billion” buying stocks around the time Lehman Brothers had failed in fall of 2008. This turned out to be months before the market would eventually reach a low.

“It was a really dumb time [to buy stocks], and I wrote an article for the New York Times on ‘Buy American,’” he said.

After that article was published, the S&P 500 fell another 26% before bottoming in March 2009.

“If I had any sense of timing and waited six months until—” he started to say. “The low was in March… I totally missed that opportunity.”

He continued to come clean.

“I totally missed, you know, March of 2020,” he said of when the stock market began a new bull market after crashing during the onset of the pandemic. “We have not been good at timing.”

Indeed, if Buffett and his team at Berkshire had conviction in their ability to predict the turns in the market, then maybe the company wouldn’t have had to report $1.8 billion in unrealized losses on its securities portfolio during Q1.2

See you in 20 years

Buffett reiterated that his trades are informed by the long-term prospects of the businesses he’s buying, not his short-term expectations for the market or the economy.

“I don’t think we’ve ever made a decision where either one of us has either said or been thinking: ‘We should buy or sell based on what the market is going to do,’” Buffett said.

These comments come as market volatility remains very high. On Friday, the S&P 500 plunged 3.6%. For the month, the S&P was down 8.8%, its worst month since March 2020 and worst April since 1970.

Fortunately for investors like Buffett, what happens in the weeks following a buy doesn’t make or break a trade.

“Over the next 20 years, I would expect [Berkshire’s stock portfolio] to have more capital gains than not,” Buffett quipped.

It’s worth noting that since 1926, there’s never been a 20-year stretch during which the stock market didn’t generate a positive return.

“I’ll report to you in 20 years whether it’s happened or not.”

More from TKer:

Rearview ?

? Stocks tumble: The S&P 500 fell 3.3% last week. It’s now up just 0.4% from its February 24 low of 4,114 but down 14.2% from its January 4 high of 4,818.

The S&P was down 8.8% in April, its worst month since March 2020 and worst April since 1970. For more on market volatility, read this and this.

? Earnings bonanza: There were a ton of companies that reported quarterly results and shares moved. Apple shares fell after the company warned of billions of dollars in costs tied to supply chain issues. Amazon shares tanked after the company reported its first quarterly loss since 2015. Microsoft shares rallied after the company said its Azure cloud business was booming. Meta (aka Facebook) shares surged after the company said user growth returned. Alphabet shares fell after the company reported revenue was short of expectations.

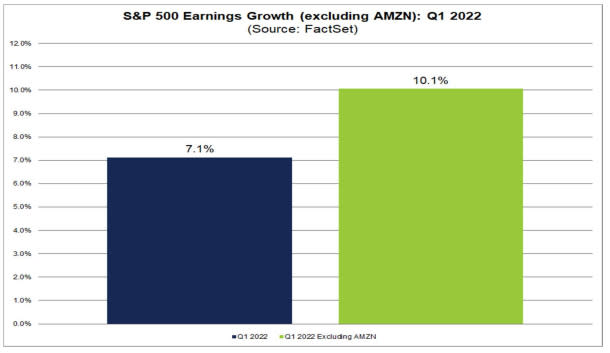

I’m not going to go through all 160 of last week’s earnings announcements. But here’s a nice big round up of earnings season so far from FactSet: “For Q1 2022 (with 55% of S&P 500 companies reporting actual results), 80% of S&P 500 companies have reported a positive EPS surprise and 72% of S&P 500 companies have reported a positive revenue surprise… For Q1 2022, the blended earnings growth rate for the S&P 500 is 7.1%. If 7.1% is the actual growth rate for the quarter, it will mark the lowest earnings growth rate reported by the index since Q4 2020 (3.8%).“

FactSet added that if you exclude Amazon’s weak quarter, S&P 500 earnings would be on track for 10.1% growth.

