Why this investor who paid $650,000 to lunch with Buffett isn’t buying or selling stocks right now

It’s 13-F season, and you’re not going to find many like Guy Spier’s Aquamarine Capital in the first quarter —- zero buys, zero sells. “Pathetic, isn’t it,” quips Spier in an interview.

Spier says he feels less pressure to trade for trading sake after he stopped charging management fees. He also cites the possibly apocryphal study showing that the best investors are actually dead, or alive but inactive. (A spokeswoman for Fidelity Investments, which is widely credited with the research, says the firm is unaware of the study.) And the bigger issue is that he just doesn’t want to sell. “I can always sell Berkshire Hathaway to raise some cash for another investment, but that investment might have a far higher risk profile, and also have significant declines, the way so many friends of mine have [who are] invested in tech.”

Spier’s investments in Berkshire Hathaway BRK.A,

He is fully on board with Berkshire Hathaway’s recent push into the oil industry with Occidental Petroleum OXY,

In what turned out to be a more morbid discussion than planned, Spier says for the last 10 years he has valued Berkshire Hathaway for what it would be if Buffett died or was otherwise incapacitated. He is willing to take the lumps — he estimates a 20% to 30% decline over three to six months after Buffett went away — because of his belief that Berkshire Hathaway would bounce back.

What makes Berkshire Hathaway unique is that its capital from insurance is invested in equities. “And I don’t know of any other insurance company that’s managed to convince the regulators to do that,” says Spier. “It was a 20-year or 30-year project for Warren to show the regulators why this was a better way to be. So I’m not assuming that there’s any extraordinary investment talent after Warren goes away.” Down the road, however, Berkshire Hathaway might lose its special culture without Buffett at the helm. “There is a very special and unique culture there. And that is part of what enables him to generate the returns.”

Some breaking news is that Spier actually has made a transaction this year — he sold Twitter TWTR,

Spier has also invested in Alibaba BABA,

“I have this conflict because I don’t like investing in locations which have abuses of human rights, and China has certainly abused human rights, but on the other side they have lifted so many people out of poverty,” he says. If China makes rational decisions, he says, “they will respect the variable interest entities, they will respect providers of capital from other countries.” All that said, the Zurich-based investor says his stake in Alibaba is probably not big enough to have a significant influence on his portfolio, and he isn’t interested in buying more. “There are businesses in the United States that I would invest in before I added to Alibaba, because I just love the United States. It is just the most amazing destination for capital.”

Also read: Why one hedge-fund manager invests in Bank of America and says Tether’s days are numbered

The buzz

Investors will be looking at Lowe’s LOW,

The U.S. economics calendar includes housing starts as well as a speech from Philadelphia Federal Reserve President Patrick Harker. U.K. inflation surged 9%, while eurozone prices climbed 7.4%.

Finland and Sweden officially applied for membership in NATO.

The markets

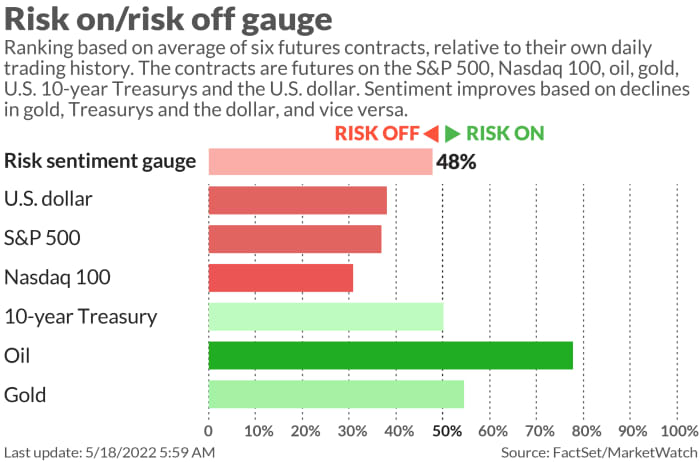

After the small cap RUT,

Top tickers

Here were the most active tickers as of 6 a.m. Eastern.

| Ticker | Security name |

| AMC, |

AMC Entertainment |

| TSLA, |

Tesla |

| GME, |

GameStop |

| NIO, |

Nio |

| BBIG, |

Vinco Ventures |

| AAPL, |

Apple |

| TWTR, |

|

| AMZN, |

Amazon.com |

| AMD, |

Advanced Micro Devices |

| MULN, |

Mullen Automotive |

Random reads

Here are election takeaways from Tuesday night’s collection of primaries.

MiamiCoin, promoted by the city’s mayor, has lost 88% of its value in less than a year.

The artificial-intelligence company DeepMind is about to predict all the protein structures known to science.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.