Which Dividend Aristocrats Are the Most Enticing?

Dividend Aristocrats are great places to be when the market waters get really rough. While they still get knocked down during bear markets, their dividends tend to offer a glimmer of certainty amid turbulent times.

The payouts of Dividend Aristocrats have held up during past crashes, crises, and everything in between. With growing fear that we’ll fall into a bear market and recession, insisting on quality may prove a wise decision.

In this piece, we used TipRanks’ Comparison Tool to evaluate three of the most enticing Dividend Aristocrats that have outpaced the broader S&P 500 on a year-to-date basis.

Chevron (CVX)

Chevron is a big oil company that Warren Buffett has been loading up lately. Following the Oracle of Omaha’s latest helping, Chevron is now a top-four holding in Berkshire Hathaway’s portfolio.

Year-to-date, shares of Chevron are up over 40%, much higher than the S&P 500, which is down around 18%. With the stock fluctuating at around $165 per share, the stock could be at risk of a pullback if the broader markets are able to find their footing.

In any case, the reality of higher oil prices seems to be sinking in for many. With Russia’s invasion of Ukraine, $100 per barrel of oil may be here to stay. If that’s the case, Chevron will be rich with cash flow over the next 18 months.

Though it’s hard to chase a stock that’s already taken off, it’s worth noting that the valuation is still incredibly cheap. The stock trades at just 15.12 times trailing earnings, with a 3.5% dividend yield. It’s not a mystery why Buffett likes the big oil firm. Energy stocks are one of the few places to hide from broader volatility, and Chevron is arguably one of the best of the bunch.

With a healthy balance sheet and top-tier production growth, Chevron appears to be one of the Dividend Aristocrats that can keep powering higher, even in the face of a recession.

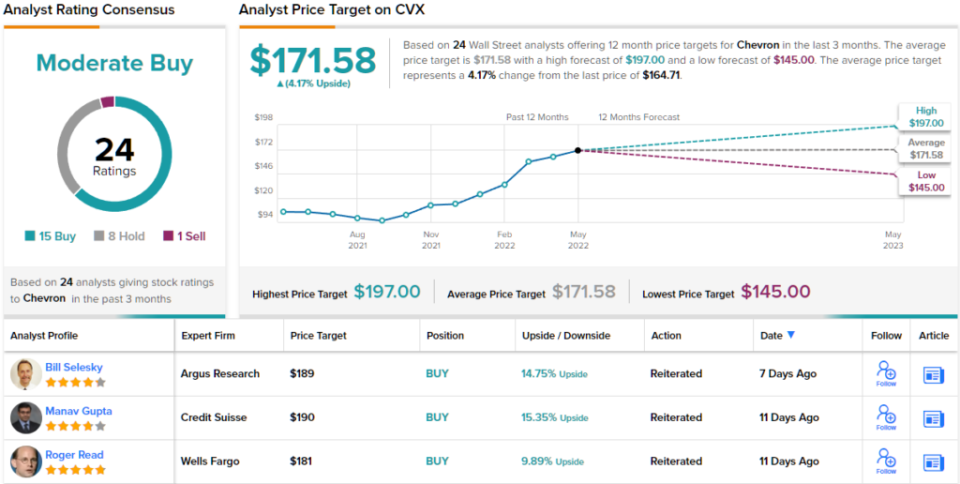

Overall, CVX holds a Moderate Buy rating from the analyst consensus view, based on 15 Buys, 8 Holds and 1 Sell. The stock’s $171.58 average price target indicates room for only 4% upside from the current share price of $164.71. (See CVX stock forecast on TipRanks)

International Business Machines (IBM)

IBM is an old-time technology company that’s also held its own relatively well amid the market correction. Shares of IBM are up 2% year-to-date. While IBM’s innovative capabilities may be subject to scrutiny, there’s no denying the value and dividend yield—currently at 5.1%—to be had in the name.

It’s been years since Berkshire Hathaway has thrown in the towel on IBM. Though the low valuation metrics and high yield were present, the stock had continued to be a perennial underachiever – and it continues to be to this day. Shares are still down from their 2013 highs, even when adjusting for dividends. It’s been around nine years, and the stock has still yet to recover.

Moving ahead, there are reasons for optimism. The company’s margin-dampening Kyndryl business has been spun off, and it could pave the way for margin expansion.

Although IBM’s latest first-quarter results beat by two pennies, management’s guidance was quite encouraging. Still, it will be difficult for the firm to sustain a rally if an economic recession is approaching.