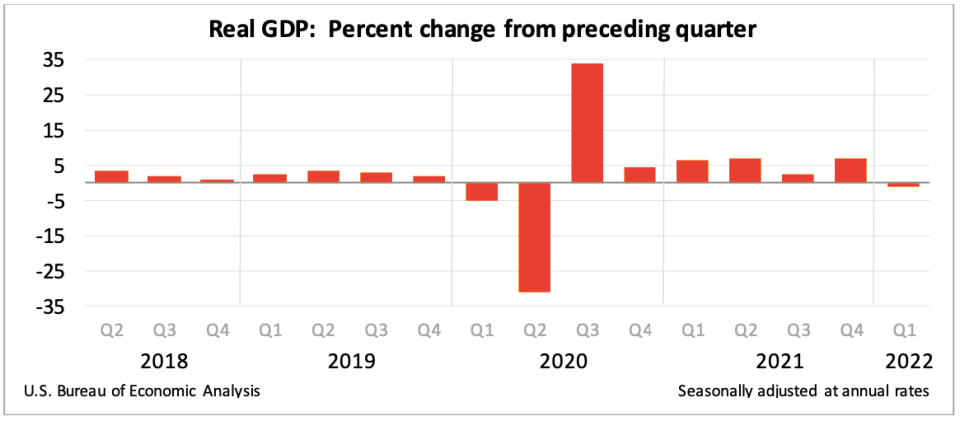

?? Negative Q1 GDP belies economic strength: GDP contracted at a 1.4% rate in Q1. However, the negative print can largely be explained by the fact that the U.S. imported a lot more than it exported. Among other things, consumer spending and business investment both grew, confirming strength in the economy. For more on the GDP report, read this.

? Businesses are investing: According to Census Bureau data released on Tuesday, orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — climbed 1.0% to a record $80.8 billion in March. This was notably stronger than the 0.5% economists expected. For more on business investment, read this.

? Labor market strength: In the week ending April 23, initial claims for unemployment insurance benefits declined to just 180,000, the tenth straight week this measure was below 200,000. Insured unemployment (i.e., the number of people who filed an initial claim and then continued to claim benefits) sat at 1.4 million, the lowest level since February 1970. For more on the strength of the economy, read this.

? Consumer confidence ticks down: The Conference Board’s Consumer Confidence Index fell to 107.3 in April from 107.6 in March. “The Present Situation Index declined, but remains quite high, suggesting the economy continued to expand in early Q2,“ The Conference Board’s Lynn Franco said. “Expectations, while still weak, did not deteriorate further amid high prices, especially at the gas pump, and the war in Ukraine. Vacation intentions cooled but intentions to buy big-ticket items like automobiles and many appliances rose somewhat.”

Keep in mind that weak consumer confidence does not necessarily mean consumer spending is falling. For more on this, read this and this.

? Home prices are up: U.S. home prices in February were up 19.8% from a year ago, according to the S&P CoreLogic Case-Shiller Index. This was the third highest reading in the index’s history. From S&P DJI’s Craig Lazzara: “The macroeconomic environment is evolving rapidly and may not support extraordinary home price growth for much longer. The post-COVID resumption of general economic activity has stoked inflation, and the Federal Reserve has begun to increase interest rates in response. We may soon begin to see the impact of increasing mortgage rates on home prices.“

? Mortgage rates tick lower, but still high: From Freddie Mac: ”The combination of swift home price growth and the fastest mortgage rate increase in over forty years is finally affecting purchase demand. homebuyers navigating the current environment are coping in a variety of ways, including switching to adjustable-rate mortgages, moving away from expensive coastal cities, and looking to more affordable suburbs. We expect the decline in demand to soften home price growth to a more sustainable pace later this year.”

Up the road ?

All eyes will be on the Federal Reserve as its monetary policy setting committee meets on Tuesday and Wednesday. Economists expect the Fed to announce a 50 basis point hike to its policy rate and share plans for reducing the size of its balance sheet. These are actions Fed officials have been signaling in recent weeks amid high inflation. Last Friday, we learned that the Fed’s favorite measure of inflation — the core PCE price index — rose 5.2% in March from a year ago. This was just below the 5.3% print in February, which was the highest since April 1983.

Friday comes with the April U.S. jobs report. Economists estimate employers added 400,000 jobs during the month.

We’re also still in the middle of earnings season. Check out the calendar below from The Transcript with some of the big names announcing their quarterly financial results this week.

1. I wrote a column about this whole ordeal for Yahoo Finance back in March 2020.

2 Berkshire Hathaway’s stock portfolio was anything but impervious to the volatility that’s been rocking global financial markets this year. The company reported $1.8 billion in unrealized losses on its securities portfolio during Q1, which compares to the $4.6 billion in unrealized gains it reported during the same period a year ago. (Unrealized gains or losses represent the change in market value of securities that weren’t actually sold. Buffett has been a long-time critic of the accounting rule that requires companies to report these so-called paper gains and losses.)

3. For more on this, read my recent Yahoo Finance column: Why Warren Buffett has ‘never made a decision based on an economic prediction’

A version of this post was originally published on TKer.co.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube