What’s next for markets after inflation data fails to deliver ‘watershed moment’

An earlier version of this article listed an incorrect figure for the annual inflation rate for March. The article has been corrected.

Stock and bond investors expecting a “watershed” moment in Wednesday’s inflation data were left disappointed, analysts and economists said, leaving open the debate over whether the market is close to putting in a bottom.

The April consumer price index was certainly hotly anticipated, attracting the sort of pre-release scrutiny usually reserved for items like the monthly jobs report. Technical analyst Jeff deGraaf, founder of Renaissance Macro Research, called it one of the most hotly anticipated CPI reading in his more-than-30-year career.

And why not? Investors were looking for confirmation that inflation was finally cooling off after running at its hottest in more than 40 years — beyond the career memory of the vast majority of Wall Street veterans.

Moreover, the data was coming amid a selloff for stocks and bonds that’s been tough on investors in 2022 as they fret over the Federal Reserve’s ability to get a grip on inflation while avoiding the dreaded “hard landing” for the economy.

Read: Investors haven’t begun to price in recession: Here’s how far the S&P 500 could fall

Perhaps evidence of an inflation peak would help steady the ship, investors may have hoped, offering a clearer view on the path ahead for the Federal Reserve as it moves to jack up interest rates and shrink its balance sheet in an effort to rein in price pressures.

In the end, the data was somewhat anticlimactic. Yes, inflation slowed, with the annual pace at 8.3% versus the March reading of 8.5%. But it was still plenty hot, and above expectations for a reading of 8.1%.

More problematic for investors was the core reading, which strips out volatile food and energy prices. It showed a 0.6% monthly rise versus a Wall Street forecast for a 0.4% increase. The increase in the core rate over the past year also slowed to 6.2% from from a 40-year high of 6.5% in March.

Investors weren’t soothed. Stocks ended the day lower after a round of choppy trading. The Dow Jones Industrial Average DJIA,

Treasurys have also seen choppy trade, but signs of an inflection point that would mark a lasting pause or a significant reversal in the selloff that drove yields to 3 1/2-year highs this month were also lacking.

“So far, at least, tentative evidence of a peak in inflation in today’s U.S. consumer price index report has not been a watershed moment for U.S. government bonds or equities,” said John Higgins, chief markets economist at Capital Economics, in a note.

“We don’t expect their fortunes to improve decisively until shortly before the Fed stops tightening policy in summer 2023, even as inflation drops back further and the U.S. economy experiences a ‘soft landing’ in the meantime,” he wrote.

The problem, analysts and investors said, is that while inflation may have peaked, the slowdown wasn’t sufficient to make clear what the Fed will have to do to get a grip on price pressures in the months ahead. The central bank last week hiked its fed funds rate by 50 basis points, or half a percentage point, the largest in more than 20 years — typically the Fed moves in quarter-point increments.

Fed Chairman Jerome Powell said half-point moves were on the table for the next two policy meetings, but poured cold water on speculation around the possibility of an even larger 75 basis point move. Now, some analysts are penciling in the potential for a change of tune that could put a three-quarter-point move back in the frame.

Also read: April’s CPI report puts 75 basis point Fed rate hikes on table at next few meetings, Jefferies says

“If inflation stays this hot, we expect the Fed to keep taking a hard stance on rate hikes. As we’ve seen, that may be a tough pill for investors to swallow,” said Callie Cox, U.S. investment analyst at eToro, in emailed remarks.

She argued that with consumer and business demand still running strong, policy makers have room to stick a “soft landing.” But stocks and crypto “may struggle to find a bottom until we see more evidence of the Fed’s control,” Cox siad. “This particular selloff could be closer to the bottom than the top. You just need to ride out the storm.”

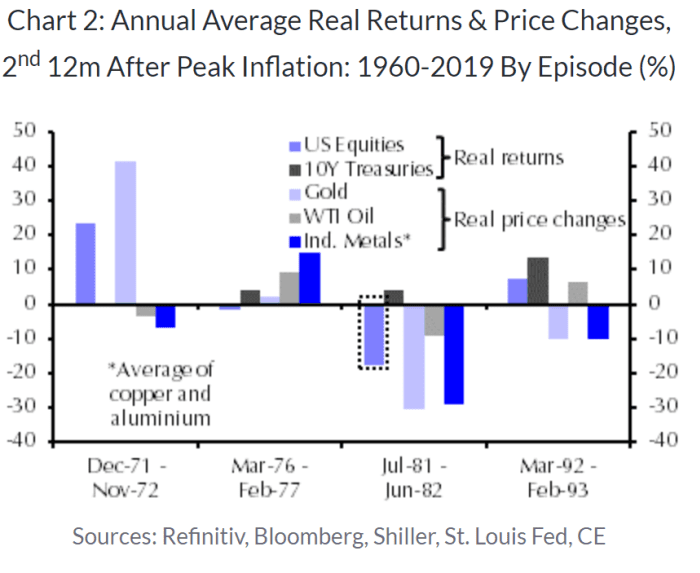

Turning to the historical record, Higgins contended that it’s far from certain stocks or bonds would turn the corner even if data in coming months shows that inflation continues to slow. Their fortunes — and those of other assets — varied on four previous occasions since 1960 after high inflation in the U.S. peaked, he noted, reflecting a combination of the Fed’s response, its effect on the economy, and their valuations (see chart below).

The poor performance of 10-year Treasurys in the initial 12 months after inflation peaked in 1980 coincided with the adoption of even tighter Fed policy then, Higgins said, with their yield peaking in the summer of 1981, around the time that the federal funds rate began to be reduced from a peak of not far short of 20% earlier that spring.

“Similarly, the weak showing of U.S. equities in the subsequent 12-month period after inflation peaked back then reflected the delayed influence of the even tighter Fed policy on the economy, which experienced a very deep recession between July 1981 and November 1982,” Higgins wrote.