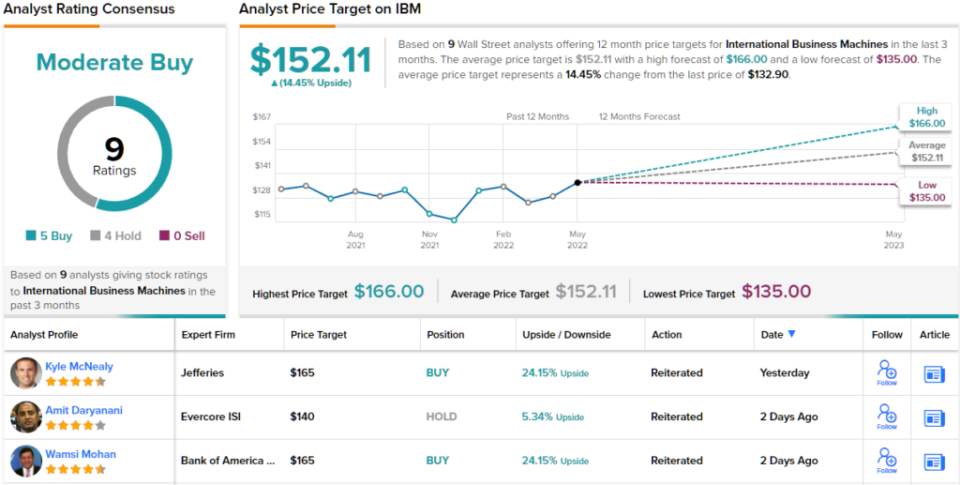

Looking to Wall Street, analysts are bullish, with the average IBM price target of $152.11 implying 14.45% upside from today’s levels. (See IBM stock forecast on TipRanks)

Johnson & Johnson (JNJ)

Johnson & Johnson is another Dividend Aristocrat that’s actually up ~5% year-to-date. The healthcare behemoth recently came off a modest earnings beat ($2.67 versus the $2.56 consensus) despite ongoing supply chain challenges.

The Oncology segment saw 15% sales growth, led by Darzalex and Erleada. Looking ahead, the company expects Pharmaceutical revenues to be around $60 billion by 2025. The ambitious target is realistic and would fuel further dividend increases for investors, regardless of where the economy heads next.

With minimal exposure to Ukraine and Russia, Johnson & Johnson has been minimally impacted by the Russia-Ukraine war. As a healthcare play, the company is also a great defensive for recessionary times.

At writing, the stock trades at 23.8 times trailing earnings and around 5 times sales. With a mere 0.72 beta, JNJ stock is yet another Dividend Aristocrat that should continue outperforming the averages amid a downturn.

The 2.55% dividend yield is modest, but it is incredibly safe and subject to growth over the years as the company looks to meet its 2025 top-line targets with or without a recession.

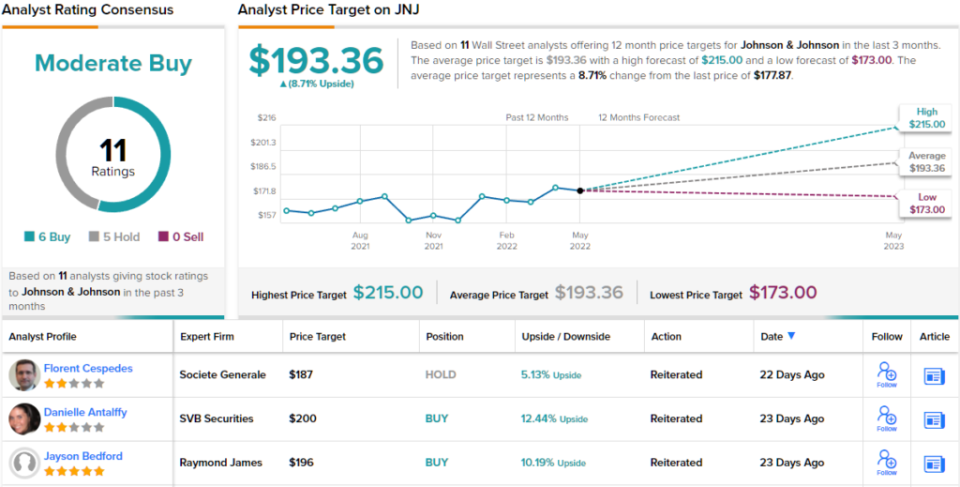

Turning to the analyst community, opinions are split almost evenly. 6 Buys and 5 Holds add up to a Moderate Buy consensus rating. At $193.36, the average price target implies ~9% upside potential. (See JNJ stock forecast on TipRanks)

Conclusion

Dividend Aristocrats may very well be one of the best places to outpace the S&P 500 in a pretty ugly 2022. So far, they’ve fared well. Solid fundamentals should pave the way for more of the same. Currently, IBM stock has the highest implied upside potential at ~14%, while Chevron has the lowest at ~4%.

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure